- United Kingdom

- /

- Communications

- /

- AIM:FTC

Undiscovered Gems In The UK Featuring 3 Promising Small Caps

Reviewed by Simply Wall St

The UK market has recently experienced some turbulence, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic challenges. In this environment, small-cap stocks can offer unique opportunities as they may be less exposed to international pressures and more focused on domestic growth. Identifying promising small caps requires looking for companies with strong fundamentals and innovative strategies that can thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| Anglo-Eastern Plantations | NA | 8.55% | 11.10% | ★★★★★★ |

| MS INTERNATIONAL | NA | 13.42% | 56.55% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Filtronic (AIM:FTC)

Simply Wall St Value Rating: ★★★★★★

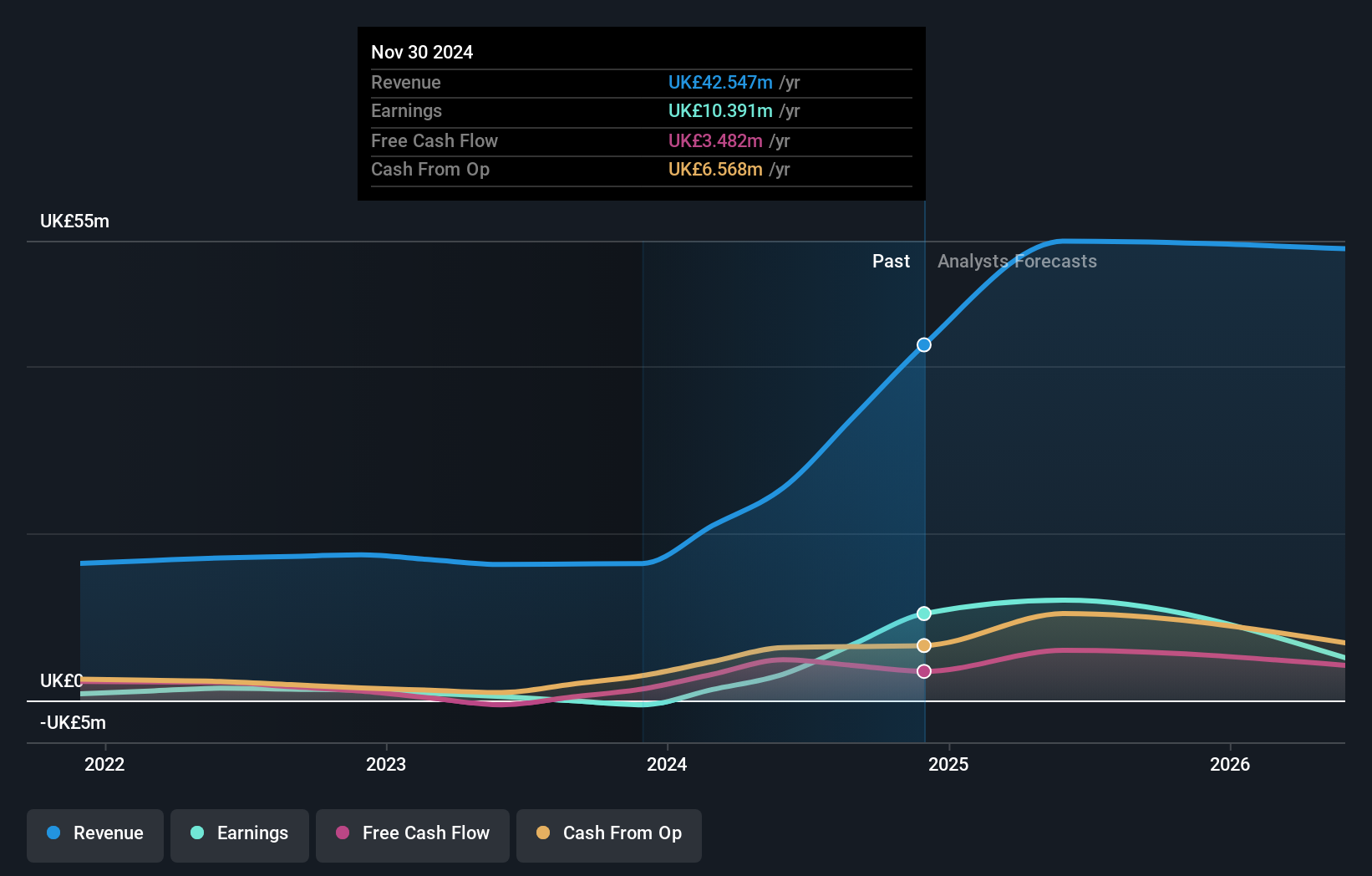

Overview: Filtronic plc designs, develops, manufactures, and sells radio frequency (RF) technology across the United Kingdom, Europe, the Americas, and internationally with a market cap of £304.41 million.

Operations: Revenue is primarily derived from the wireless communications equipment segment, amounting to £42.55 million.

Filtronic, a nimble player in the UK market, boasts a debt-free balance sheet and has recently turned profitable. The company’s strategic partnership with SpaceX has been strengthened, leading to a $32.5 million order for its E-band Cerus 32 SSPA. Filtronic's revenue is projected to grow by 10% annually, outpacing the industry average of -1.3%. Recent contracts with major players like Airbus and Leonardo highlight its expanding role in satellite communications and defense sectors. Despite some volatility in share price over the past three months, Filtronic remains free cash flow positive with high-quality earnings.

- Dive into the specifics of Filtronic here with our thorough health report.

Understand Filtronic's track record by examining our Past report.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

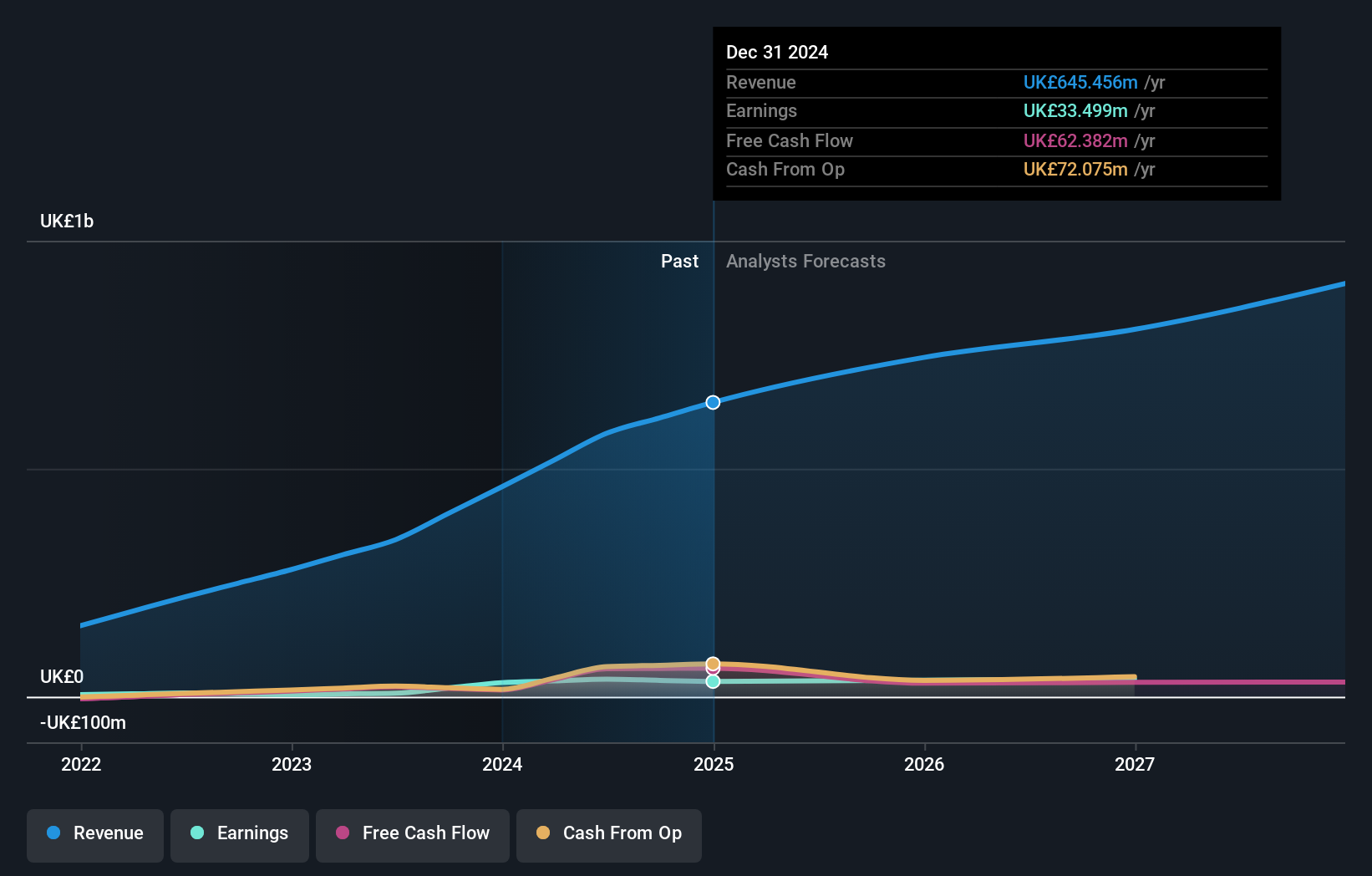

Overview: Yü Group PLC, with a market cap of £288.78 million, operates through its subsidiaries to supply energy and utility solutions primarily in the United Kingdom.

Operations: Yü Group PLC generates revenue primarily from its Retail segment, contributing £645.26 million, followed by the Smart segment at £12.73 million and Metering Assets at £0.66 million. The company also engages in intra-segment trading, resulting in a deduction of £13.20 million from total revenues.

Yü Group, a promising player in the UK energy sector, has shown robust earnings growth of 8.6%, outpacing the Renewable Energy industry's -6.3%. Over five years, its debt to equity ratio rose from 0% to 7.1%, yet it remains financially sound with more cash than total debt and positive free cash flow. Trading at a discount of 34.7% below estimated fair value, it offers good relative value against peers. Recent results highlight sales jumping to £645 million from £460 million last year and net income reaching £33.5 million, alongside an increased dividend payout aligning with their progressive policy.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

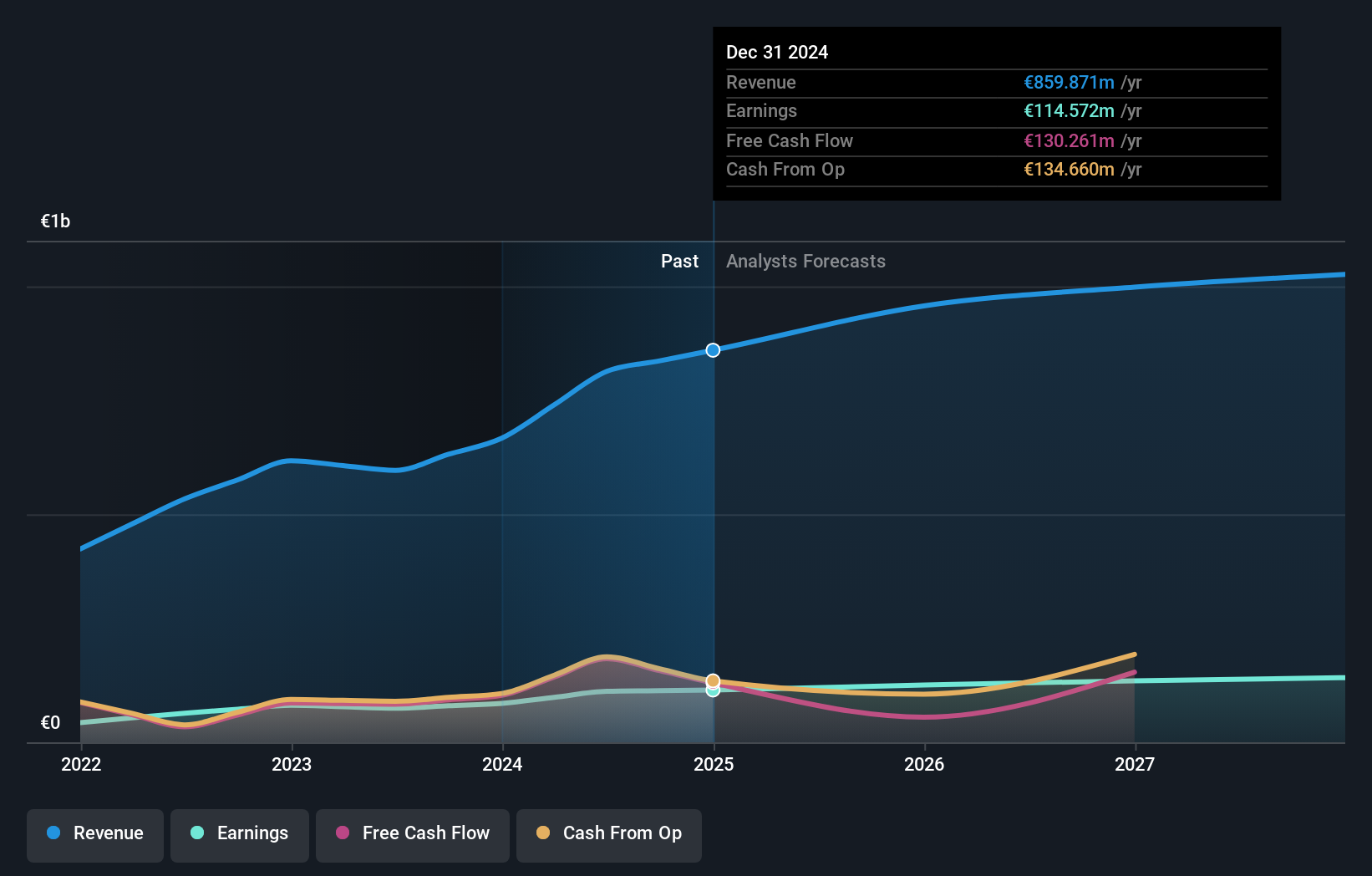

Overview: Cairn Homes plc is a homebuilder operating in Ireland with a market cap of £1.20 billion.

Operations: Cairn Homes generates revenue primarily from building and property development, totaling €859.87 million. The company's financial performance is influenced by its cost structure and market conditions in the Irish housing sector.

Cairn Homes, a key player in Ireland's housing sector, is leveraging strategic land acquisitions and efficient construction methods to bolster profitability. The company's earnings grew by 34% over the past year, outpacing the Consumer Durables industry which saw a 12% decline. With its debt-to-equity ratio rising from 19.4% to 24% over five years, Cairn's net debt level remains satisfactory at 20.4%. Despite insider selling recently, the firm trades at nearly half its estimated fair value and expects revenue growth exceeding 10%, with operating profit around €160 million for fiscal year 2025.

Seize The Opportunity

- Dive into all 57 of the UK Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FTC

Filtronic

Designs, develops, manufactures, and sells radio frequency (RF) technology in the United Kingdom, Europe, the Americas, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives