Should Shareholders Reconsider Zytronic plc's (LON:ZYT) CEO Compensation Package?

Zytronic plc (LON:ZYT) has not performed well recently and CEO Mark Cambridge will probably need to up their game. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 03 March 2022. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

See our latest analysis for Zytronic

Comparing Zytronic plc's CEO Compensation With the industry

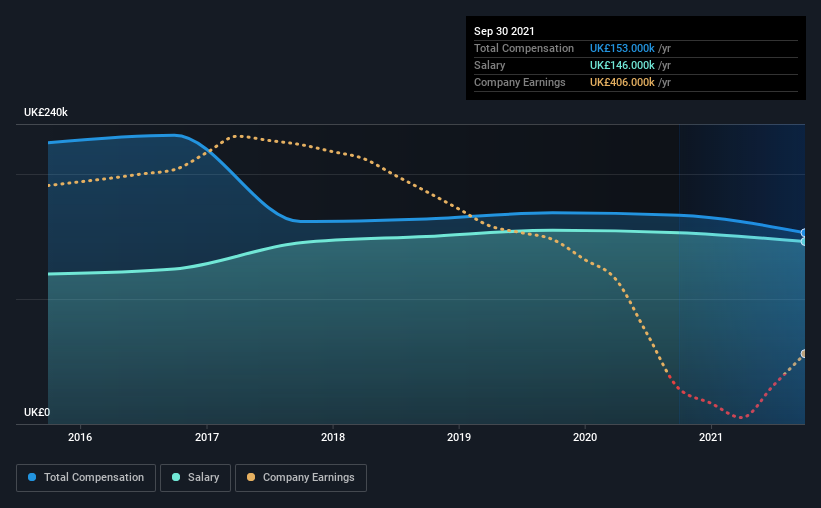

Our data indicates that Zytronic plc has a market capitalization of UK£17m, and total annual CEO compensation was reported as UK£153k for the year to September 2021. Notably, that's a decrease of 8.4% over the year before. Notably, the salary which is UK£146.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below UK£150m, we found that the median total CEO compensation was UK£209k. So it looks like Zytronic compensates Mark Cambridge in line with the median for the industry. Furthermore, Mark Cambridge directly owns UK£136k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£146k | UK£153k | 95% |

| Other | UK£7.0k | UK£14k | 5% |

| Total Compensation | UK£153k | UK£167k | 100% |

Talking in terms of the industry, salary represented approximately 80% of total compensation out of all the companies we analyzed, while other remuneration made up 20% of the pie. Zytronic has gone down a largely traditional route, paying Mark Cambridge a high salary, giving it preference over non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Zytronic plc's Growth Numbers

Zytronic plc has reduced its earnings per share by 46% a year over the last three years. It saw its revenue drop 7.9% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Zytronic plc Been A Good Investment?

Few Zytronic plc shareholders would feel satisfied with the return of -50% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Zytronic pays its CEO a majority of compensation through a salary. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Zytronic (1 is a bit unpleasant!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zytronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ZYT

Zytronic

Develops, manufactures, and markets interactive touch sensor products.

Flawless balance sheet slight.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion