- United Kingdom

- /

- Electric Utilities

- /

- LSE:JEL

Shareholders May Be More Conservative With Jersey Electricity plc's (LON:JEL) CEO Compensation For Now

Performance at Jersey Electricity plc (LON:JEL) has been reasonably good and CEO Chris Ambler has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 03 March 2022. However, some shareholders will still be cautious of paying the CEO excessively.

View our latest analysis for Jersey Electricity

Comparing Jersey Electricity plc's CEO Compensation With the industry

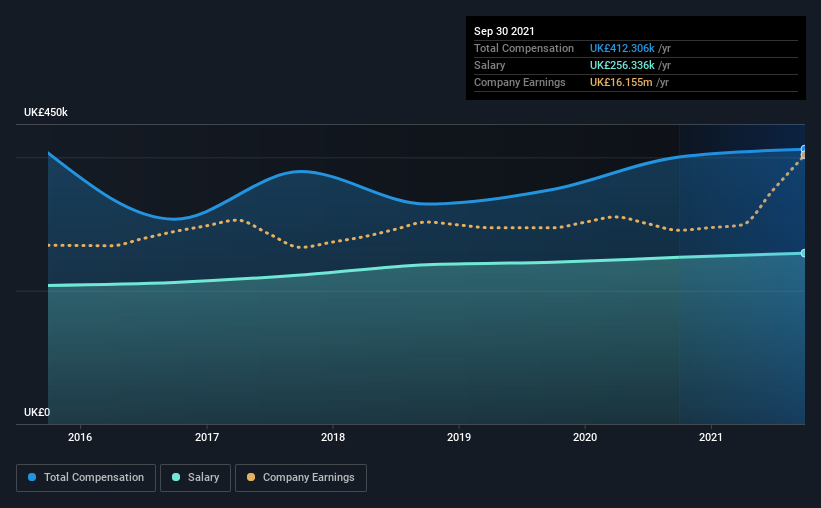

Our data indicates that Jersey Electricity plc has a market capitalization of UK£188m, and total annual CEO compensation was reported as UK£412k for the year to September 2021. That's mostly flat as compared to the prior year's compensation. In particular, the salary of UK£256.3k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from UK£75m to UK£299m, the reported median CEO total compensation was UK£133k. This suggests that Chris Ambler is paid more than the median for the industry. Furthermore, Chris Ambler directly owns UK£47k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£256k | UK£250k | 62% |

| Other | UK£156k | UK£151k | 38% |

| Total Compensation | UK£412k | UK£401k | 100% |

On an industry level, roughly 61% of total compensation represents salary and 39% is other remuneration. Our data reveals that Jersey Electricity allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Jersey Electricity plc's Growth

Jersey Electricity plc has seen its earnings per share (EPS) increase by 10% a year over the past three years. Its revenue is up 6.1% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Jersey Electricity plc Been A Good Investment?

Most shareholders would probably be pleased with Jersey Electricity plc for providing a total return of 44% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Jersey Electricity that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:JEL

Jersey Electricity

Engages in the generation, transmission, distribution, and supply of electricity in Jersey.

Excellent balance sheet and good value.

Market Insights

Community Narratives