Why Investors Shouldn't Be Surprised By Helios Towers plc's (LON:HTWS) 27% Share Price Surge

Helios Towers plc (LON:HTWS) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 30%.

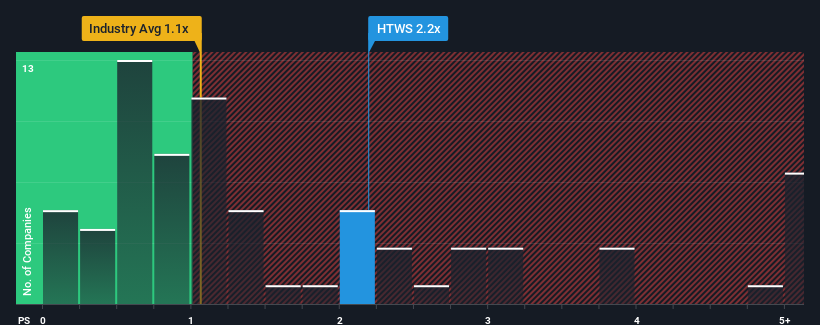

After such a large jump in price, when almost half of the companies in the United Kingdom's Telecom industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Helios Towers as a stock probably not worth researching with its 2.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Helios Towers

What Does Helios Towers' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Helios Towers has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Helios Towers will help you uncover what's on the horizon.How Is Helios Towers' Revenue Growth Trending?

Helios Towers' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 29% gain to the company's top line. The latest three year period has also seen an excellent 74% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 9.7% per year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.8% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why Helios Towers' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Helios Towers' P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Helios Towers shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Helios Towers that you should be aware of.

If these risks are making you reconsider your opinion on Helios Towers, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Helios Towers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:HTWS

Helios Towers

An independent tower company, acquires, builds, and operates telecommunications towers.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives