Stock Analysis

- United Kingdom

- /

- IT

- /

- LSE:NCC

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index experiences downward pressure due to weak trade data from China, the broader market sentiment is cautious amid global economic uncertainties. In this environment, identifying high-growth tech stocks requires a focus on companies with strong innovation capabilities and resilience to external economic fluctuations.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Facilities by ADF | 48.47% | 189.97% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Windar Photonics | 79.38% | 195.81% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Oxford Biomedica | 21.02% | 93.23% | ★★★★★☆ |

| YouGov | 9.23% | 55.39% | ★★★★★☆ |

| Beeks Financial Cloud Group | 22.12% | 36.94% | ★★★★★☆ |

| Seeing Machines | 20.01% | 97.40% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

YouGov (AIM:YOU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: YouGov plc is a company that offers online market research services across various regions including the United Kingdom, the United States, the Middle East, Mainland Europe, and the Asia Pacific with a market capitalization of approximately £542.96 million.

Operations: The company generates revenue through three primary segments: Research (£177.70 million), Data Products (£83.80 million), and Consumer Panel Services (£74.20 million).

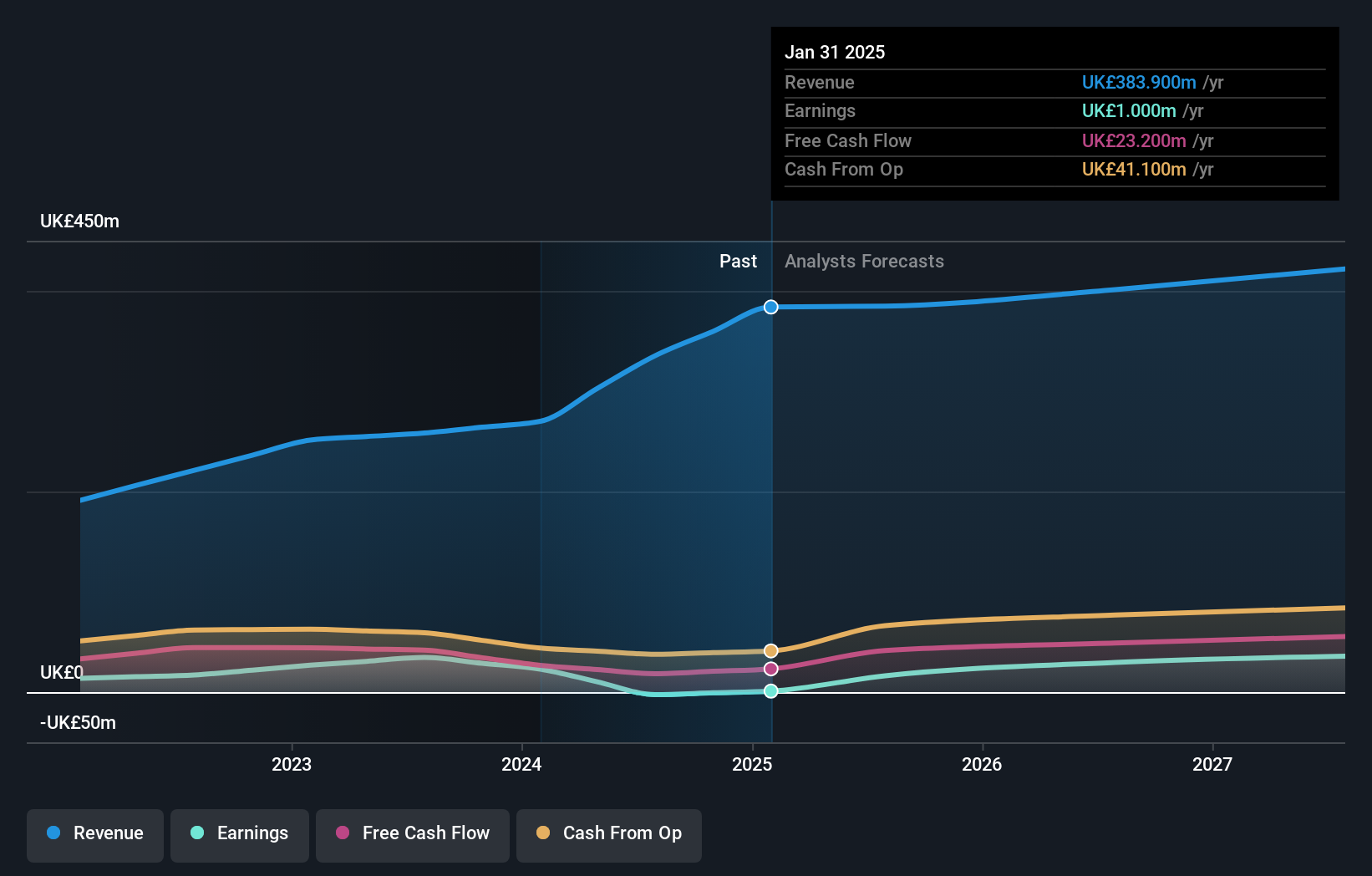

YouGov, despite a challenging fiscal year with a reported net loss of £2.4 million from a prior net income of £34.5 million, is navigating through its financial turbulence by focusing on strategic growth areas that could reshape its market stance. The company's commitment to innovation is evident in its R&D spending trends, which are crucial for staying competitive against industry averages. With revenue projected to grow at 9.2% annually, outpacing the UK market forecast of 3.6%, and earnings expected to surge by 55.39% per year, YouGov is aligning its operations towards lucrative sectors that promise robust future profitability. Moreover, the decision to recommend a final dividend of 9 pence per share underscores management's confidence in YouGov’s recovery and future cash flows, signaling potential stability and shareholder value enhancement moving forward. This approach not only helps mitigate past losses but also strategically positions YouGov within the high-growth tech landscape in the United Kingdom by leveraging both current performance metrics and forward-looking financial health indicators.

- Click here to discover the nuances of YouGov with our detailed analytical health report.

Assess YouGov's past performance with our detailed historical performance reports.

NCC Group (LSE:NCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe with a market capitalization of £489.01 million.

Operations: NCC Group plc generates revenue primarily from its Cyber Security segment, which accounts for £258.50 million, and the Escode segment, contributing £65.90 million. The company operates in multiple regions including the UK, Asia-Pacific, North America, and Europe.

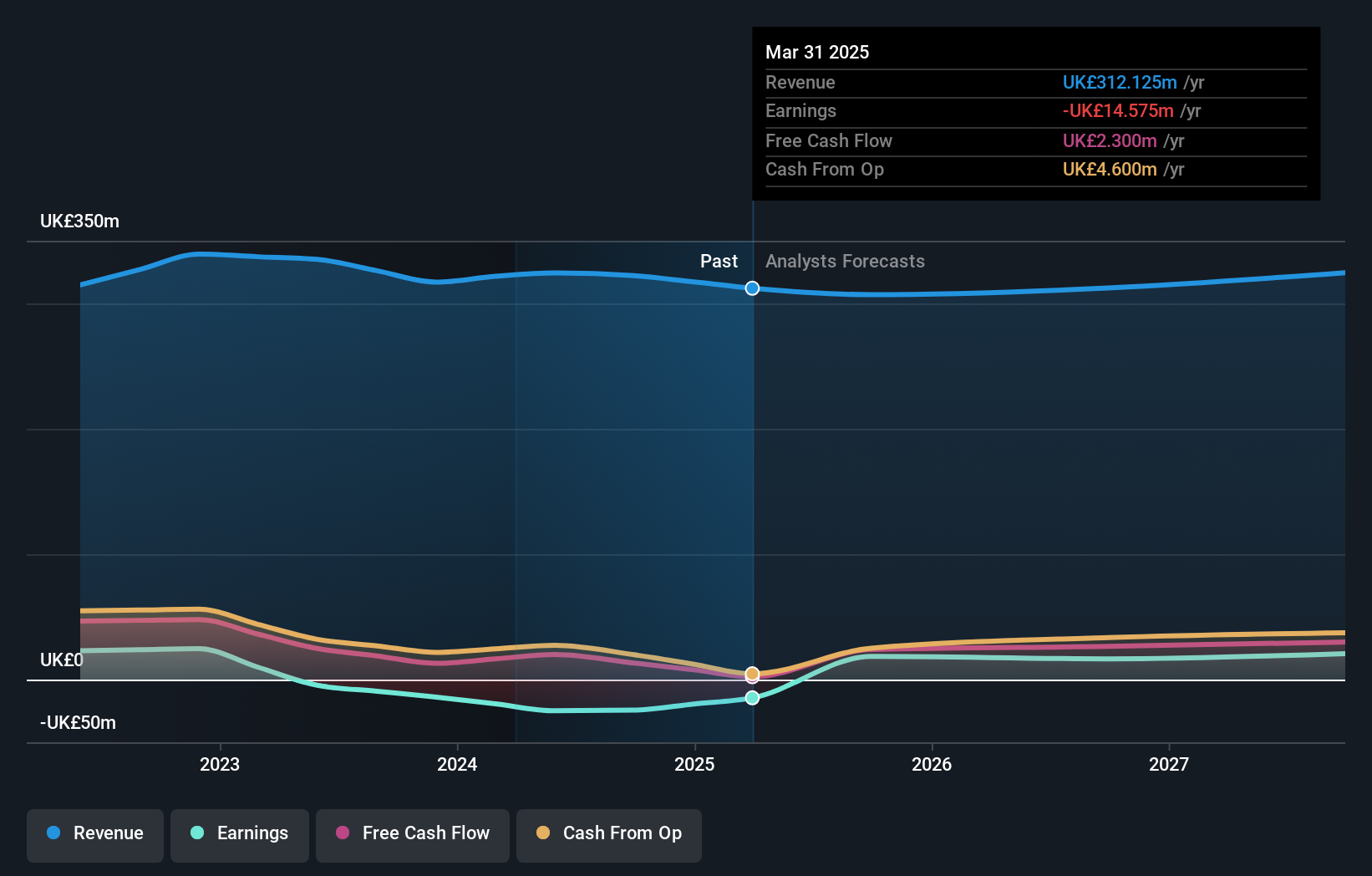

NCC Group's recent inclusion in the FTSE 350 and FTSE 250 indices underscores its growing relevance within the UK tech sector, despite its current lack of profitability. The company is poised for significant growth with earnings expected to surge by 87.4% annually, outstripping the broader market's forecast. This growth trajectory is supported by a robust commitment to R&D, which remains integral as NCC navigates through competitive landscapes and strives for innovation in cybersecurity solutions. Additionally, their strategic project for Ale Municipality not only enhances infrastructure resilience but also aligns with environmental standards, marking a pivotal step in operational expansion and sustainability efforts.

- Dive into the specifics of NCC Group here with our thorough health report.

Gain insights into NCC Group's past trends and performance with our Past report.

Spirent Communications (LSE:SPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across various regions, including the Americas, Asia Pacific, Europe, the Middle East, and Africa, with a market cap of £980.50 million.

Operations: Spirent Communications generates revenue primarily from its Networks & Security segment, which accounts for $258.50 million. The company's operations focus on providing automated test and assurance solutions across multiple global regions.

Spirent Communications, amidst a challenging market landscape, has demonstrated resilience with an expected revenue growth of 5.4% annually, outpacing the UK market's average of 3.6%. This growth is bolstered by strategic advancements in its 5G Fixed Wireless Access (FWA) testing services and significant enhancements to its Octobox Wi-Fi solutions, addressing the rapid evolution of connectivity demands. However, it faces hurdles with a notable profit margin contraction from 12.8% to 3% over the past year and an earnings decline of 81.1%. Despite these challenges, Spirent's commitment to innovation is evident in its R&D endeavors which remain crucial as it navigates through competitive pressures and shifts towards high-demand tech sectors like Wi-Fi 7 testing platforms and mesh network configurations. Looking forward, Spirent's earnings are forecasted to surge by an impressive rate of 40.5% annually, indicating potential for recovery and growth in emerging technology markets.

- Get an in-depth perspective on Spirent Communications' performance by reading our health report here.

Explore historical data to track Spirent Communications' performance over time in our Past section.

Key Takeaways

- Reveal the 46 hidden gems among our UK High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:NCC

NCC Group

Engages in the cyber and software resilience business in the United Kingdom, the Asian-Pacific, North America, and Europe.