We Like These Underlying Return On Capital Trends At Selected Textiles (ATH:EPIL)

If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So on that note, Selected Textiles (ATH:EPIL) looks quite promising in regards to its trends of return on capital.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Selected Textiles is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.039 = €996k ÷ (€83m - €58m) (Based on the trailing twelve months to June 2022).

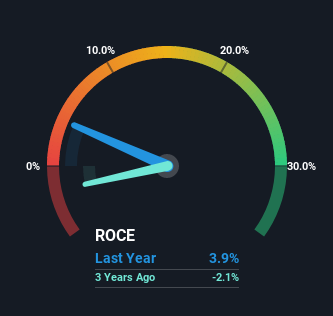

So, Selected Textiles has an ROCE of 3.9%. Ultimately, that's a low return and it under-performs the Luxury industry average of 14%.

Our analysis indicates that EPIL is potentially undervalued!

Historical performance is a great place to start when researching a stock so above you can see the gauge for Selected Textiles' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Selected Textiles, check out these free graphs here.

What Does the ROCE Trend For Selected Textiles Tell Us?

It's great to see that Selected Textiles has started to generate some pre-tax earnings from prior investments. While the business is profitable now, it used to be incurring losses on invested capital five years ago. At first glance, it seems the business is getting more proficient at generating returns, because over the same period, the amount of capital employed has reduced by 74%. Selected Textiles could be selling under-performing assets since the ROCE is improving.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. Effectively this means that suppliers or short-term creditors are now funding 70% of the business, which is more than it was five years ago. Given it's pretty high ratio, we'd remind investors that having current liabilities at those levels can bring about some risks in certain businesses.

The Bottom Line On Selected Textiles' ROCE

In summary, it's great to see that Selected Textiles has been able to turn things around and earn higher returns on lower amounts of capital. Astute investors may have an opportunity here because the stock has declined 50% in the last five years. So researching this company further and determining whether or not these trends will continue seems justified.

One final note, you should learn about the 3 warning signs we've spotted with Selected Textiles (including 2 which are a bit concerning) .

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:EPIL

Selected Textiles

Engages in the production, dyeing, and treatment of yarns in Greece.

Good value slight.

Market Insights

Community Narratives