We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Triad Group (LON:TRD) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Triad Group

When Might Triad Group Run Out Of Money?

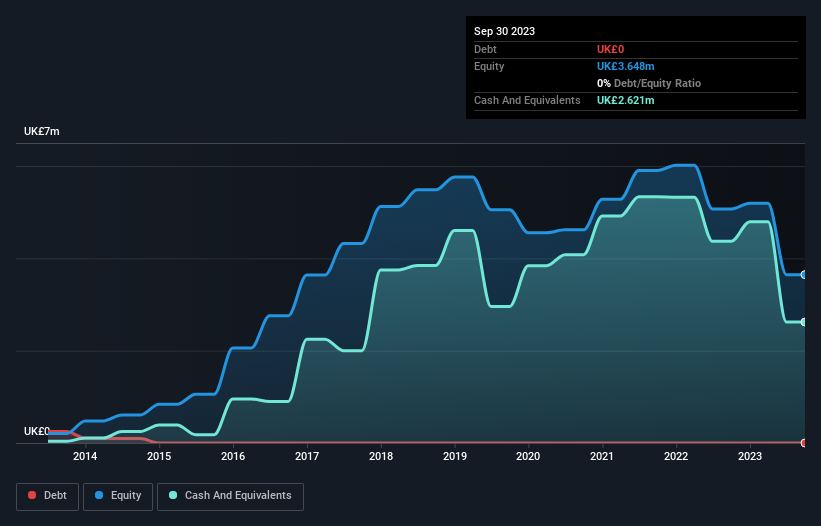

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Triad Group last reported its September 2023 balance sheet in December 2023, it had zero debt and cash worth UK£2.6m. Looking at the last year, the company burnt through UK£544k. So it had a cash runway of about 4.8 years from September 2023. A runway of this length affords the company the time and space it needs to develop the business. Depicted below, you can see how its cash holdings have changed over time.

Is Triad Group's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because Triad Group actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Unfortunately, the last year has been a disappointment, with operating revenue dropping 9.2% during the period. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic earnings and revenue shows how Triad Group is building its business over time.

How Hard Would It Be For Triad Group To Raise More Cash For Growth?

Since its revenue growth is moving in the wrong direction, Triad Group shareholders may wish to think ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of UK£42m, Triad Group's UK£544k in cash burn equates to about 1.3% of its market value. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About Triad Group's Cash Burn?

As you can probably tell by now, we're not too worried about Triad Group's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. While its falling revenue wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Triad Group (of which 2 are concerning!) you should know about.

Of course Triad Group may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Triad Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TRD

Triad Group

Provides information technology consultancy services to the public, private, and not-for-profit sectors in the United Kingdom.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026