- United Kingdom

- /

- Infrastructure

- /

- LSE:GPH

What You Can Learn From Global Ports Holding Plc's (LON:GPH) P/S

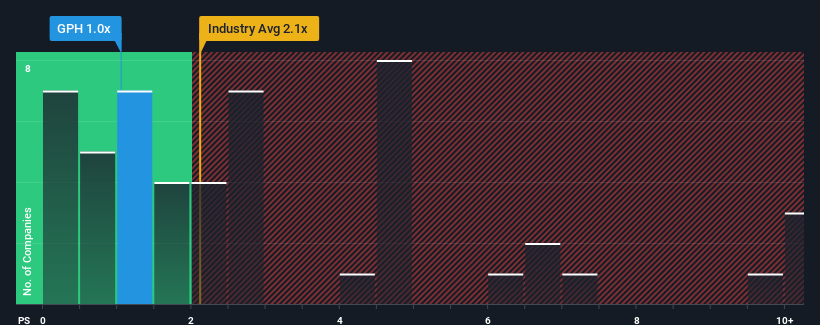

With a median price-to-sales (or "P/S") ratio of close to 1x in the Infrastructure industry in the United Kingdom, you could be forgiven for feeling indifferent about Global Ports Holding Plc's (LON:GPH) P/S ratio, which comes in at about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Global Ports Holding

What Does Global Ports Holding's Recent Performance Look Like?

Recent times haven't been great for Global Ports Holding as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Global Ports Holding's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Global Ports Holding?

In order to justify its P/S ratio, Global Ports Holding would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 8.1% gain to the company's revenues. Pleasingly, revenue has also lifted 222% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 3.4% per annum during the coming three years according to the sole analyst following the company. That's shaping up to be similar to the 3.9% per annum growth forecast for the broader industry.

In light of this, it's understandable that Global Ports Holding's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Global Ports Holding's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Plus, you should also learn about this 1 warning sign we've spotted with Global Ports Holding.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GPH

Global Ports Holding

Engages in the operation of ports in Turkey, Montenegro, Malta, Spain, Bahamas, Antigua and Barbuda, Italy, and Croatia.

Slight with questionable track record.