- United Kingdom

- /

- Metals and Mining

- /

- AIM:GFM

Undiscovered Gems in the UK to Watch February 2025

Reviewed by Simply Wall St

As the UK market grapples with global economic challenges, notably impacted by weak trade data from China, the FTSE 100 and FTSE 250 indices have experienced declines, reflecting broader concerns about international demand and commodity prices. In this environment of uncertainty, identifying promising small-cap stocks requires a focus on companies with resilient business models and growth potential that can withstand external pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -3.68% | -4.07% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Griffin Mining (AIM:GFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the mining, exploration, and development of mineral properties, with a market cap of £267.56 million.

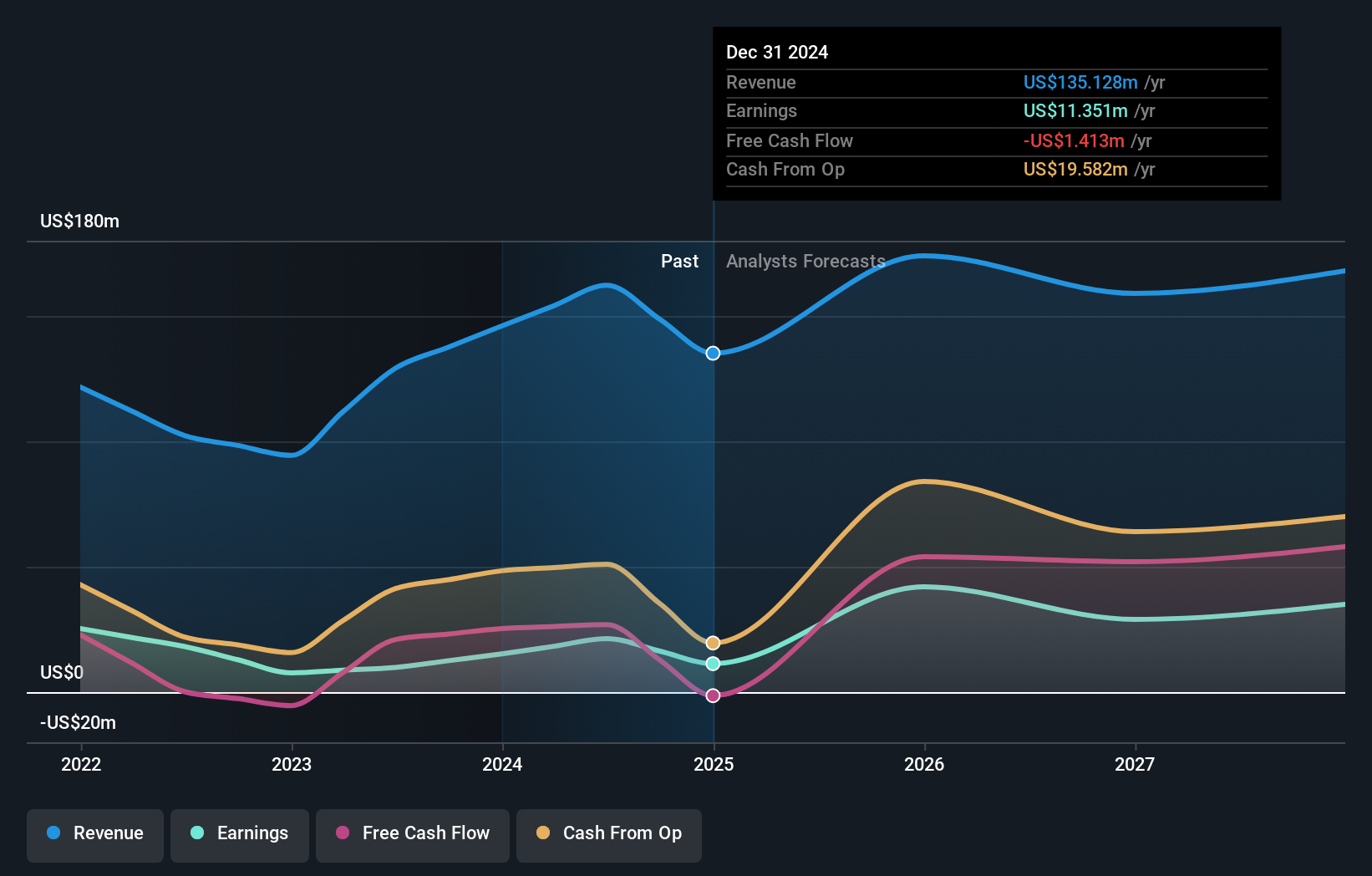

Operations: Griffin Mining generates revenue primarily from its Caijiaying Zinc Gold Mine, amounting to $162.25 million.

Griffin Mining, a nimble player in the UK market, recently reported a significant earnings growth of 116.5% over the past year, outpacing the Metals and Mining industry average of 13%. The company is debt-free, which removes concerns about interest payments and positions it well for future growth. Trading at 32.2% below its estimated fair value suggests potential upside for investors. Recent operational updates include resumed activities at the Caijiaying Mine after receiving necessary approvals and a change in auditors to BDO LLP following PwC's departure due to unrelated regulatory issues in China.

- Click here to discover the nuances of Griffin Mining with our detailed analytical health report.

Gain insights into Griffin Mining's historical performance by reviewing our past performance report.

Hargreaves Services (AIM:HSP)

Simply Wall St Value Rating: ★★★★★★

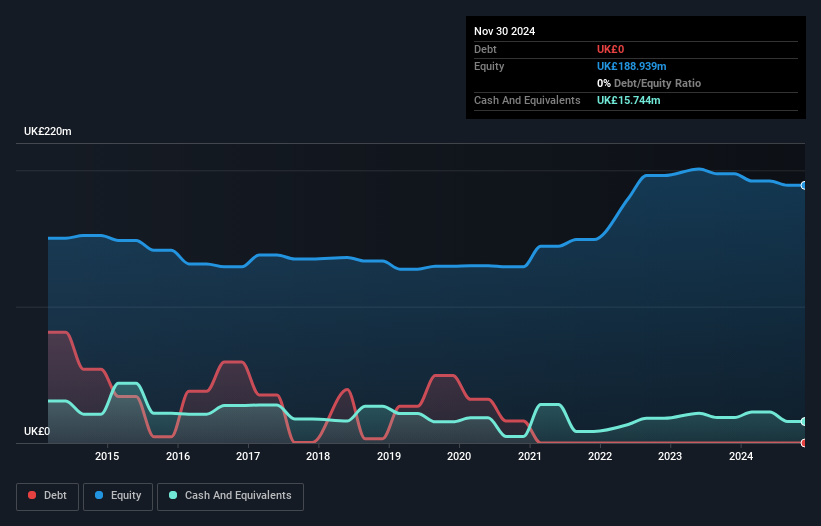

Overview: Hargreaves Services Plc offers environmental and industrial services across the United Kingdom, Europe, Hong Kong, and other international markets with a market cap of £205.68 million.

Operations: Hargreaves Services generates revenue primarily from its services segment, amounting to £219.11 million, with additional contributions from Hargreaves Land at £10.54 million.

Hargreaves Services, a relatively small player in the UK market, shows promise with its recent financial performance. The company reported half-year sales of £125.34 million, up from £110.17 million the previous year, and net income increased to £3.99 million from £1.71 million. Basic earnings per share rose to 12 pence from 5 pence a year ago, indicating strong profitability improvements despite a one-off gain of £6.2M affecting results until November 2024. With no debt on its books and trading at 45% below estimated fair value, Hargreaves appears well-positioned for future growth in the infrastructure sector under new COO Simon Hicks's leadership starting June 2025.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

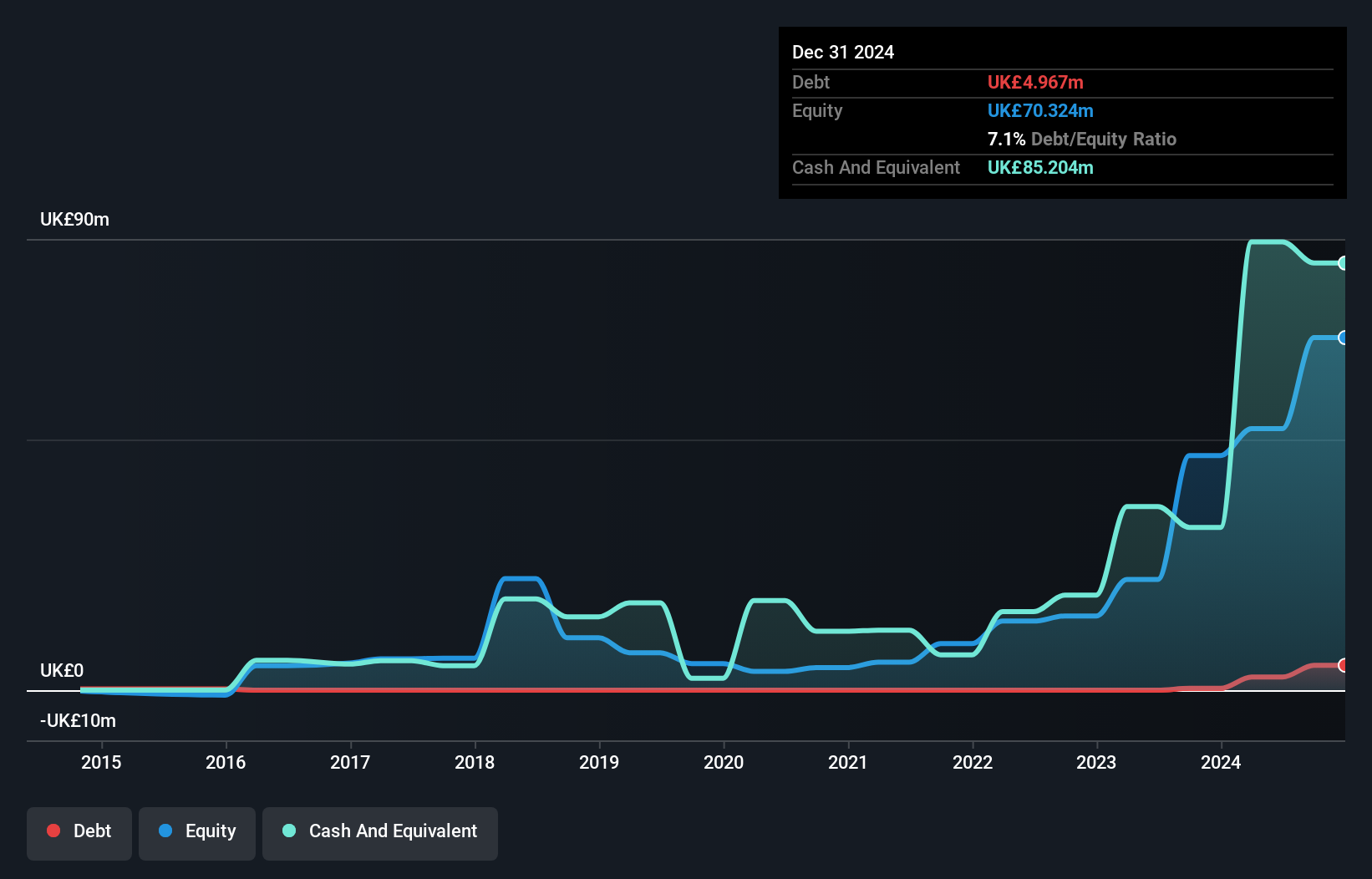

Overview: Yü Group PLC, with a market cap of £271.91 million, supplies energy and utility solutions primarily in the United Kingdom through its subsidiaries.

Operations: Yü Group generates revenue primarily from supplying energy and utility solutions in the UK. Its financial performance includes a market capitalization of £271.91 million.

Yü Group, a dynamic player in the UK market, has seen its earnings soar by 400% over the past year, outpacing the Renewable Energy sector's -5%. The company is trading at nearly 30% below its estimated fair value, suggesting potential for upside. Despite an increase in its debt-to-equity ratio from 0% to 5% over five years, Yü maintains more cash than total debt and comfortably covers interest payments with profits. With revenue expected to grow by about 16% annually and high-quality earnings reported, Yü appears well-positioned despite forecasted declines in earnings.

- Click here and access our complete health analysis report to understand the dynamics of Yü Group.

Understand Yü Group's track record by examining our Past report.

Next Steps

- Click through to start exploring the rest of the 57 UK Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GFM

Griffin Mining

A mining and investment company, engages in the mining, exploration, and development of mineral properties.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives