- Greece

- /

- Trade Distributors

- /

- ATSE:VOSYS

The Vogiatzoglou Systems (ATH:VOSYS) Share Price Has Gained 79% And Shareholders Are Hoping For More

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at Vogiatzoglou Systems S.A. (ATH:VOSYS), which is up 79%, over three years, soundly beating the market return of 20% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 17%, including dividends.

View our latest analysis for Vogiatzoglou Systems

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

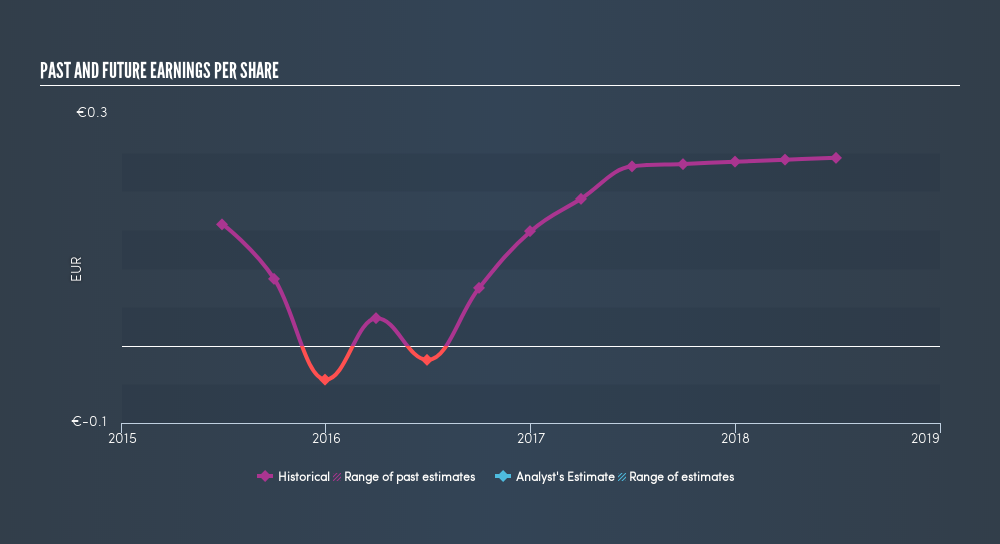

During three years of share price growth, Vogiatzoglou Systems achieved compound earnings per share growth of 16% per year. This EPS growth is lower than the 21% average annual increase in the share price. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Vogiatzoglou Systems's key metrics by checking this interactive graph of Vogiatzoglou Systems's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Vogiatzoglou Systems's TSR for the last 3 years was 109%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Vogiatzoglou Systems has rewarded shareholders with a total shareholder return of 17% in the last twelve months. Of course, that includes the dividend. However, the TSR over five years, coming in at 18% per year, is even more impressive. Keeping this in mind, a solid next step might be to take a look at Vogiatzoglou Systems's dividend track record. This freeinteractive graph is a great place to start.

We will like Vogiatzoglou Systems better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ATSE:VOSYS

Vogiatzoglou Systems

Provides furnishing equipment solutions for retail stores, warehouses, and distribution centers in Greece.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion