- United Kingdom

- /

- Infrastructure

- /

- LSE:OCN

Undiscovered Gems in the United Kingdom for October 2024

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 and FTSE 250 indices both closing lower amid weak trade data from China. This broader market sentiment underscores the importance of identifying resilient stocks that can navigate economic uncertainties effectively. In this article, we explore three undiscovered gems in the UK market for October 2024, focusing on companies that demonstrate strong fundamentals and potential for growth despite current global headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

Overview: James Halstead plc manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally with a market cap of £766.89 million.

Operations: James Halstead generates revenue primarily from the sale of flooring products across various regions including the UK, Europe, and internationally. The company reported a market cap of £766.89 million.

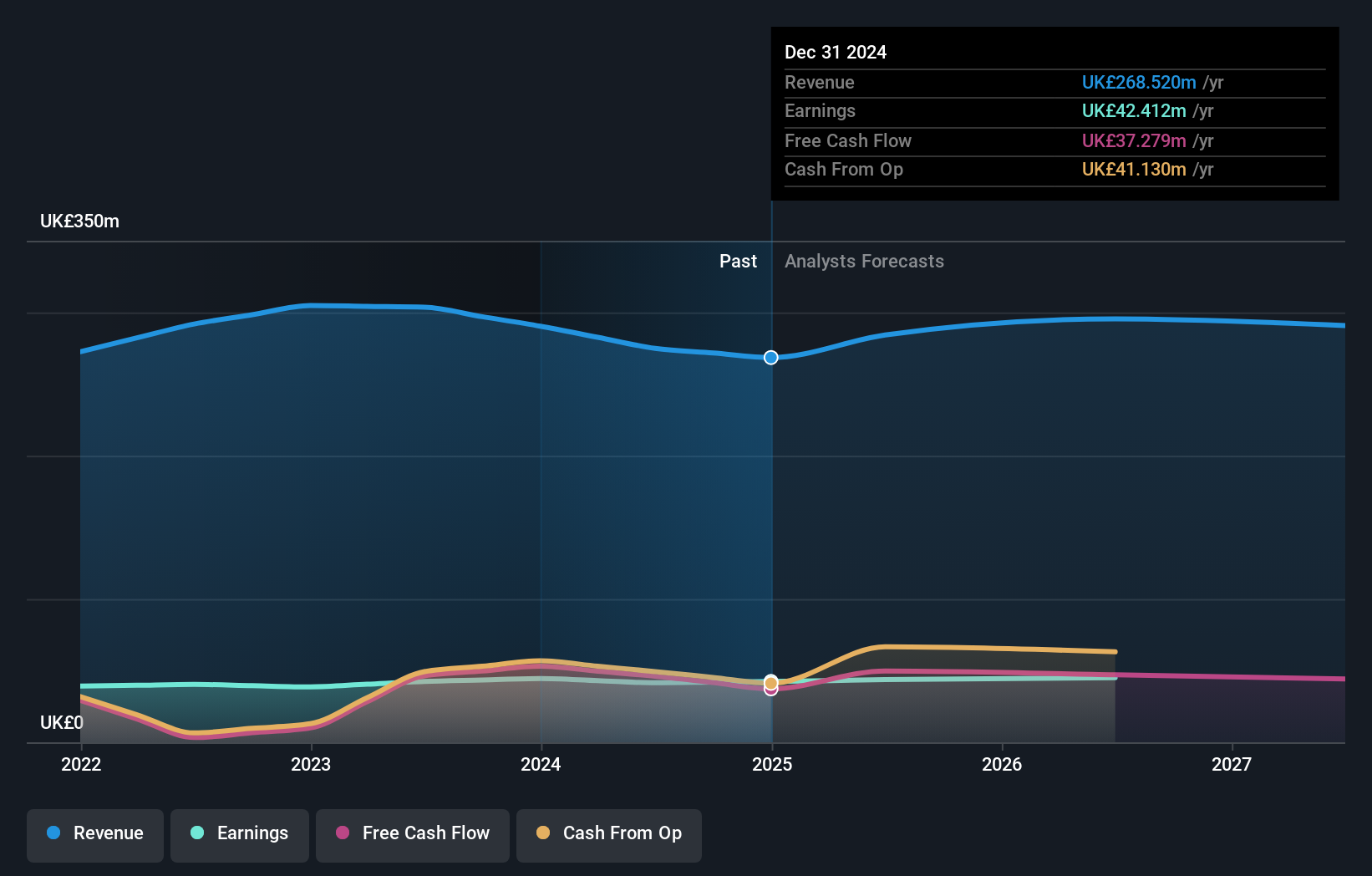

James Halstead, a notable player in the flooring sector, reported sales of £274.88 million for the year ending June 2024, down from £303.56 million previously. Net income stood at £41.52 million compared to £42.4 million last year, with basic earnings per share stable at £0.1. The company trades 5% below its estimated fair value and has reduced its debt-to-equity ratio from 0.2 to 0.1 over five years while maintaining high-quality earnings despite recent negative growth (-2.1%).

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that operates as a home and community builder in Ireland with a market cap of £1.02 billion.

Operations: The primary revenue stream for Cairn Homes comes from its building and property development segment, which generated €813.40 million. The company has a market cap of £1.02 billion.

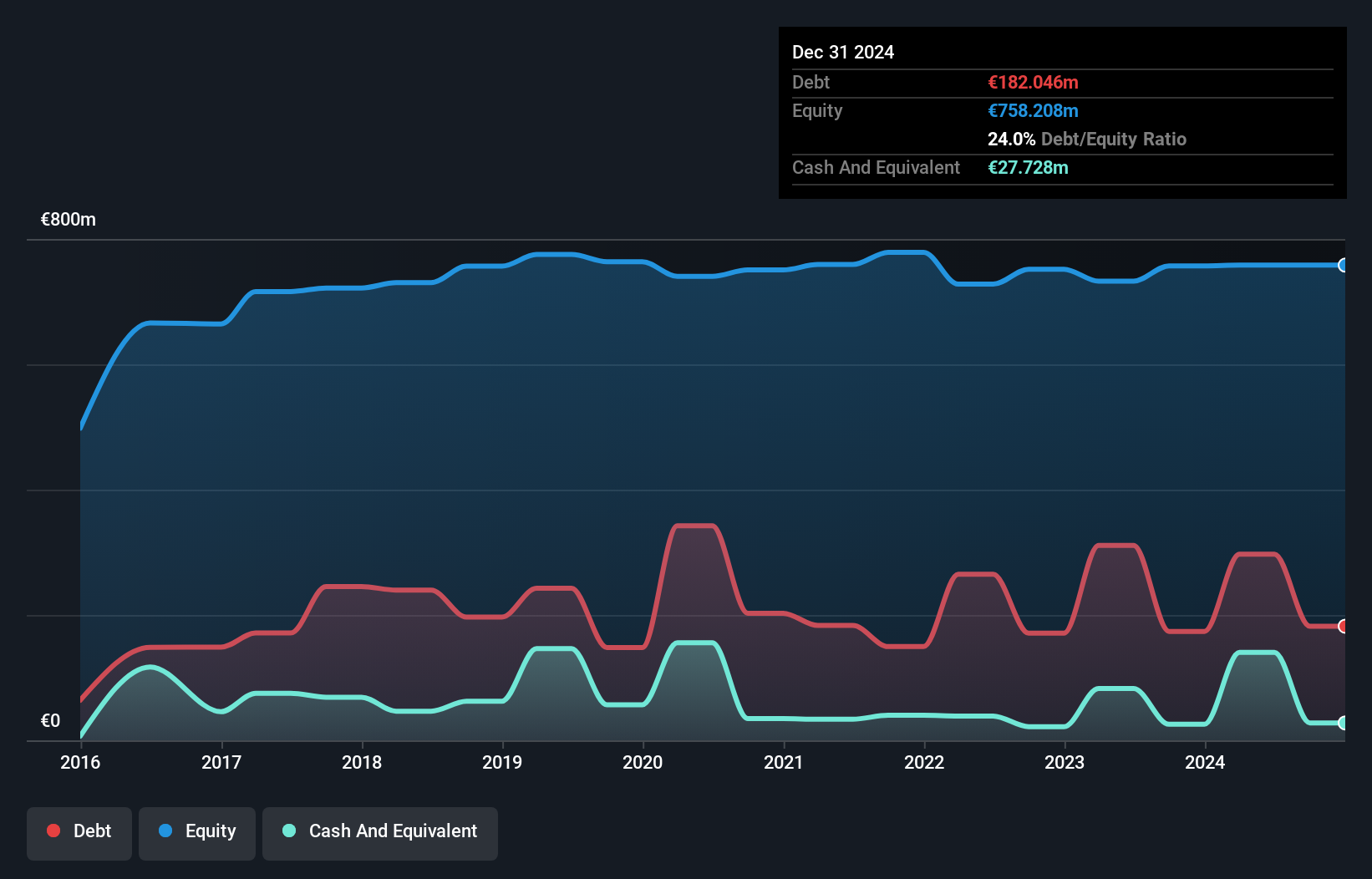

Cairn Homes has shown robust earnings growth, with a 49.5% increase over the past year, outpacing the industry average of -14.6%. The company repurchased 56.5 million shares for €70 million in 2024, reducing its share capital by 8.43%. Cairn's net debt to equity ratio stands at a satisfactory 20.7%, and its interest payments are well covered by EBIT at 9.5x coverage. The P/E ratio of 11x is attractive compared to the UK market average of 16.8x.

- Click here and access our complete health analysis report to understand the dynamics of Cairn Homes.

Review our historical performance report to gain insights into Cairn Homes''s past performance.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ocean Wilsons Holdings Limited, with a market cap of £514.53 million, is an investment holding company that provides maritime and logistics services in Brazil.

Operations: The company generates revenue primarily from its maritime services in Brazil, amounting to $519.35 million.

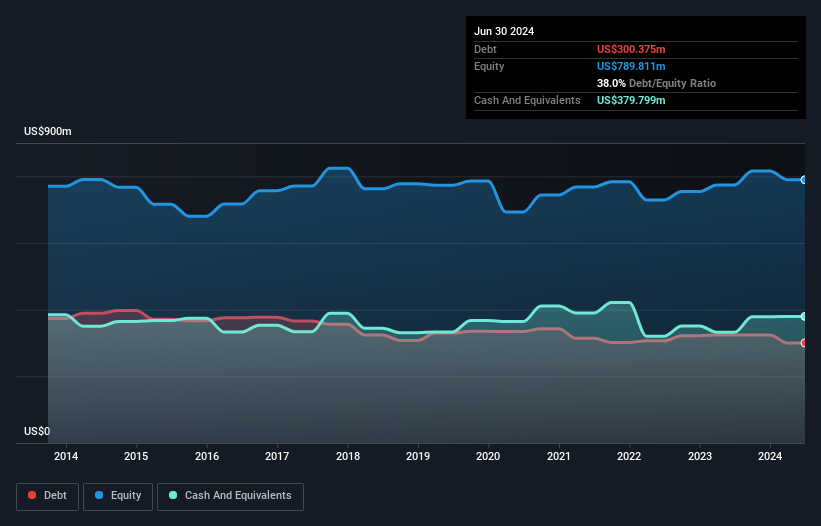

Ocean Wilsons Holdings (OCN) has been making waves with its robust financial performance and strategic moves. The company's earnings grew by 32.7% over the past year, outpacing the Infrastructure industry's 12%. With a price-to-earnings ratio of 11.1x, it's attractively valued compared to the UK market's 16.8x. OCN's debt-to-equity ratio improved from 42.7% to 38% over five years, and it holds more cash than total debt. Recent discussions about selling its subsidiary Wilson Sons could further impact its valuation positively or negatively based on transaction outcomes.

- Get an in-depth perspective on Ocean Wilsons Holdings' performance by reading our health report here.

Explore historical data to track Ocean Wilsons Holdings' performance over time in our Past section.

Taking Advantage

- Explore the 81 names from our UK Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OCN

Ocean Wilsons Holdings

An investment holding company, offers maritime and logistics services in Brazil.

Flawless balance sheet established dividend payer.