Improved Revenues Required Before Gooch & Housego PLC (LON:GHH) Stock's 25% Jump Looks Justified

Gooch & Housego PLC (LON:GHH) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.6% over the last year.

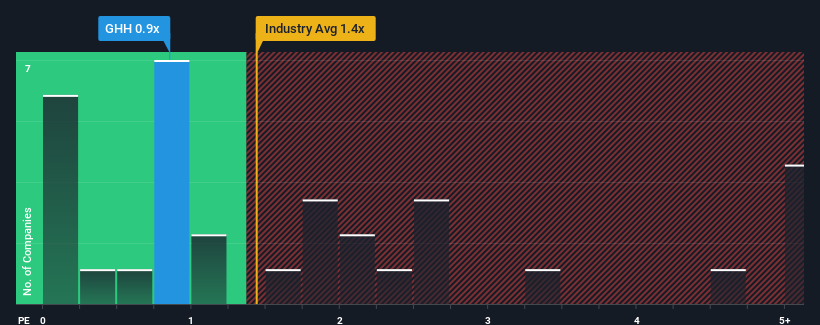

In spite of the firm bounce in price, it would still be understandable if you think Gooch & Housego is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.9x, considering almost half the companies in the United Kingdom's Electronic industry have P/S ratios above 1.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Gooch & Housego

What Does Gooch & Housego's Recent Performance Look Like?

Recent times have been advantageous for Gooch & Housego as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Gooch & Housego will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Gooch & Housego's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 9.1% gain to the company's revenues. Revenue has also lifted 20% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.2% as estimated by the four analysts watching the company. Meanwhile, the broader industry is forecast to expand by 6.0%, which paints a poor picture.

With this in consideration, we find it intriguing that Gooch & Housego's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

The latest share price surge wasn't enough to lift Gooch & Housego's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Gooch & Housego's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Having said that, be aware Gooch & Housego is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Gooch & Housego, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:GHH

Gooch & Housego

Engages in the manufacture and sale of acousto-optics, electro-optics, fiber optics, and precision optics and systems in the United Kingdom, North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives