The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting global economic interdependencies. In such a climate, identifying high-growth tech stocks requires focusing on companies that can demonstrate resilience and adaptability in the face of international economic pressures.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ENGAGE XR Holdings | 22.08% | 84.46% | ★★★★★★ |

| Audioboom Group | 8.49% | 59.18% | ★★★★★☆ |

| YouGov | 3.98% | 64.42% | ★★★★★☆ |

| ActiveOps | 14.40% | 43.34% | ★★★★★☆ |

| Oxford Biomedica | 18.08% | 68.63% | ★★★★★☆ |

| Trustpilot Group | 15.07% | 38.95% | ★★★★★☆ |

| Quantum Base Holdings | 132.55% | 92.87% | ★★★★★☆ |

| Windar Photonics | 36.00% | 48.66% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 53.95% | 53.30% | ★★★★★☆ |

| SRT Marine Systems | 45.54% | 91.35% | ★★★★★★ |

Click here to see the full list of 44 stocks from our UK High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oxford Biomedica plc is a contract development and manufacturing organization specializing in delivering therapies globally, with a market capitalization of £364.58 million.

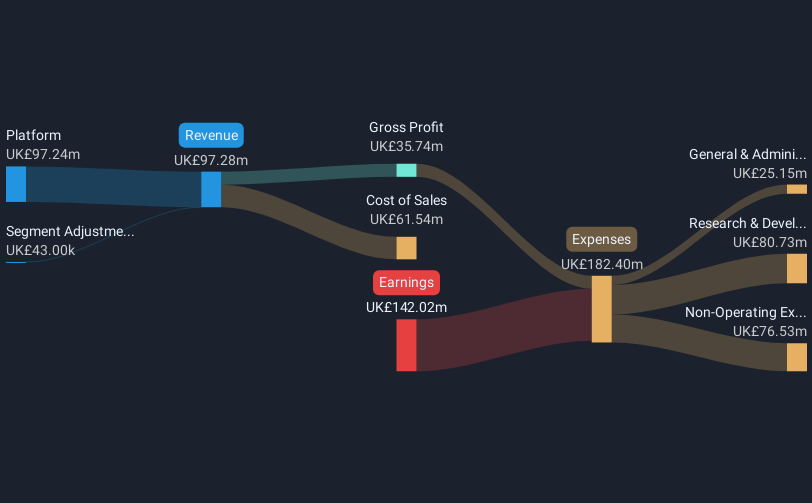

Operations: Oxford Biomedica generates revenue primarily from Manufacturing Services (£68.35 million) and Development (£47.27 million), with additional income from Licence Fees & Incentives (£7.33 million) and Procurement and Storage Services (£5.85 million).

Oxford Biomedica, a UK-based biotech firm, is set to pivot towards profitability by 2025 with an impressive forecasted earnings growth of 68.63% per year. This growth is underpinned by a robust R&D strategy that has seen the company invest significantly in innovation, particularly in cell and gene therapy technologies. The recent formation of its Innovation and Technology Excellence Board, populated by industry luminaries, underscores its commitment to maintaining a cutting-edge position in biotechnology. Furthermore, with revenue growth outpacing the UK market average at 18.1% annually compared to 3.6%, Oxford Biomedica is strategically positioned to capitalize on advanced therapeutic modalities and manufacturing processes that could redefine treatment paradigms across various diseases.

- Delve into the full analysis health report here for a deeper understanding of Oxford Biomedica.

Understand Oxford Biomedica's track record by examining our Past report.

Raspberry Pi Holdings (LSE:RPI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raspberry Pi Holdings plc is a company that specializes in designing and developing single-board computers, compute modules, and semiconductors with operations spanning the United Kingdom, Europe, the United States, Asia Pacific, and other international markets; it has a market cap of £907.51 million.

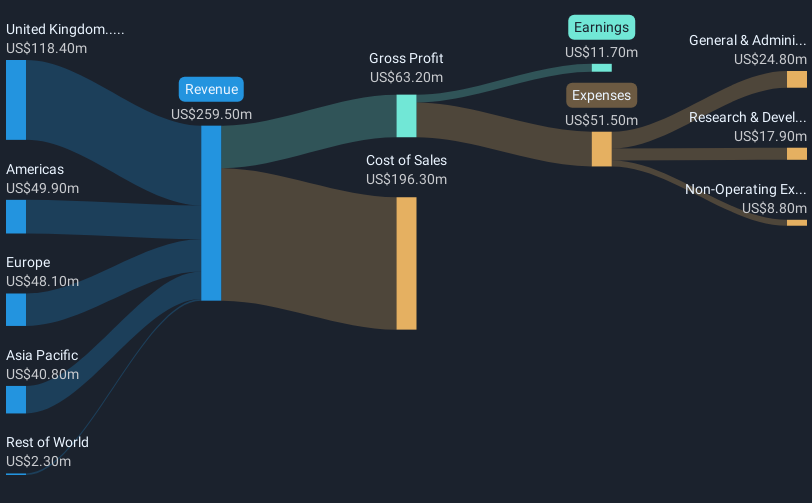

Operations: The company generates revenue primarily from its computer hardware segment, amounting to $259.50 million. With a market cap of £907.51 million, its focus on single-board computers and semiconductors positions it across multiple international markets including the UK, Europe, and the US.

Raspberry Pi Holdings, despite facing challenges, shows a promising trajectory with an annual revenue growth of 15% and earnings growth of 31%, outpacing the UK tech industry's averages. However, recent concerns by auditors about its sustainability as a going concern highlight significant risks. The company's R&D focus remains robust but is shadowed by a decrease in profit margins from 11.9% to 4.5% last year and negative earnings growth recently. Its participation in key tech conferences and an upcoming AGM may provide platforms for strategic reassurances and future direction insights amidst these financial volatilities.

- Click here and access our complete health analysis report to understand the dynamics of Raspberry Pi Holdings.

Evaluate Raspberry Pi Holdings' historical performance by accessing our past performance report.

Trustpilot Group (LSE:TRST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trustpilot Group plc operates an online review platform connecting businesses and consumers across the United Kingdom, North America, Europe, and other international markets, with a market capitalization of £1.02 billion.

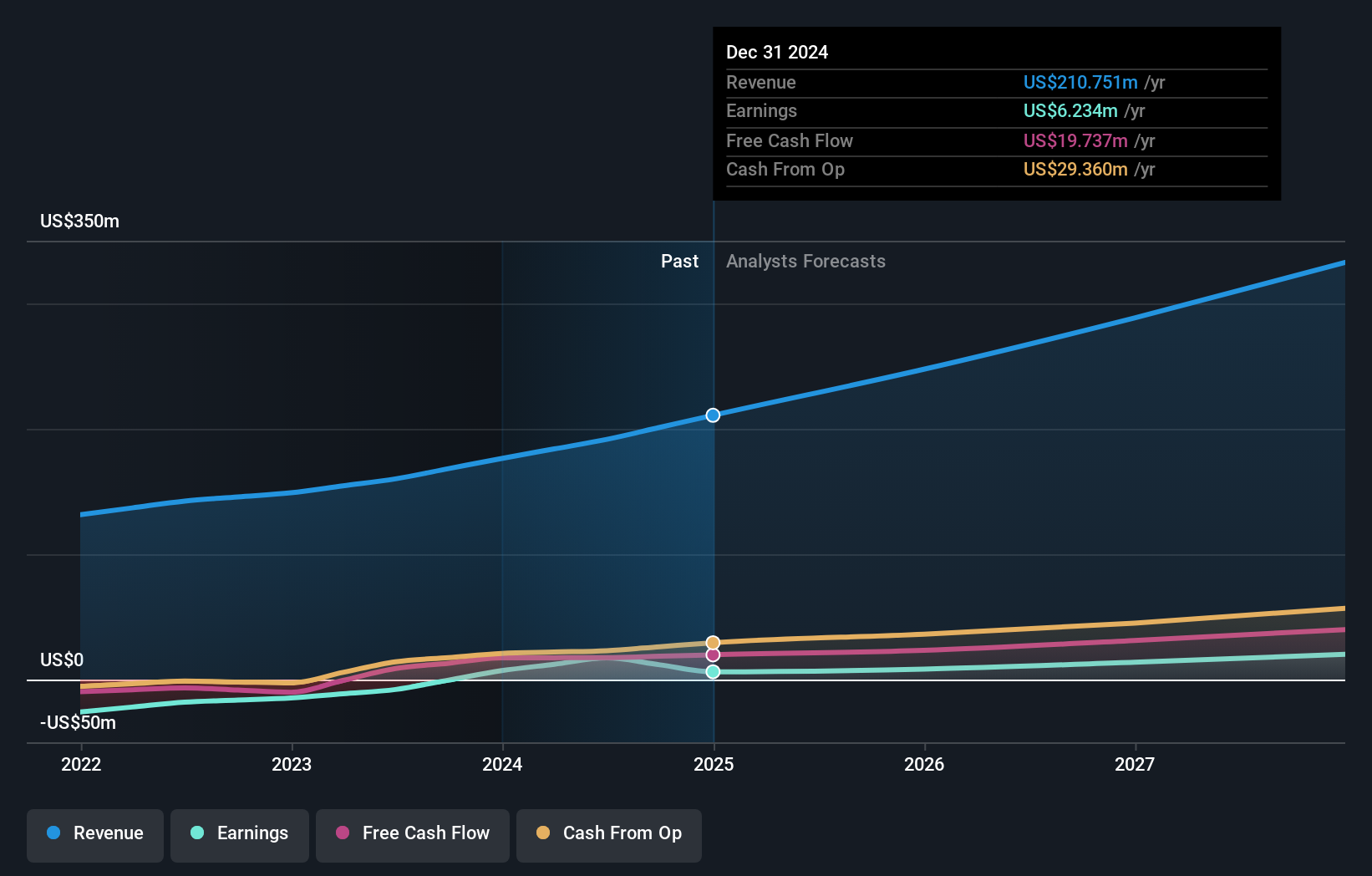

Operations: The company generates revenue primarily from its role as an Internet Information Provider, amounting to $210.75 million. It focuses on developing and hosting a platform that facilitates interactions between businesses and consumers globally.

Trustpilot Group, amidst the dynamic landscape of UK's tech sector, is navigating through challenges with a nuanced strategy. Despite experiencing a 12.3% dip in earnings last year, it contrasts sharply with an impressive projected annual earnings growth of 39%, significantly outstripping the UK market average of 14.4%. This rebound is anchored by robust R&D investments and a forward-looking approach evident from its recent AGM discussions aimed at refining governance and strategic growth frameworks. The company's revenue growth forecast at 15.1% annually also surpasses the broader UK market's pace of 3.6%, positioning it favorably within the competitive tech space for potential future gains.

- Click here to discover the nuances of Trustpilot Group with our detailed analytical health report.

Assess Trustpilot Group's past performance with our detailed historical performance reports.

Key Takeaways

- Click this link to deep-dive into the 44 companies within our UK High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trustpilot Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TRST

Trustpilot Group

Engages in the development and hosting of an online review platform for businesses and consumers in the United Kingdom, North America, Europe, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives