Is Bigblu Broadband (LON:BBB) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Bigblu Broadband plc (LON:BBB) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Bigblu Broadband

What Is Bigblu Broadband's Debt?

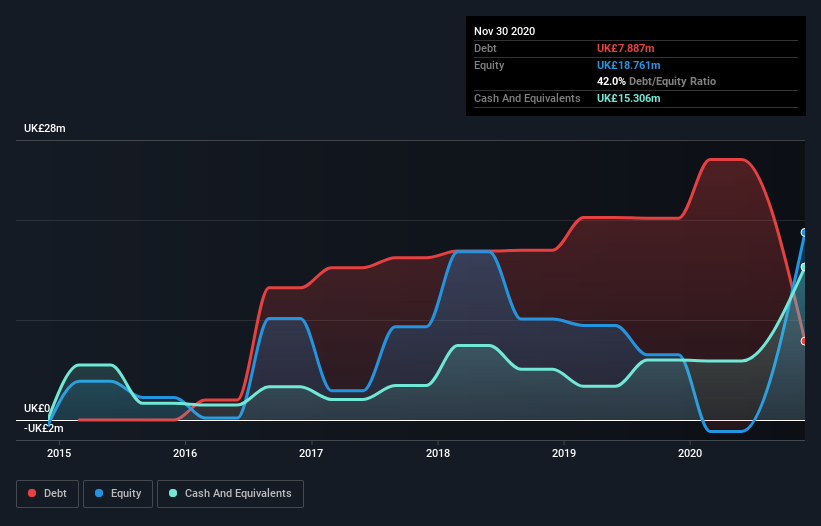

As you can see below, Bigblu Broadband had UK£7.89m of debt at November 2020, down from UK£20.2m a year prior. However, its balance sheet shows it holds UK£15.3m in cash, so it actually has UK£7.42m net cash.

How Strong Is Bigblu Broadband's Balance Sheet?

According to the last reported balance sheet, Bigblu Broadband had liabilities of UK£14.0m due within 12 months, and liabilities of UK£10.6m due beyond 12 months. Offsetting these obligations, it had cash of UK£15.3m as well as receivables valued at UK£3.80m due within 12 months. So its liabilities total UK£5.48m more than the combination of its cash and short-term receivables.

Of course, Bigblu Broadband has a market capitalization of UK£72.0m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, Bigblu Broadband also has more cash than debt, so we're pretty confident it can manage its debt safely.

We also note that Bigblu Broadband improved its EBIT from a last year's loss to a positive UK£2.4m. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Bigblu Broadband's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Bigblu Broadband may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last year, Bigblu Broadband burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Bigblu Broadband has UK£7.42m in net cash. So although we see some areas for improvement, we're not too worried about Bigblu Broadband's balance sheet. Given our hesitation about the stock, it would be good to know if Bigblu Broadband insiders have sold any shares recently. You click here to find out if insiders have sold recently.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Bigblu Broadband or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bigblu Broadband might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:BBB

Bigblu Broadband

Provides satellite and wireless broadband telecommunications and related products and services in the United Kingdom and internationally.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026