Stock Analysis

- United Kingdom

- /

- Renewable Energy

- /

- AIM:YU.

Exploring Warpaint London And Two More Hidden UK Stocks With Robust Financials

Reviewed by Simply Wall St

The United Kingdom market has shown a positive trajectory, rising by 4.9% over the past year with earnings projected to grow by 13% annually. In such an optimistic climate, stocks like Warpaint London that combine robust financials with lesser visibility can present intriguing opportunities for investors looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 17.80% | 18.35% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, together with its subsidiaries, produces and sells cosmetics and has a market capitalization of £479.77 million.

Operations: Warpaint London primarily generates its revenue through its own brand products, contributing significantly with £87.07 million, while the close-out segment adds a smaller portion at £2.52 million. The company's business model focuses on maintaining a robust gross profit margin which has recently been recorded at 39.87%.

Warpaint London, a standout in the UK's personal products sector, has demonstrated robust financial health and growth potential. With no debt and a past year earnings surge of 122%, the company outpaces industry growth of 17%. Forecasted annual earnings growth stands at 15%, underpinned by high-quality earnings. Recent strategic moves include a £31.5 million equity offering and a dividend increase to 6 pence per share, signaling confidence in sustained profitability and shareholder value enhancement.

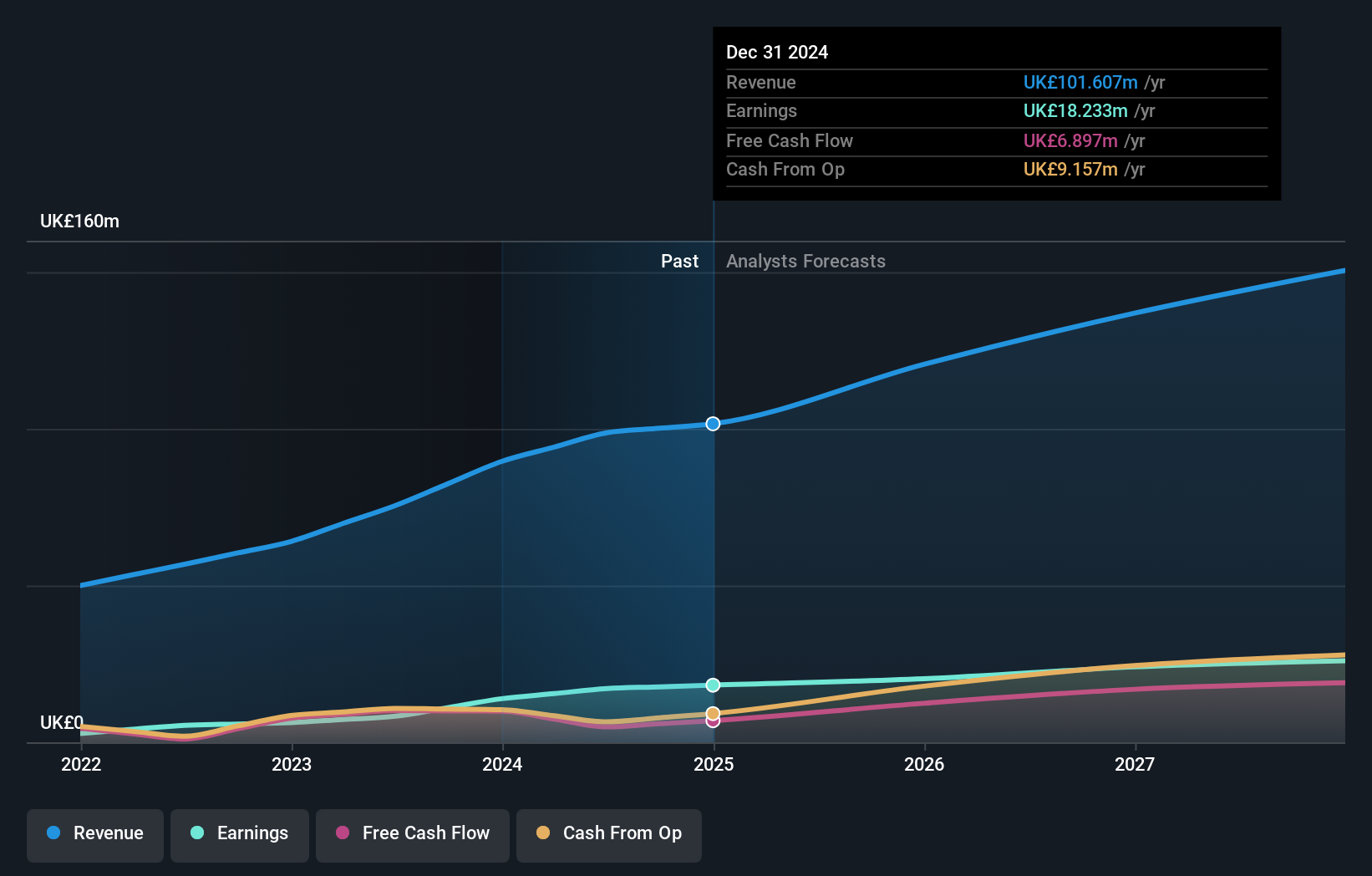

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC is a UK-based company that specializes in providing energy and utility solutions, with a market capitalization of £317.22 million.

Operations: The entity primarily generates revenue through its retail segment, which contributed £459.80 million, supplemented by smaller segments in smart technology and metering assets. Over recent periods, the gross profit margin has shown an upward trend, reaching 18.05% by the end of 2023, reflecting improved operational efficiency despite varying net income figures across the years.

Yü Group, a notable player in the UK's renewable energy sector, has demonstrated remarkable financial performance with earnings growth of 547% last year. Trading at 63% below its estimated fair value and with a positive cash flow, the company is positioned well against industry peers. Recently announcing a significant dividend increase to 37 pence for 2023, up from 3 pence, reflects strong profitability and shareholder confidence. Despite recent insider selling and share price volatility, Yü Group's robust earnings outlook suggests potential for growth.

- Dive into the specifics of Yü Group here with our thorough health report.

Evaluate Yü Group's historical performance by accessing our past performance report.

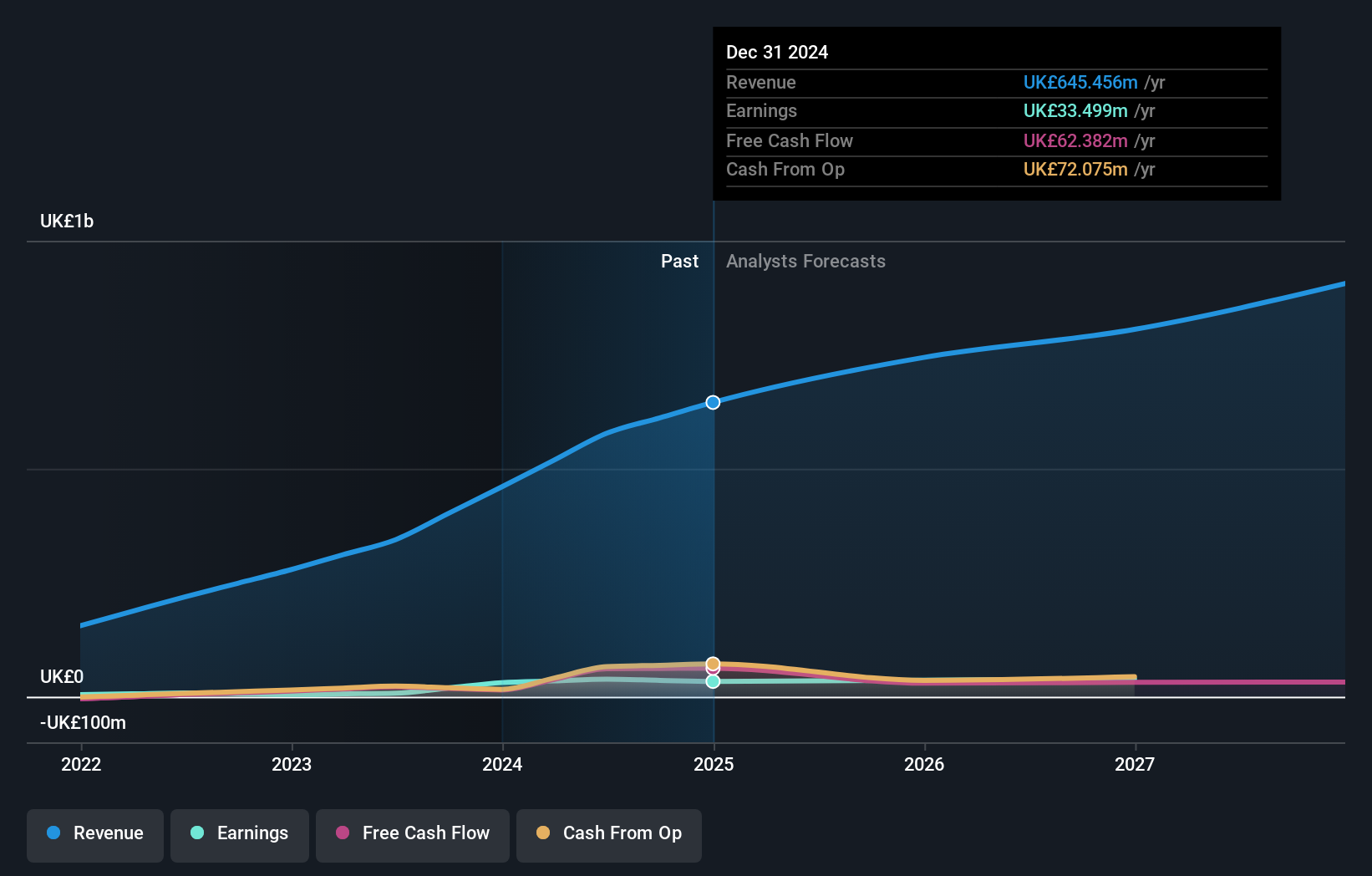

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Cairn Homes plc, a holding company based in Ireland, specializes in building homes and communities with a market capitalization of approximately £1.05 billion.

Operations: The company generates its revenue primarily through building and property development, with recent figures showing a revenue of €666.81 million. It has demonstrated a consistent increase in gross profit margin over the years, reaching 22.14% by the end of 2023, reflecting improved operational efficiency and cost management strategies.

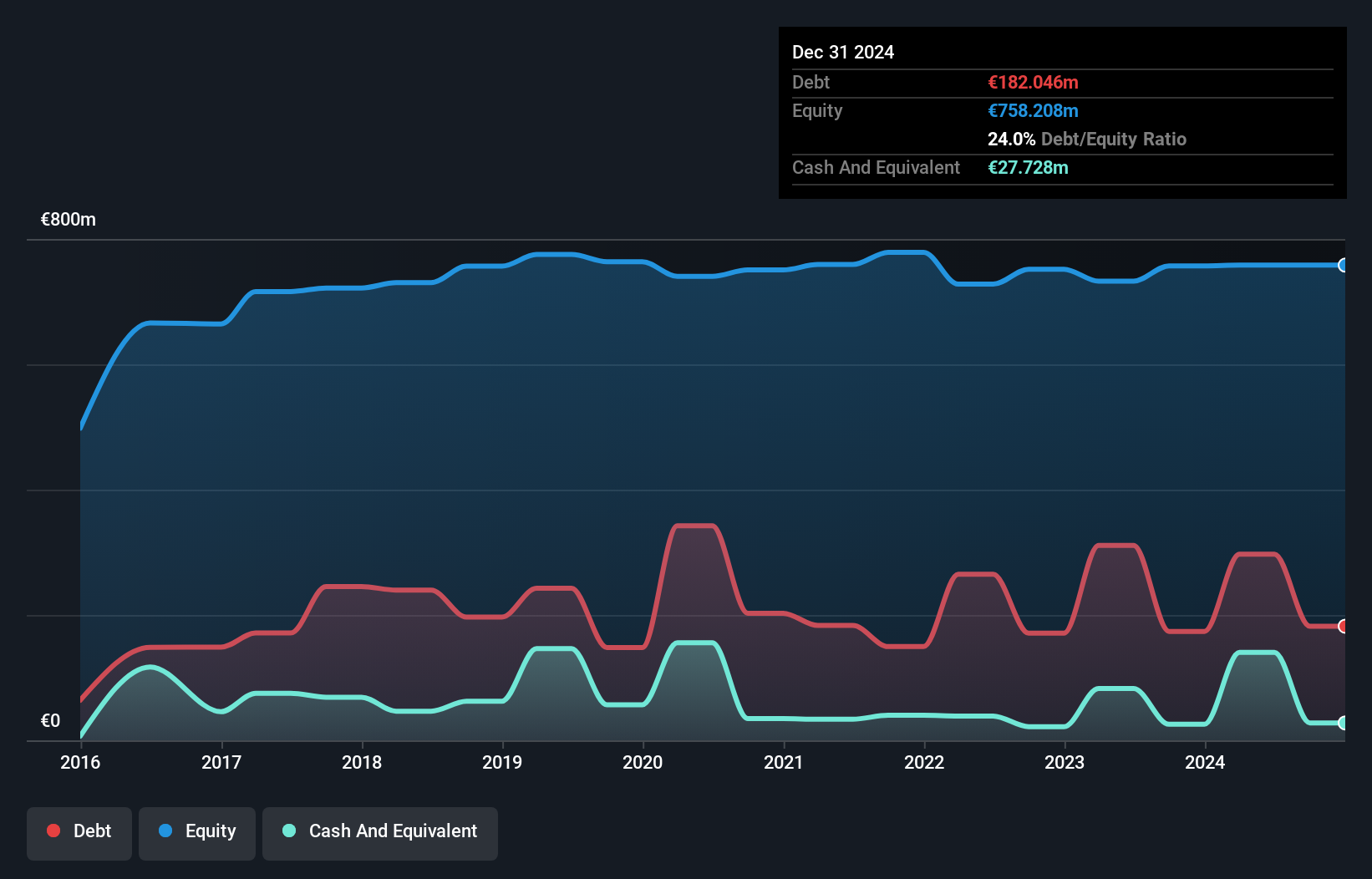

Cairn Homes stands out with its robust financial health and growth trajectory. The company's earnings have grown by 5.4% over the past year, surpassing the Consumer Durables industry's decline of 21.1%. Its net debt to equity ratio has improved from 26% to 23%, reflecting prudent financial management. With earnings forecasted to grow by nearly 11% annually, Cairn Homes trades at a compelling valuation, approximately 2.9% below its estimated fair value, signaling potential for investors seeking overlooked opportunities in the UK market.

- Unlock comprehensive insights into our analysis of Cairn Homes stock in this health report.

Assess Cairn Homes' past performance with our detailed historical performance reports.

Make It Happen

- Discover the full array of 79 UK Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Yü Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YU.

Yü Group

Through its subsidiaries, supplies energy and utility solutions primarily in the United Kingdom.

Outstanding track record and undervalued.