- United Kingdom

- /

- IT

- /

- LSE:FDM

FDM Group (Holdings) plc's (LON:FDM) Share Price Is Matching Sentiment Around Its Earnings

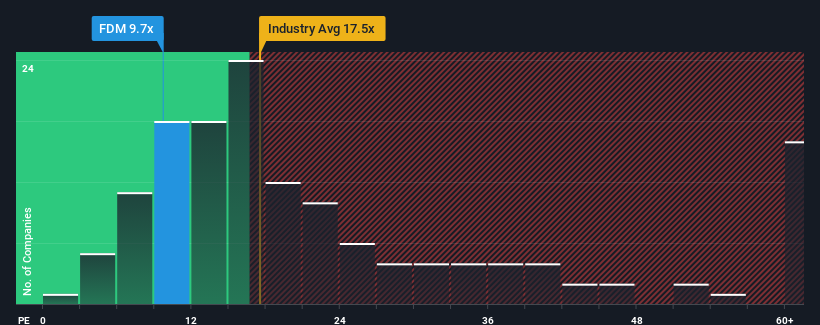

When close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 16x, you may consider FDM Group (Holdings) plc (LON:FDM) as an attractive investment with its 9.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

FDM Group (Holdings) could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for FDM Group (Holdings)

How Is FDM Group (Holdings)'s Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like FDM Group (Holdings)'s to be considered reasonable.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 7.5% each year during the coming three years according to the five analysts following the company. With the market predicted to deliver 13% growth per annum, that's a disappointing outcome.

In light of this, it's understandable that FDM Group (Holdings)'s P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that FDM Group (Holdings) maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - FDM Group (Holdings) has 2 warning signs (and 1 which is potentially serious) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:FDM

FDM Group (Holdings)

Provides information technology (IT) services in the United Kingdom, North America, Europe, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives