- United Kingdom

- /

- Consumer Finance

- /

- AIM:RFX

Futura Medical Leads The Pack Of 3 UK Penny Stocks To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index closing lower amid weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, certain investment opportunities remain compelling. Penny stocks, although often considered a niche area of investing, can offer unique growth potential when backed by solid financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| FRP Advisory Group (AIM:FRP) | £1.235 | £307.76M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £183.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.11 | £794.96M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.065 | £405.78M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £5.06 | £477.11M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.515 | £170.25M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.488 | £229.49M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.54 | £196.12M | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | £3.865 | £468.35M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.4225 | £121.47M | ★★★★★★ |

Click here to see the full list of 471 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Futura Medical (AIM:FUM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Futura Medical plc researches, develops, and sells pharmaceutical and healthcare products focused on sexual health, with a market cap of £102.82 million.

Operations: The company generates revenue of £8.40 million from the development and commercialisation of MED3000.

Market Cap: £102.82M

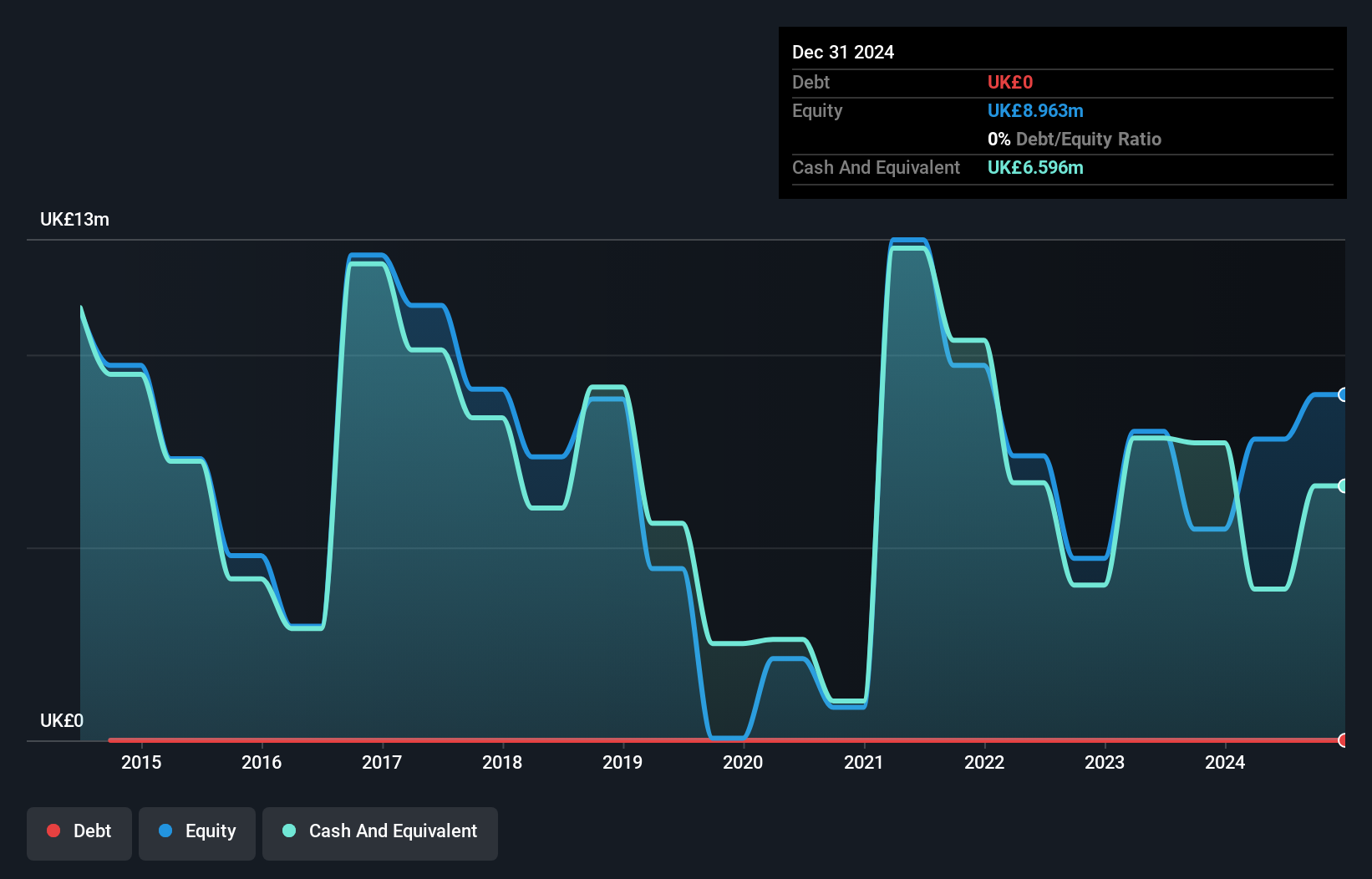

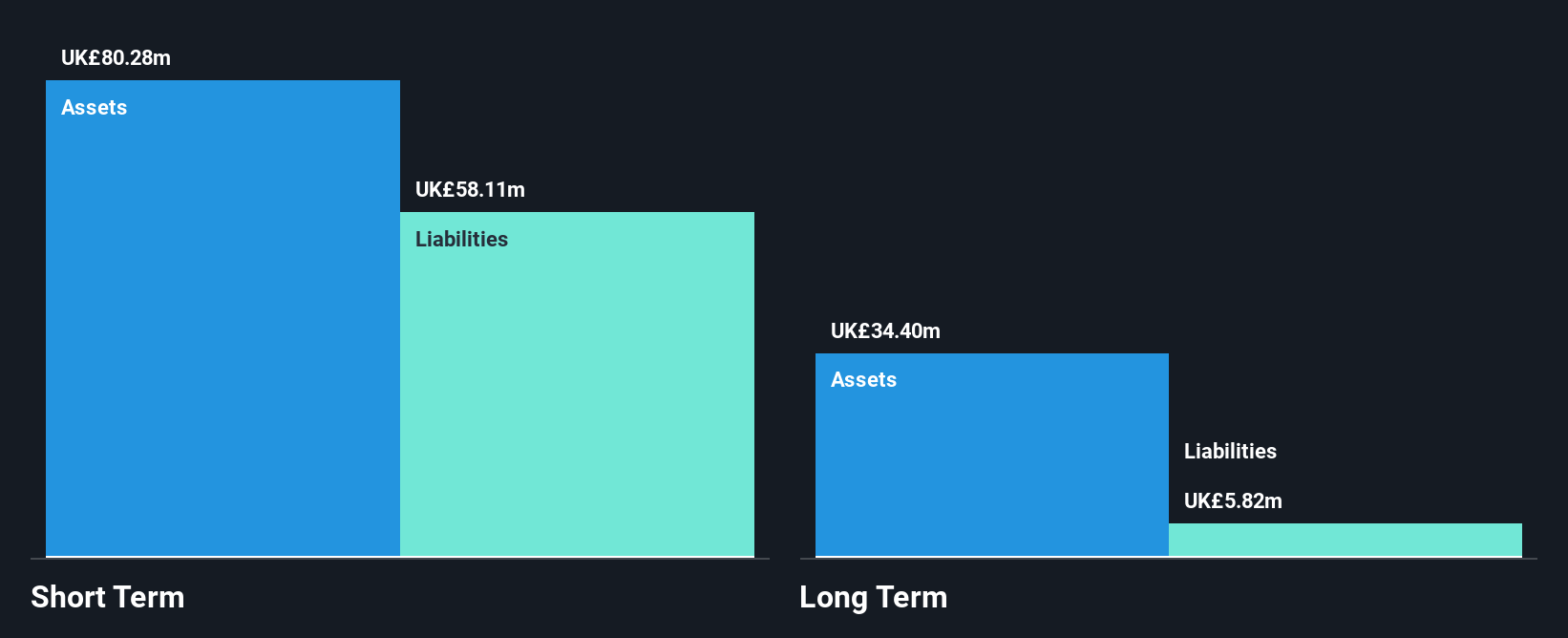

Futura Medical, with a market cap of £102.82 million, has demonstrated significant revenue growth, reporting £7 million in sales for the first half of 2024 compared to £1.7 million the previous year. Despite being unprofitable, it has reduced losses over the past five years and is debt-free with no long-term liabilities. The company's short-term assets exceed its short-term liabilities by a comfortable margin. However, its cash runway is less than a year based on current free cash flow levels. Analysts widely agree on potential stock price appreciation despite high share price volatility recently.

- Dive into the specifics of Futura Medical here with our thorough balance sheet health report.

- Evaluate Futura Medical's prospects by accessing our earnings growth report.

Good Energy Group (AIM:GOOD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Good Energy Group PLC, with a market cap of £52.93 million, operates in the United Kingdom through its subsidiaries by purchasing, generating, and selling electricity from renewable sources.

Operations: The company's revenue is derived from Energy as a Service (£8.84 million), Gas Supply (£27.19 million), Electricity Supply (£154.51 million), and FIT Administration (£5.46 million) within the United Kingdom.

Market Cap: £52.93M

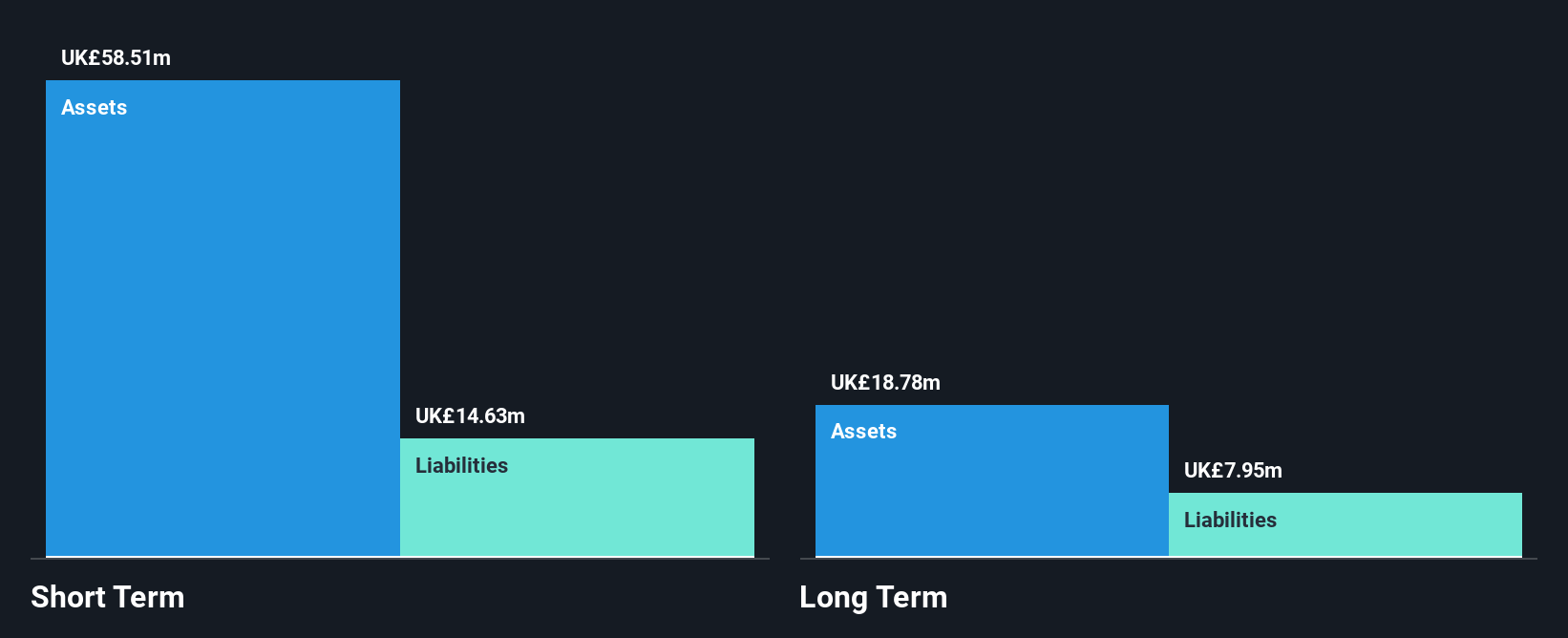

Good Energy Group PLC, with a market cap of £52.93 million, remains unprofitable but is trading at a significant discount to its estimated fair value. The company has successfully reduced its debt-to-equity ratio from 280.3% to 9.9% over five years and has more cash than total debt, indicating strong financial management despite shareholder dilution by 8.6%. Recent innovations include the FIT REGO Boost service for microgenerators and an EV tariff with competitive rates, enhancing customer offerings in renewable energy solutions. Short-term assets of £92.8M cover both short- and long-term liabilities comfortably, supporting operational stability amidst earnings challenges.

- Navigate through the intricacies of Good Energy Group with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Good Energy Group's future.

Ramsdens Holdings (AIM:RFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ramsdens Holdings PLC provides diversified financial services in the United Kingdom and internationally, with a market cap of £66.98 million.

Operations: The company's revenue is derived from several segments, including Pawnbroking (£12.81 million), Retail Jewellery Sales (£33.68 million), Foreign Currency Margin (£14.31 million), Purchases of Precious Metals (£27.18 million), and Income from Other Financial Services (£0.60 million).

Market Cap: £66.98M

Ramsdens Holdings PLC, with a market cap of £66.98 million, demonstrates solid financial health with more cash than total debt and short-term assets of £56.8 million exceeding liabilities. The company's diversified revenue streams include Retail Jewellery Sales (£33.68 million) and Purchases of Precious Metals (£27.18 million), contributing to high-quality earnings despite a slight decline in profit margins from last year (10.1% to 8.8%). While the company trades at a discount to its estimated fair value, recent significant insider selling could be a concern for potential investors seeking stability in penny stocks.

- Click here to discover the nuances of Ramsdens Holdings with our detailed analytical financial health report.

- Examine Ramsdens Holdings' earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Embark on your investment journey to our 471 UK Penny Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RFX

Ramsdens Holdings

Engages in the provision of diversified financial services in the United Kingdom and internationally.

Excellent balance sheet second-rate dividend payer.