- United Kingdom

- /

- Software

- /

- AIM:ACSO

Those Who Purchased accesso Technology Group (LON:ACSO) Shares A Year Ago Have A 63% Loss To Show For It

The nature of investing is that you win some, and you lose some. And unfortunately for accesso Technology Group plc (LON:ACSO) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 63%. At least the damage isn't so bad if you look at the last three years, since the stock is down 14% in that time. Furthermore, it's down 41% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for accesso Technology Group

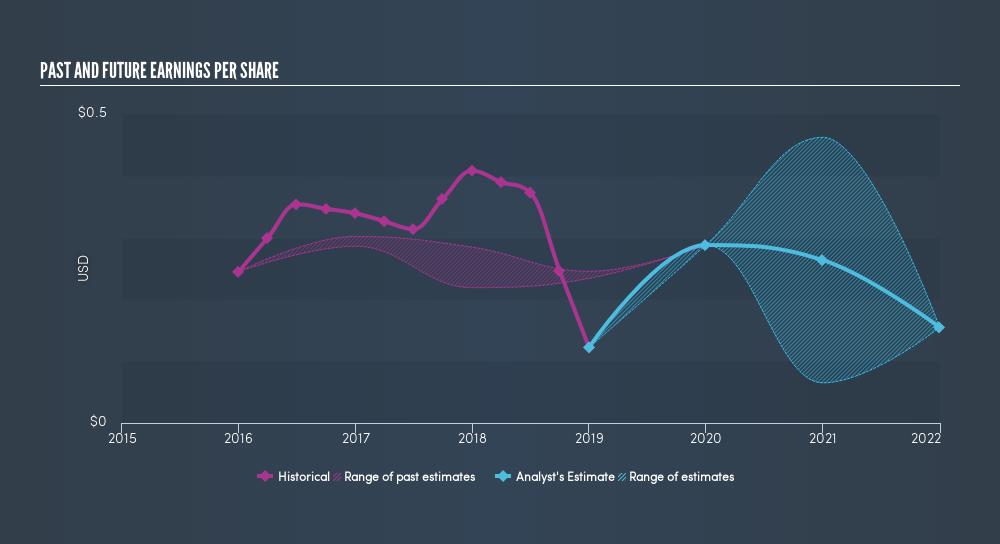

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately accesso Technology Group reported an EPS drop of 70% for the last year. We note that the 63% share price drop is very close to the EPS drop. Given the lower EPS we might have expected investors to lose confidence in the stock, but that doesn't seemed to have happened. Rather, the share price has approximately tracked EPS growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our freereport on accesso Technology Group's earnings, revenue and cash flow.

A Different Perspective

Investors in accesso Technology Group had a tough year, with a total loss of 63%, against a market gain of about 5.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 4.1%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before spending more time on accesso Technology Group it might be wise to click here to see if insiders have been buying or selling shares.

But note: accesso Technology Group may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:ACSO

accesso Technology Group

Develops technology solutions for the attractions and leisure industry.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives