- United Kingdom

- /

- Communications

- /

- AIM:FTC

Market Participants Recognise Filtronic plc's (LON:FTC) Revenues Pushing Shares 27% Higher

Despite an already strong run, Filtronic plc (LON:FTC) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days were the cherry on top of the stock's 407% gain in the last year, which is nothing short of spectacular.

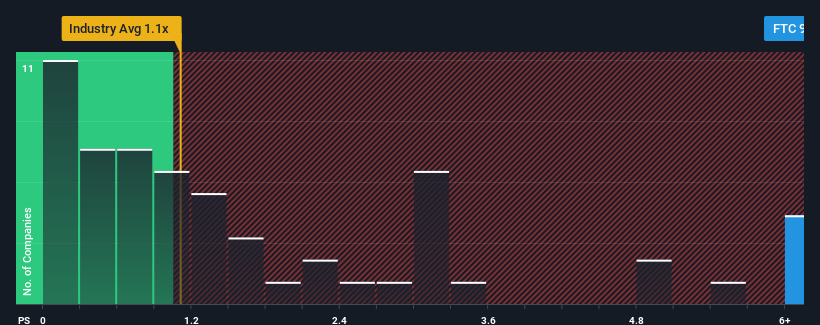

Since its price has surged higher, you could be forgiven for thinking Filtronic is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.5x, considering almost half the companies in the United Kingdom's Communications industry have P/S ratios below 1x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Filtronic

What Does Filtronic's Recent Performance Look Like?

With only a limited decrease in revenue compared to most other companies of late, Filtronic has been doing relatively well. Perhaps the market is expecting the company to continue to outperform the industry, which has propped up the P/S. While you'd prefer that its revenue trajectory turned around, you'd at least be hoping it remains less negative than other companies, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Filtronic's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Filtronic's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.9%. This means it has also seen a slide in revenue over the longer-term as revenue is down 2.5% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 83% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Filtronic's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in Filtronic have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Filtronic shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Filtronic that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FTC

Filtronic

Designs, develops, manufactures, and sells radio frequency (RF) technology in the United Kingdom, Europe, the Americas, and rest of the world.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives