- United Kingdom

- /

- Software

- /

- LSE:MCRO

Micro Focus International (LON:MCRO) Share Prices Have Dropped 85% In The Last Three Years

It is a pleasure to report that the Micro Focus International plc (LON:MCRO) is up 54% in the last quarter. But the last three years have seen a terrible decline. Indeed, the share price is down a whopping 85% in the last three years. So we're relieved for long term holders to see a bit of uplift. But the more important question is whether the underlying business can justify a higher price still.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Micro Focus International

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Micro Focus International has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 23% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Micro Focus International more closely, as sometimes stocks fall unfairly. This could present an opportunity.

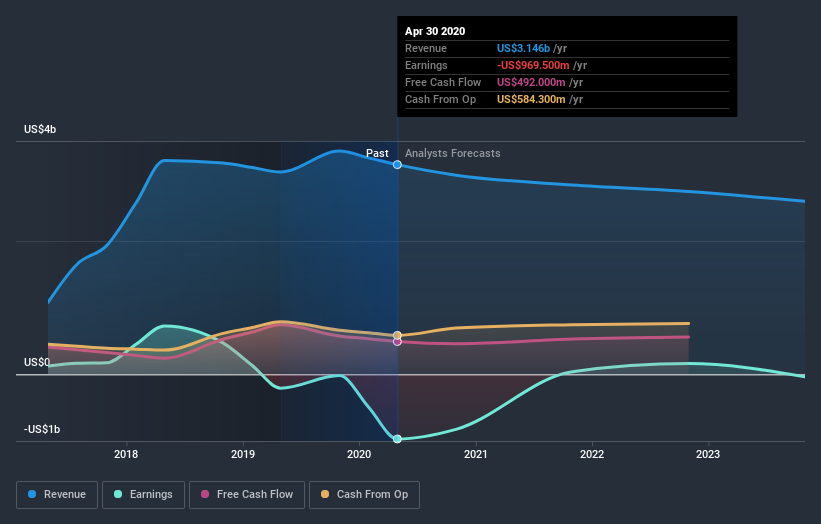

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Micro Focus International stock, you should check out this free report showing analyst profit forecasts.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Micro Focus International's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Micro Focus International shareholders, and that cash payout explains why its total shareholder loss of 80%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

We regret to report that Micro Focus International shareholders are down 65% for the year. Unfortunately, that's worse than the broader market decline of 3.3%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Micro Focus International has 2 warning signs (and 1 which is concerning) we think you should know about.

Micro Focus International is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

When trading Micro Focus International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:MCRO

Micro Focus International

Micro Focus International plc operates in the enterprise software business in the United Kingdom, the United States, Germany, Canada, France, Japan, and internationally.

Good value low.

Similar Companies

Market Insights

Community Narratives