For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Jet2 (LON:JET2). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Jet2

How Fast Is Jet2 Growing Its Earnings Per Share?

Over the last three years, Jet2 has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Jet2's EPS catapulted from UK£0.95 to UK£2.01, over the last year. Year on year growth of 111% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

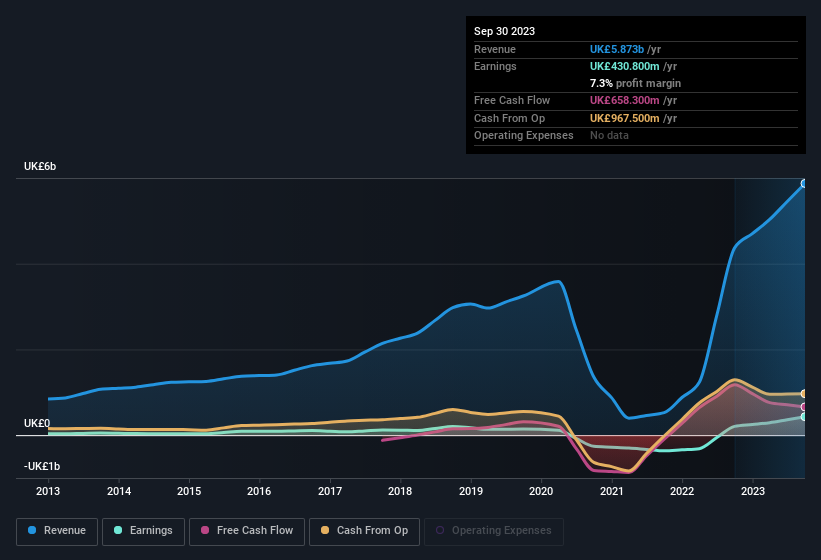

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Jet2 maintained stable EBIT margins over the last year, all while growing revenue 34% to UK£5.9b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Jet2's future EPS 100% free.

Are Jet2 Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first, there weren't any reports of insiders selling shares in Jet2 in the last 12 months. Even better, though, is that the company insider, Philip Meeson, bought a whopping UK£169k worth of shares, paying about UK£11.24 per share, on average. Big buys like that may signal an opportunity; actions speak louder than words.

The good news, alongside the insider buying, for Jet2 bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth UK£493m. This totals to 19% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Looking very optimistic for investors.

Does Jet2 Deserve A Spot On Your Watchlist?

Jet2's earnings per share have been soaring, with growth rates sky high. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Jet2 belongs near the top of your watchlist. Still, you should learn about the 1 warning sign we've spotted with Jet2.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Jet2, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:JET2

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026