- United Kingdom

- /

- Renewable Energy

- /

- AIM:GOOD

What Percentage Of Good Energy Group PLC (LON:GOOD) Shares Do Insiders Own?

The big shareholder groups in Good Energy Group PLC (LON:GOOD) have power over the company. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. Warren Buffett said that he likes 'a business with enduring competitive advantages that is run by able and owner-oriented people'. So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

Good Energy Group is a smaller company with a market capitalization of UK£39m, so it may still be flying under the radar of many institutional investors. In the chart below, we can see that institutions are noticeable on the share registry. Let's delve deeper into each type of owner, to discover more about Good Energy Group.

See our latest analysis for Good Energy Group

What Does The Institutional Ownership Tell Us About Good Energy Group?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

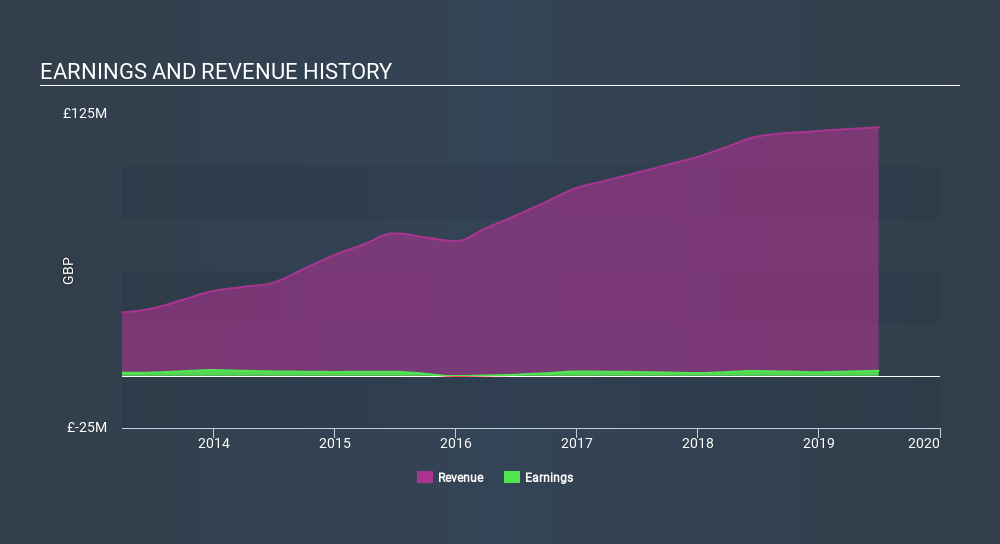

As you can see, institutional investors own 34% of Good Energy Group. This suggests some credibility amongst professional investors. But we can't rely on that fact alone, since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Good Energy Group's earnings history, below. Of course, the future is what really matters.

We note that hedge funds don't have a meaningful investment in Good Energy Group. Ecotricity Group Limited is currently the company's largest shareholder with 26% of shares outstanding. Hargreaves Lansdown Asset Management Limited is the second largest shareholder with 7.1% of common stock, followed by Martin Edwards, holding 4.1% of the stock.

On studying the facts and figures more closely, we found that 8 of the top shareholders account for 50% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There is some analyst coverage of the stock, but it could still become more well known, with time.

Insider Ownership Of Good Energy Group

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own some shares in Good Energy Group PLC. In their own names, insiders own UK£3.3m worth of stock in the UK£39m company. This shows at least some alignment, but I usually like to see larger insider holdings. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 30% ownership, the general public have some degree of sway over GOOD. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

Our data indicates that Private Companies hold 26%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Good Energy Group better, we need to consider many other factors. Take risks, for example - Good Energy Group has 4 warning signs (and 1 which can't be ignored) we think you should know about.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:GOOD

Good Energy Group

Through its subsidiaries, engages in the purchase, generation, and sale of electricity from renewable sources in the United Kingdom.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion