- United Kingdom

- /

- Capital Markets

- /

- AIM:PMI

UK Penny Stocks Spotlight: Billington Holdings And 2 Others To Consider

Reviewed by Simply Wall St

The London market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting global economic interconnections. Amid these broader market shifts, investors often turn their attention to smaller companies that may offer unique opportunities for growth. Penny stocks, despite their somewhat outdated name, represent such opportunities; they are typically smaller or newer companies that can provide substantial value when backed by strong financials and a clear growth path. In this article, we explore three UK penny stocks that exhibit financial resilience and potential for long-term appreciation.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.57 | £512.74M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.775 | £304.97M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.242 | £135.77M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 4 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.865 | £319.86M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.97 | £305.63M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.205 | £191.75M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.50 | £77.24M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £2.21 | £834.69M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 300 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Billington Holdings (AIM:BILN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Billington Holdings Plc, with a market cap of £49.28 million, operates through its subsidiaries to offer structural steel and construction safety solutions in the United Kingdom and Europe.

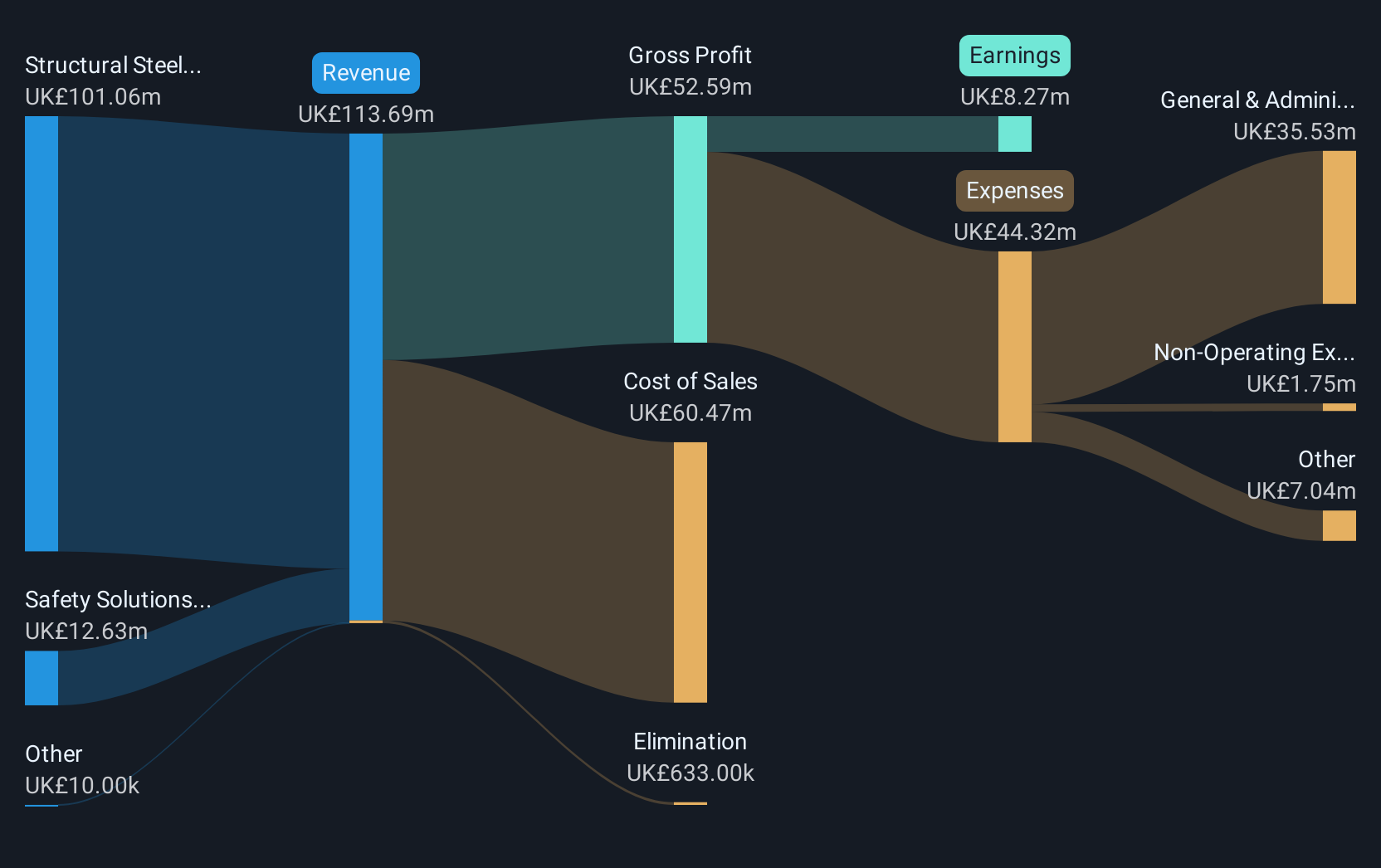

Operations: The company generates revenue primarily from its Structural Steelwork segment, which accounts for £101.06 million, and Safety Solutions, contributing £12.63 million.

