- United Kingdom

- /

- Wireless Telecom

- /

- LSE:AAF

With Airtel Africa Plc (LON:AAF) It Looks Like You'll Get What You Pay For

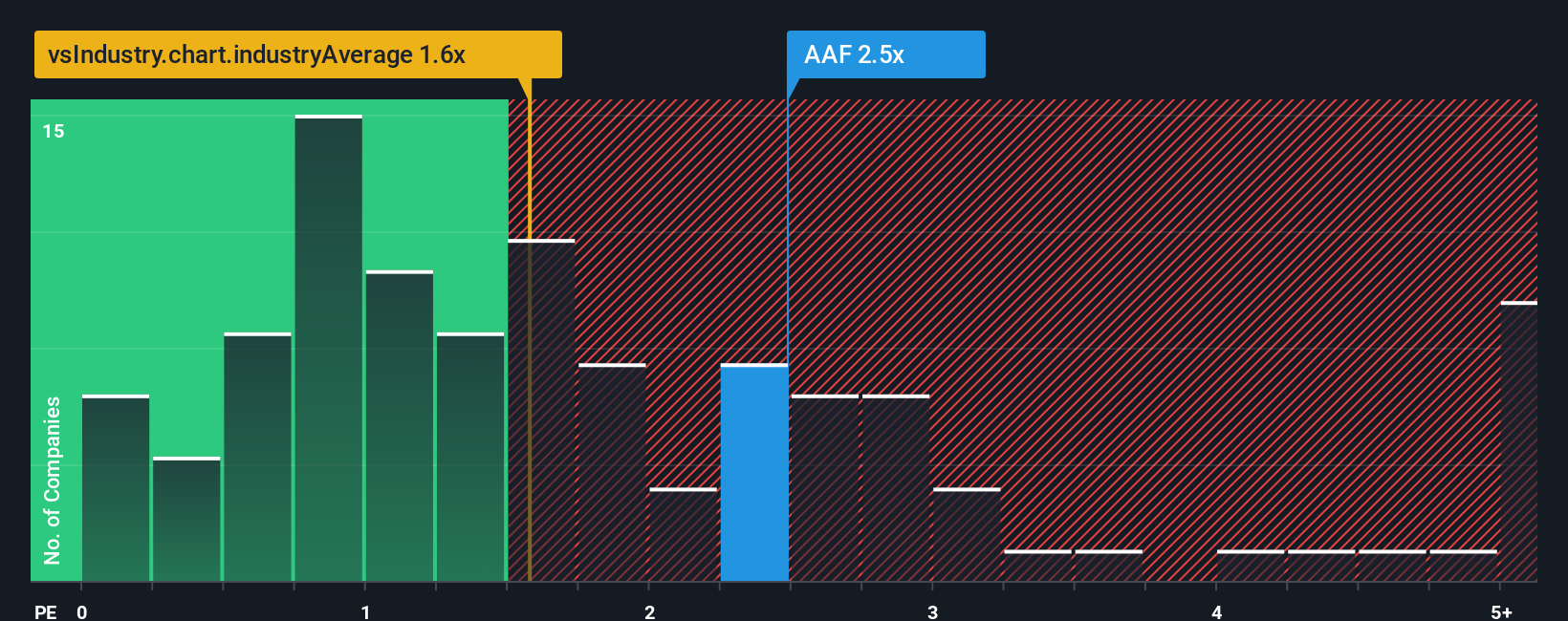

When close to half the companies in the Wireless Telecom industry in the United Kingdom have price-to-sales ratios (or "P/S") below 1.3x, you may consider Airtel Africa Plc (LON:AAF) as a stock to potentially avoid with its 2.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Airtel Africa

How Airtel Africa Has Been Performing

Recent times have been advantageous for Airtel Africa as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Airtel Africa.Is There Enough Revenue Growth Forecasted For Airtel Africa?

Airtel Africa's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.5%. The latest three year period has also seen a 7.5% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 16% per annum during the coming three years according to the nine analysts following the company. With the industry only predicted to deliver 5.7% per year, the company is positioned for a stronger revenue result.

With this information, we can see why Airtel Africa is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Airtel Africa maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Wireless Telecom industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you settle on your opinion, we've discovered 1 warning sign for Airtel Africa that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AAF

Airtel Africa

Provides telecommunications and mobile money services in Nigeria, East Africa, and Francophone Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives