Investors Give Northamber plc (LON:NAR) Shares A 28% Hiding

Northamber plc (LON:NAR) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 14% in that time.

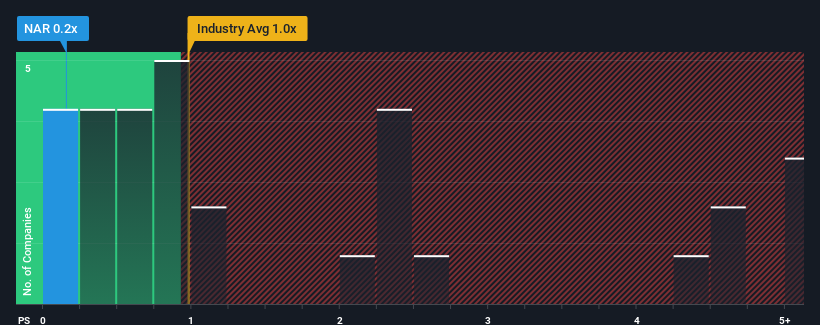

Since its price has dipped substantially, Northamber may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Electronic industry in the United Kingdom have P/S ratios greater than 1x and even P/S higher than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Northamber

What Does Northamber's P/S Mean For Shareholders?

For instance, Northamber's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Northamber, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Northamber's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.2%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 4.1% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Northamber is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

What We Can Learn From Northamber's P/S?

The southerly movements of Northamber's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Northamber revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

We don't want to rain on the parade too much, but we did also find 2 warning signs for Northamber (1 is significant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Northamber, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Northamber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:NAR

Northamber

Engages in the supply of computer hardware, computer printers and peripheral products, computer telephony products, and other electronic transmission equipment in the United Kingdom.

Flawless balance sheet and good value.

Market Insights

Community Narratives