Market Cap: £49.28M

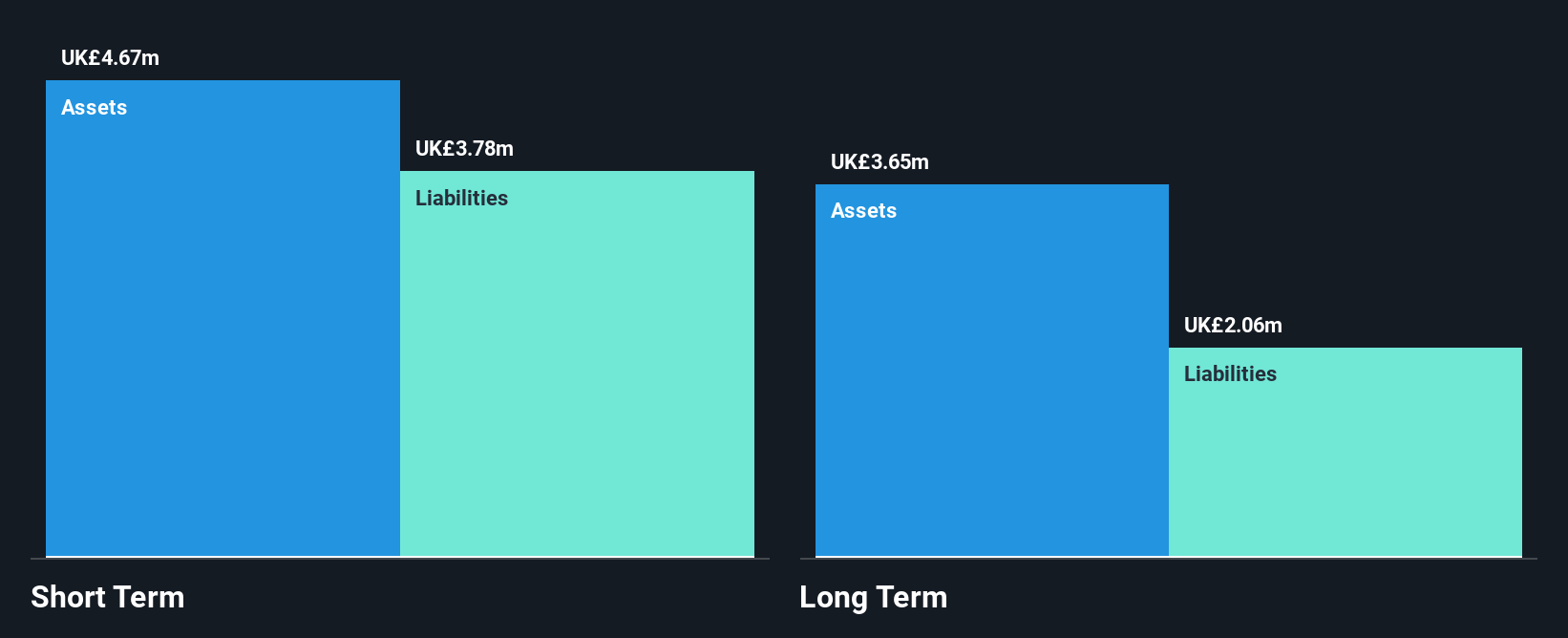

Billington Holdings Plc, with a market cap of £49.28 million, presents a mixed picture for investors in the penny stock category. The company is debt-free and has stable weekly volatility at 4%, though it experienced negative earnings growth of -19.9% last year despite significant profit growth over five years. Its P/E ratio of 6x suggests good value compared to the UK market average, but its net profit margin has slightly declined from 7.8% to 7.3%. Recent news highlights an increased dividend payout, covered by earnings, reflecting management's confidence in cash flow stability despite forecasted earnings decline.

- Jump into the full analysis health report here for a deeper understanding of Billington Holdings.

- Review our growth performance report to gain insights into Billington Holdings' future.

Light Science Technologies Holdings (AIM:LST)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Light Science Technologies Holdings Plc develops and manufactures electronic boards in the United Kingdom and Ireland, with a market cap of £12.15 million.

Operations: The company's revenue is derived from Passive Fire Protection (£1.78 million), Contract Electronics Manufacture (£9.51 million), and Controlled Environment Agriculture (£0.78 million).

Market Cap: £12.15M

Light Science Technologies Holdings, with a market cap of £12.15 million, is navigating the penny stock landscape with promising yet cautious prospects. The company remains unprofitable but has achieved a reduction in losses by 10.1% annually over five years and maintains positive free cash flow, ensuring a cash runway exceeding three years. Its recent product innovations, including the Injectaclad fire-resistant system and sensorGRO environmental sensors, position it for potential growth in niche markets. While short-term assets cover both short- and long-term liabilities comfortably, its fair value suggests significant undervaluation at current trading levels.

- Take a closer look at Light Science Technologies Holdings' potential here in our financial health report.

- Explore historical data to track Light Science Technologies Holdings' performance over time in our past results report.

Premier Miton Group (AIM:PMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Premier Miton Group plc is a publicly owned investment manager with a market cap of £102.43 million.

Operations: The company generates revenue of £66.22 million from its Asset Management segment.

Market Cap: £102.43M

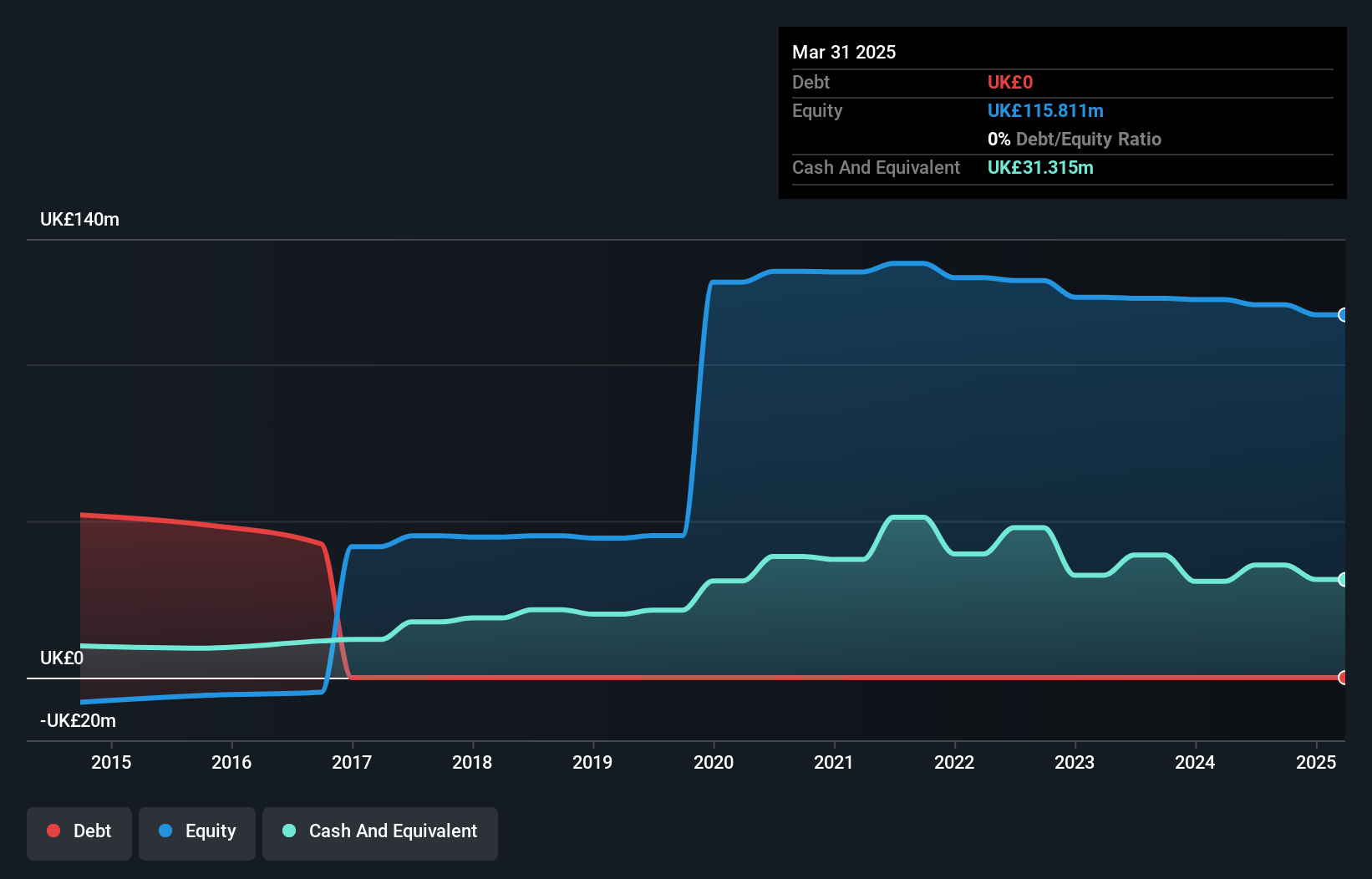

Premier Miton Group, with a market cap of £102.43 million, presents a mixed picture in the penny stock arena. Despite its earnings growth of 12.2% over the past year and stable weekly volatility, its dividend yield of 9.23% is not well covered by earnings, raising sustainability concerns. The company remains debt-free with strong asset coverage for liabilities but has experienced a significant decline in earnings over five years at -25.8% annually on average. Recent half-year results show improved net income to £0.521 million from £0.057 million last year, yet return on equity remains low at 2%.

- Click here and access our complete financial health analysis report to understand the dynamics of Premier Miton Group.

- Understand Premier Miton Group's earnings outlook by examining our growth report.

Where To Now?

- Click here to access our complete index of 300 UK Penny Stocks.

- Ready For A Different Approach? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PMI

Flawless balance sheet with proven track record.

Market Insights

Community Narratives