- United Kingdom

- /

- Food

- /

- LSE:AEP

3 UK Dividend Stocks With Yields Up To 6.3%

Reviewed by Simply Wall St

Amidst recent declines in the FTSE 100 and FTSE 250, driven by weak trade data from China impacting global markets, investors are increasingly cautious about their portfolios. In such uncertain times, dividend stocks can offer a measure of stability and income, making them an attractive option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 6.15% | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | 8.38% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.17% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.83% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.51% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.32% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.88% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.84% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.60% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.12% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Anglo-Eastern Plantations (LSE:AEP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anglo-Eastern Plantations Plc, along with its subsidiaries, owns, operates, and develops agricultural plantations in Indonesia and Malaysia, with a market cap of £272.08 million.

Operations: Anglo-Eastern Plantations Plc generates revenue from the cultivation of plantations, amounting to $364.23 million.

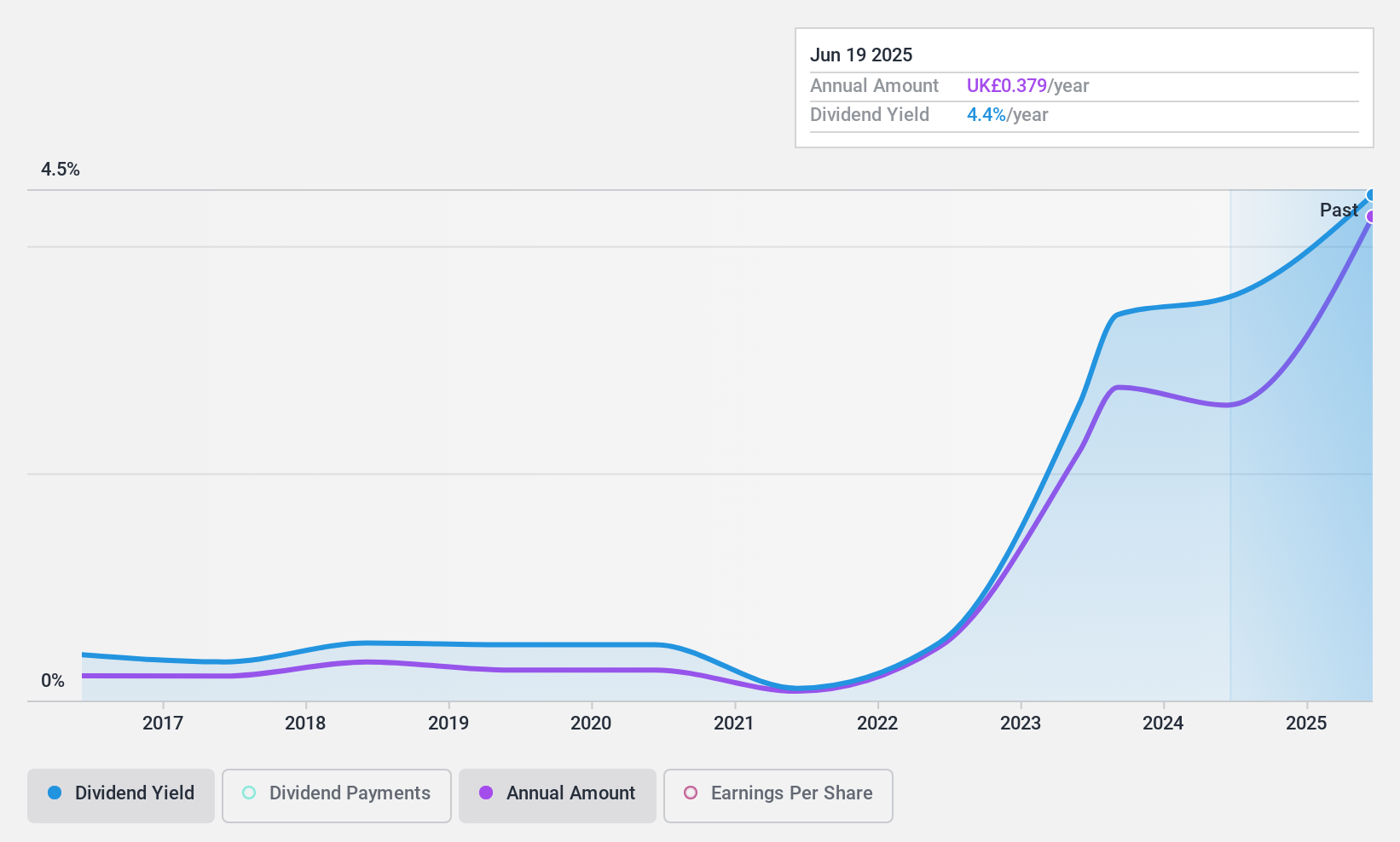

Dividend Yield: 3.4%

Anglo-Eastern Plantations offers a dividend yield of 3.43%, lower than the UK's top quartile dividend payers. Despite a low payout ratio of 10.7% and cash payout ratio of 24.4%, ensuring dividends are well-covered by earnings and cash flow, its dividend history is volatile with unreliable growth over the past decade. Recent executive changes, including Kevin Wong's promotion to CEO, aim to enhance strategic growth amid declining production figures for fresh fruit bunches and crude palm oil.

- Click to explore a detailed breakdown of our findings in Anglo-Eastern Plantations' dividend report.

- Our valuation report here indicates Anglo-Eastern Plantations may be undervalued.

Man Group (LSE:EMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Man Group Limited is a publicly owned investment manager with a market cap of £2.34 billion.

Operations: Man Group Limited generates revenue of $1.40 billion from its Investment Management Business segment.

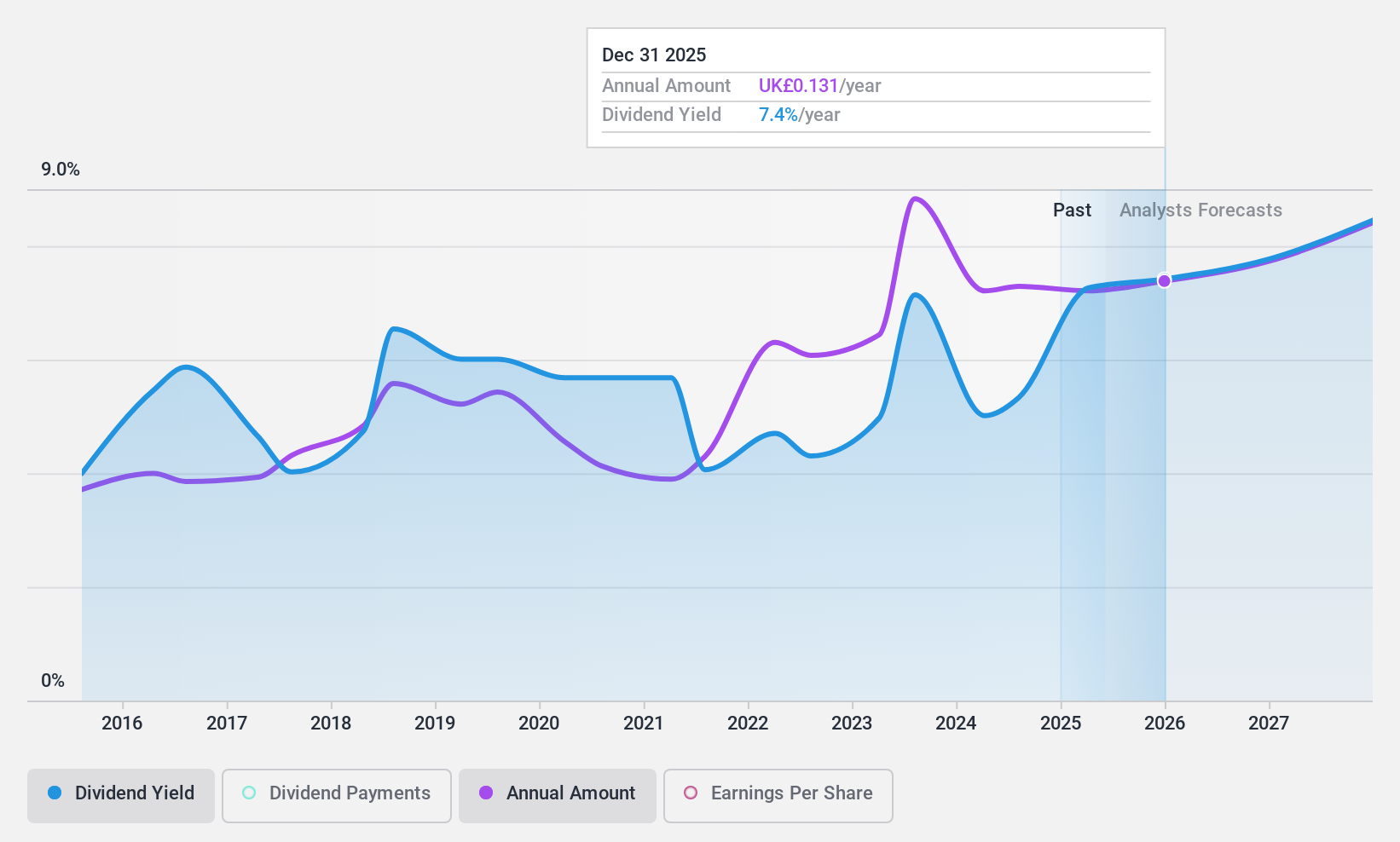

Dividend Yield: 6.3%

Man Group's dividend yield of 6.32% ranks in the top 25% of UK dividend payers, supported by a sustainable payout ratio of 60.3% and cash payout ratio of 48.1%. However, its dividends have been volatile over the past decade, with periods of significant reduction. Recent executive appointments include Emma Holden as Chief People Officer and Paco Ybarra as Non-Executive Director, potentially influencing future strategic direction and governance practices.

- Navigate through the intricacies of Man Group with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Man Group's share price might be too pessimistic.

Norcros (LSE:NXR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norcros plc, with a market cap of £237.93 million, develops, manufactures, and markets bathroom and kitchen products in the United Kingdom, Ireland, and South Africa.

Operations: Norcros plc generates its revenue from the Building Products segment, which amounts to £392.10 million.

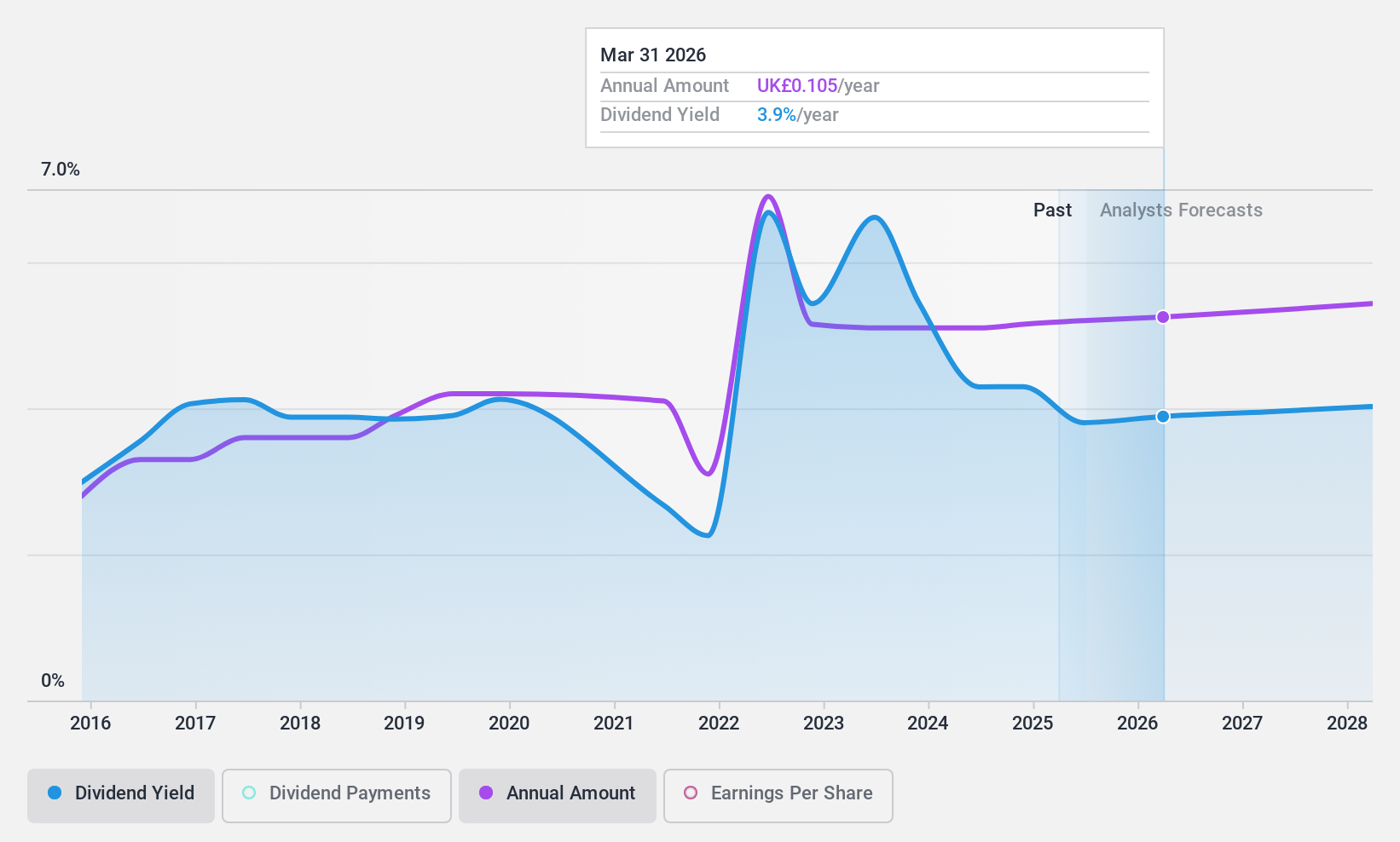

Dividend Yield: 3.8%

Norcros offers a mixed dividend profile, with a low payout ratio of 33.9% and cash payout ratio of 31.3%, ensuring dividends are well covered by earnings and cash flows. However, its dividend history has been volatile over the past decade. Trading at a favorable price-to-earnings ratio of 8.9x compared to the UK market average, Norcros provides good relative value despite recent revenue declines, with expected full-year profits aligning with market forecasts amidst challenging conditions.

- Click here and access our complete dividend analysis report to understand the dynamics of Norcros.

- Our expertly prepared valuation report Norcros implies its share price may be lower than expected.

Make It Happen

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 58 more companies for you to explore.Click here to unveil our expertly curated list of 61 Top UK Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AEP

Anglo-Eastern Plantations

Owns, operates, and develops oil palm plantations in Indonesia and Malaysia.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives