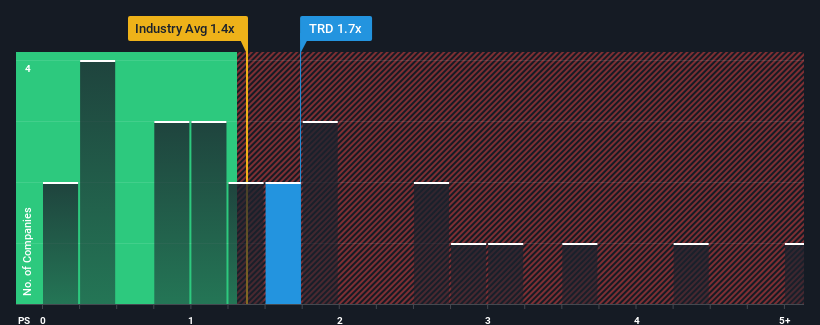

It's not a stretch to say that Triad Group plc's (LON:TRD) price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" for companies in the IT industry in the United Kingdom, where the median P/S ratio is around 1.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Triad Group

What Does Triad Group's P/S Mean For Shareholders?

For instance, Triad Group's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Triad Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Triad Group's Revenue Growth Trending?

In order to justify its P/S ratio, Triad Group would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.2%. This means it has also seen a slide in revenue over the longer-term as revenue is down 26% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 5.2% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that Triad Group's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

The fact that Triad Group currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Triad Group (2 shouldn't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Triad Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Triad Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:TRD

Triad Group

Provides information technology consultancy services to the public, private, and not-for-profit sectors in the United Kingdom.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026