- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:QQ.

UK Growth Stocks With Strong Insider Ownership For November 2025

Reviewed by Simply Wall St

As the UK market grapples with challenges stemming from weak trade data from China, the FTSE 100 and FTSE 250 indices have experienced declines, reflecting concerns over global economic recovery. In this environment, growth companies with strong insider ownership can be particularly appealing as they often signal confidence in a company's long-term prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| Metals Exploration (AIM:MTL) | 10.4% | 88.2% |

| Manolete Partners (AIM:MANO) | 38.1% | 38.1% |

| LSL Property Services (LSE:LSL) | 10.4% | 21.2% |

| Kainos Group (LSE:KNOS) | 20.5% | 23.5% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Foresight Group Holdings (LSE:FSG) | 34.7% | 20.1% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| Afentra (AIM:AET) | 37.7% | 31.6% |

We'll examine a selection from our screener results.

Big Technologies (AIM:BIG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Big Technologies PLC, operating under the Buddi brand, develops and delivers remote monitoring technologies and services for the offender and personal monitoring industry, with a market cap of £195 million.

Operations: The company's revenue segment includes the provision of electronic tracking devices, products, and services, generating £48.62 million.

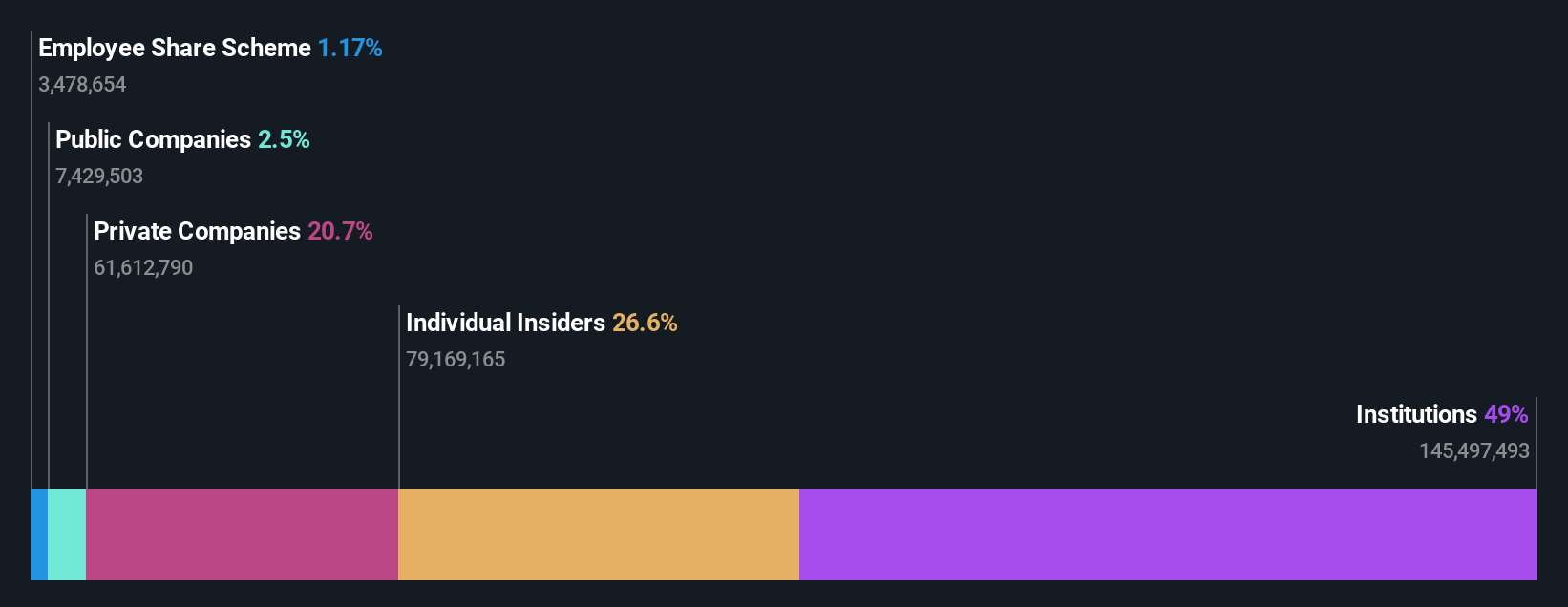

Insider Ownership: 26.6%

Big Technologies faces challenges, with a recent net loss of £28.84 million for the half-year ending June 2025, contrasting with a previous profit. Despite this, the company is trading significantly below its estimated fair value and is forecasted to achieve profitability within three years. Insider activity has been mixed; while there has been significant selling recently, more shares were bought than sold over the past quarter. Leadership changes include Sangita Shah as interim chair following Alexander Brennan's departure amidst ongoing litigation issues.

- Click here and access our complete growth analysis report to understand the dynamics of Big Technologies.

- In light of our recent valuation report, it seems possible that Big Technologies is trading beyond its estimated value.

PensionBee Group (LSE:PBEE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PensionBee Group plc offers online retirement saving services in the United Kingdom and the United States, with a market cap of £374.69 million.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, which generated £36.69 million.

Insider Ownership: 37.8%

PensionBee Group is poised for growth with forecasted revenue increases of 18.2% annually, outpacing the UK market. Despite being unprofitable now, it is expected to achieve profitability within three years. Recent initiatives include a $10 million program to consolidate American retirement accounts and a partnership with Madison Square Garden, enhancing brand visibility and addressing financial education gaps. The stock trades below analyst targets, suggesting potential upside as earnings are projected to grow significantly each year.

- Click here to discover the nuances of PensionBee Group with our detailed analytical future growth report.

- Our valuation report unveils the possibility PensionBee Group's shares may be trading at a premium.

QinetiQ Group (LSE:QQ.)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QinetiQ Group plc offers science and technology solutions in the defense, security, and infrastructure sectors across the UK, US, Australia, and globally with a market cap of £2.31 billion.

Operations: The company's revenue is derived from two main segments: EMEA Services, contributing £1.47 billion, and Global Solutions, generating £417 million.

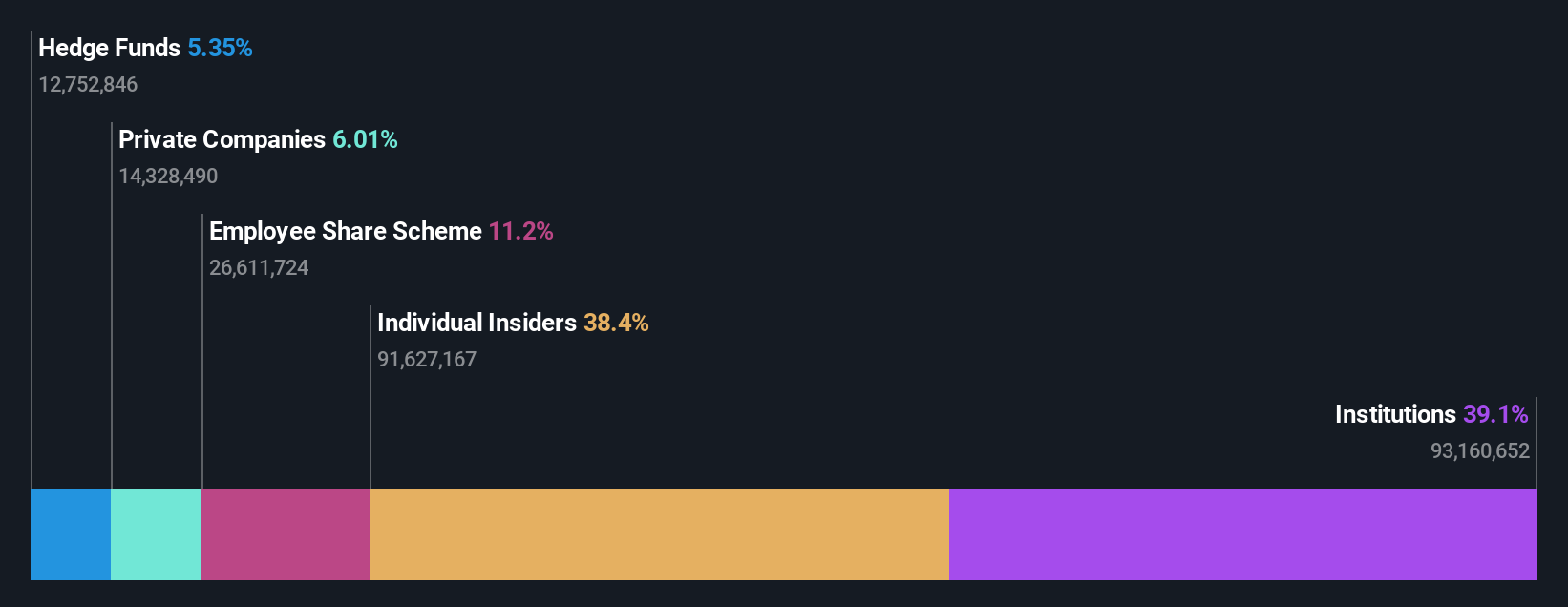

Insider Ownership: 13.3%

QinetiQ Group is positioned for growth, with revenue expected to increase at 6.1% annually, surpassing the UK market's average. The company anticipates becoming profitable within three years and is trading below its estimated fair value, indicating potential upside. Recent board appointments of experienced leaders Brad Feldmann and John Kavanaugh may bolster strategic direction. Despite a dip in half-year earnings to £38.3 million from £63 million last year, QinetiQ maintains a progressive dividend policy with recent increases.

- Dive into the specifics of QinetiQ Group here with our thorough growth forecast report.

- Our expertly prepared valuation report QinetiQ Group implies its share price may be lower than expected.

Seize The Opportunity

- Click this link to deep-dive into the 60 companies within our Fast Growing UK Companies With High Insider Ownership screener.

- Searching for a Fresh Perspective? Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if QinetiQ Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:QQ.

QinetiQ Group

Provides science and technology solution in the defense, security, and infrastructure markets in the United Kingdom, the United States, Australia, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives