- United Kingdom

- /

- IT

- /

- LSE:KNOS

UK Growth Companies With Insider Ownership Up To 36%

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. In such a landscape, growth companies with high insider ownership can be appealing as they often indicate strong confidence in the company’s future prospects by those closest to its operations.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| QinetiQ Group (LSE:QQ.) | 13.3% | 67.7% |

| Metals Exploration (AIM:MTL) | 10.4% | 85.9% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| LSL Property Services (LSE:LSL) | 10.4% | 21.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 21.6% | 62% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| ActiveOps (AIM:AOM) | 19.5% | 40.7% |

We're going to check out a few of the best picks from our screener tool.

Aston Martin Lagonda Global Holdings (LSE:AML)

Simply Wall St Growth Rating: ★★★★☆☆

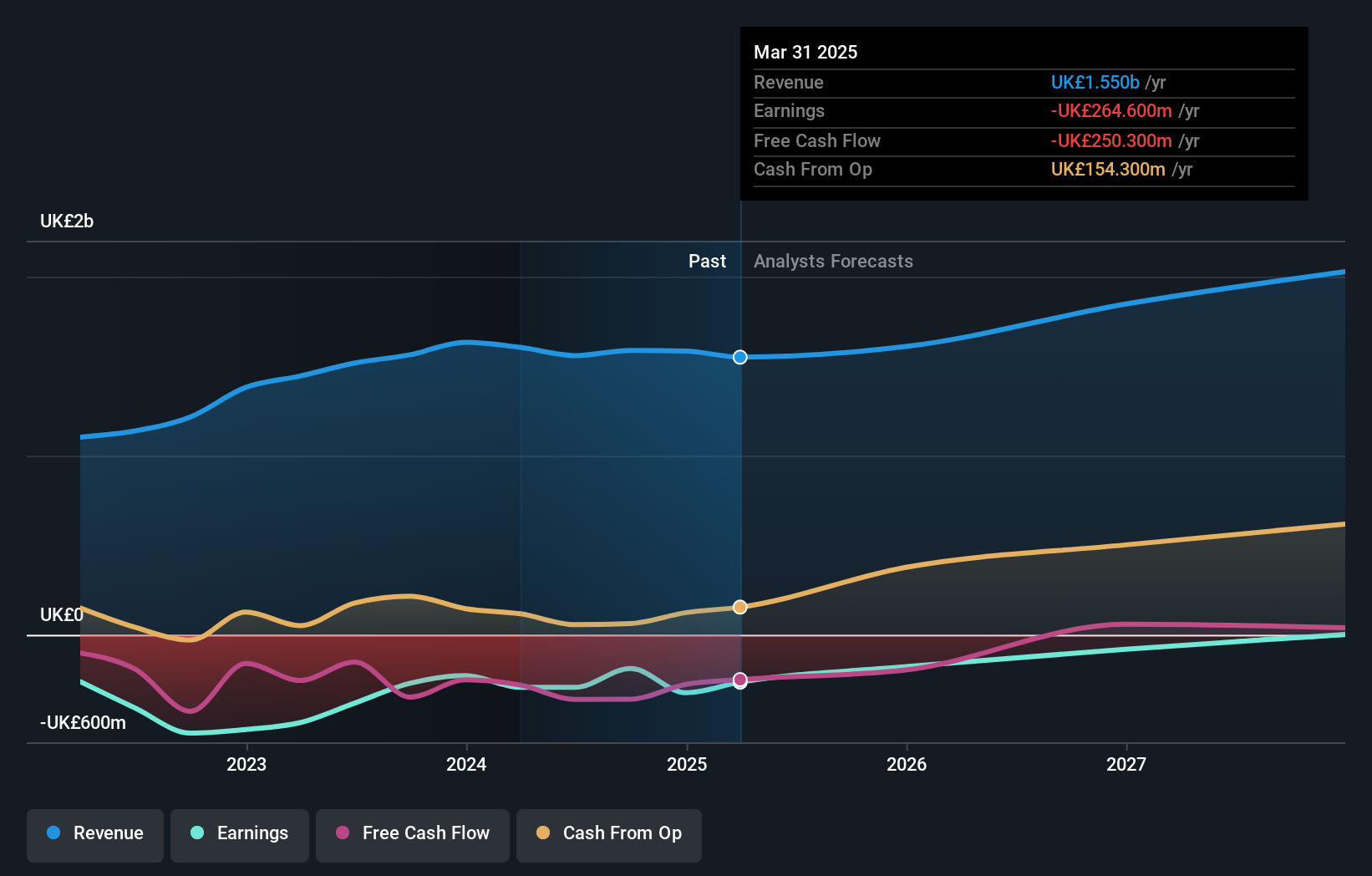

Overview: Aston Martin Lagonda Global Holdings plc designs, develops, manufactures, and markets luxury sports cars across various regions including the UK, Americas, Middle East, Africa, Europe, and Asia Pacific with a market cap of approximately £605 million.

Operations: The company's revenue primarily comes from its Automotive segment, generating £1.33 billion.

Insider Ownership: 16.6%

Aston Martin Lagonda Global Holdings, despite high insider ownership, faces challenges with recent earnings showing a decline in sales and an increased net loss. The company is forecast to grow earnings by 73.5% annually and aims for profitability within three years, outpacing average market growth. However, revenue growth expectations at 14.6% per year are below the desired threshold for high-growth companies. Recent guidance revisions highlight improved future financial performance driven by new product deliveries and cost reductions.

- Click here and access our complete growth analysis report to understand the dynamics of Aston Martin Lagonda Global Holdings.

- Our valuation report unveils the possibility Aston Martin Lagonda Global Holdings' shares may be trading at a premium.

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★☆☆

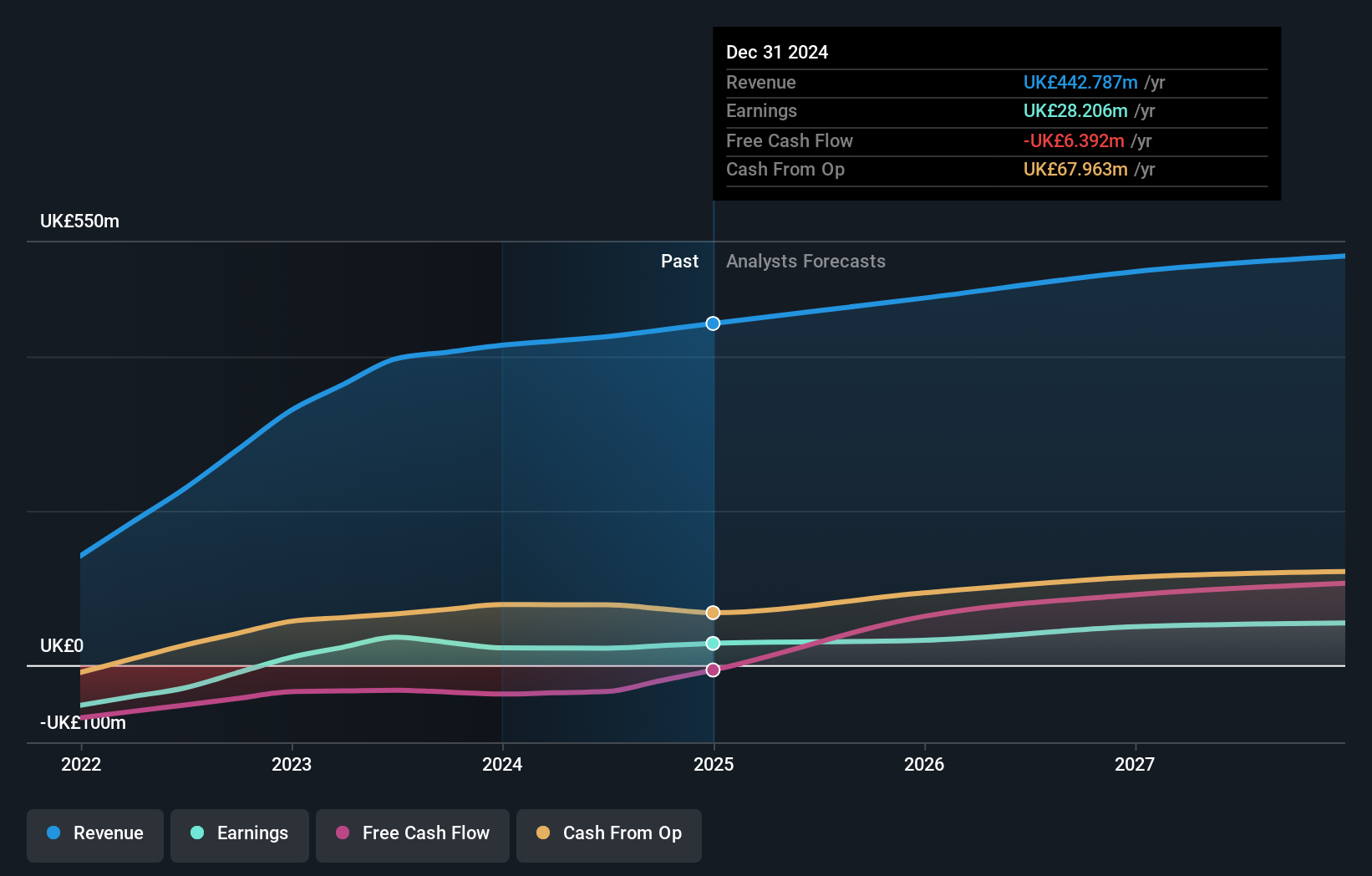

Overview: Kainos Group plc provides digital technology services across the United Kingdom, Ireland, the Americas, Central Europe, and internationally, with a market cap of £1.11 billion.

Operations: The company's revenue is derived from three main segments: Digital Services (£197.17 million), Workday Products (£71.35 million), and Workday Services (£98.72 million).

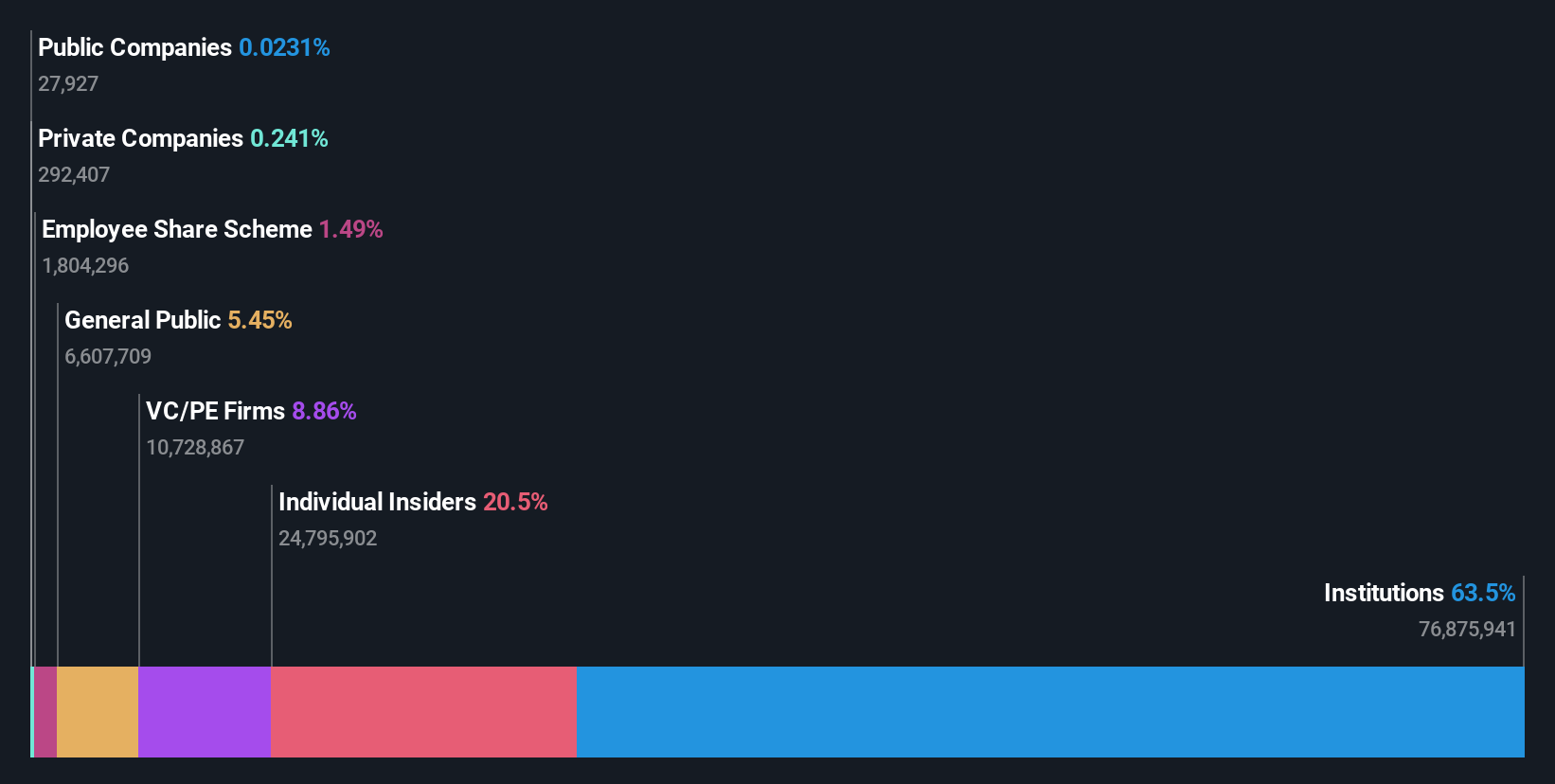

Insider Ownership: 20.5%

Kainos Group, with significant insider ownership, is positioned for growth despite revenue forecasts of 7.2% annually falling below high-growth benchmarks. However, earnings are expected to grow at 16.16% per year, surpassing the UK market average of 14.5%. Recent guidance indicates revenues could reach £393.4 million by March 2026 due to strong sales performance. The company's high return on equity forecast and strategic insights from its recent Analyst Day further support its growth trajectory.

- Click here to discover the nuances of Kainos Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Kainos Group shares in the market.

PPHE Hotel Group (LSE:PPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PPHE Hotel Group Limited is involved in owning, co-owning, developing, leasing, operating, and franchising hospitality real estate across several European countries including the Netherlands and the United Kingdom, with a market cap of £615.29 million.

Operations: The company's revenue segments include Owned Hotel Operations in the United Kingdom (£256.21 million), Croatia (£85.91 million), The Netherlands (£64.59 million), and Germany (£23.33 million), as well as Management and Central Services (£56.70 million).

Insider Ownership: 36.4%

PPHE Hotel Group exhibits strong growth potential with significant insider ownership and a forecasted annual earnings growth of 28.1%, outpacing the UK market average. Despite slower revenue growth at 5% annually, recent acquisitions, such as a prime London development site for £17.5 million, bolster its expansion strategy. The company reported increased Q3 revenues to £155.9 million but faces challenges with unstable dividends and interest payments not fully covered by earnings.

- Delve into the full analysis future growth report here for a deeper understanding of PPHE Hotel Group.

- In light of our recent valuation report, it seems possible that PPHE Hotel Group is trading beyond its estimated value.

Turning Ideas Into Actions

- Get an in-depth perspective on all 60 Fast Growing UK Companies With High Insider Ownership by using our screener here.

- Ready For A Different Approach? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kainos Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:KNOS

Kainos Group

Engages in the provision of digital technology services in the United Kingdom, Ireland, the Americas, Central Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives