- United Kingdom

- /

- Other Utilities

- /

- LSE:TEP

Here's Why We're Wary Of Buying Telecom Plus PLC's (LON:TEP) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Telecom Plus PLC (LON:TEP) is about to go ex-dividend in just 3 days. Investors can purchase shares before the 28th of November in order to be eligible for this dividend, which will be paid on the 13th of December.

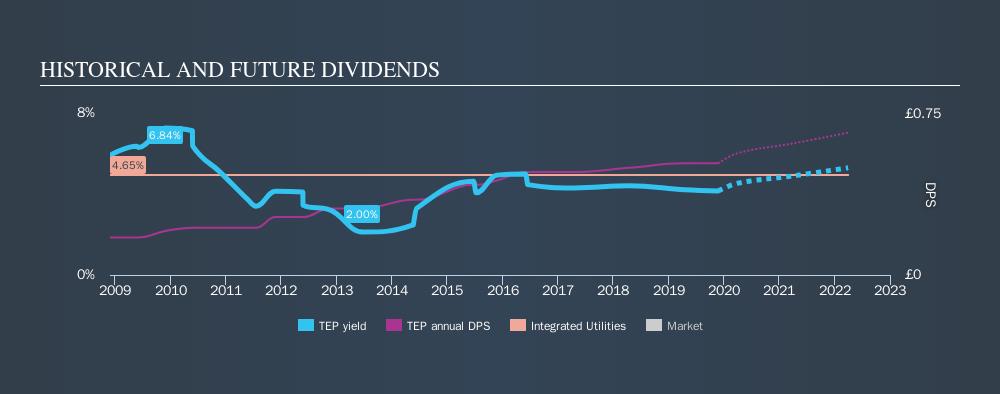

Telecom Plus's next dividend payment will be UK£0.27 per share, and in the last 12 months, the company paid a total of UK£0.52 per share. Last year's total dividend payments show that Telecom Plus has a trailing yield of 3.9% on the current share price of £13.28. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Telecom Plus can afford its dividend, and if the dividend could grow.

View our latest analysis for Telecom Plus

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Telecom Plus paid out 125% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out an unsustainably high 212% of its free cash flow as dividends over the past 12 months, which is worrying. Our definition of free cash flow excludes cash generated from asset sales, so since Telecom Plus is paying out such a high percentage of its cash flow, it might be worth seeing if it sold assets or had similar events that might have led to such a high dividend payment.

Cash is slightly more important than profit from a dividend perspective, but given Telecom Plus's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. This is why it's a relief to see Telecom Plus earnings per share are up 2.8% per annum over the last five years. Minimal earnings growth, combined with concerningly high payout ratios suggests that Telecom Plus is unlikely to grow the dividend much in future, and indeed the payment could be vulnerable to a cut.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last ten years, Telecom Plus has lifted its dividend by approximately 12% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

Should investors buy Telecom Plus for the upcoming dividend? The dividends are not well covered by either income or free cash flow, although at least earnings per share are slowly increasing. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

Wondering what the future holds for Telecom Plus? See what the five analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About LSE:TEP

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion