- United Kingdom

- /

- IT

- /

- LSE:FDM

Earnings Working Against FDM Group (Holdings) plc's (LON:FDM) Share Price Following 42% Dive

FDM Group (Holdings) plc (LON:FDM) shareholders that were waiting for something to happen have been dealt a blow with a 42% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 71% share price decline.

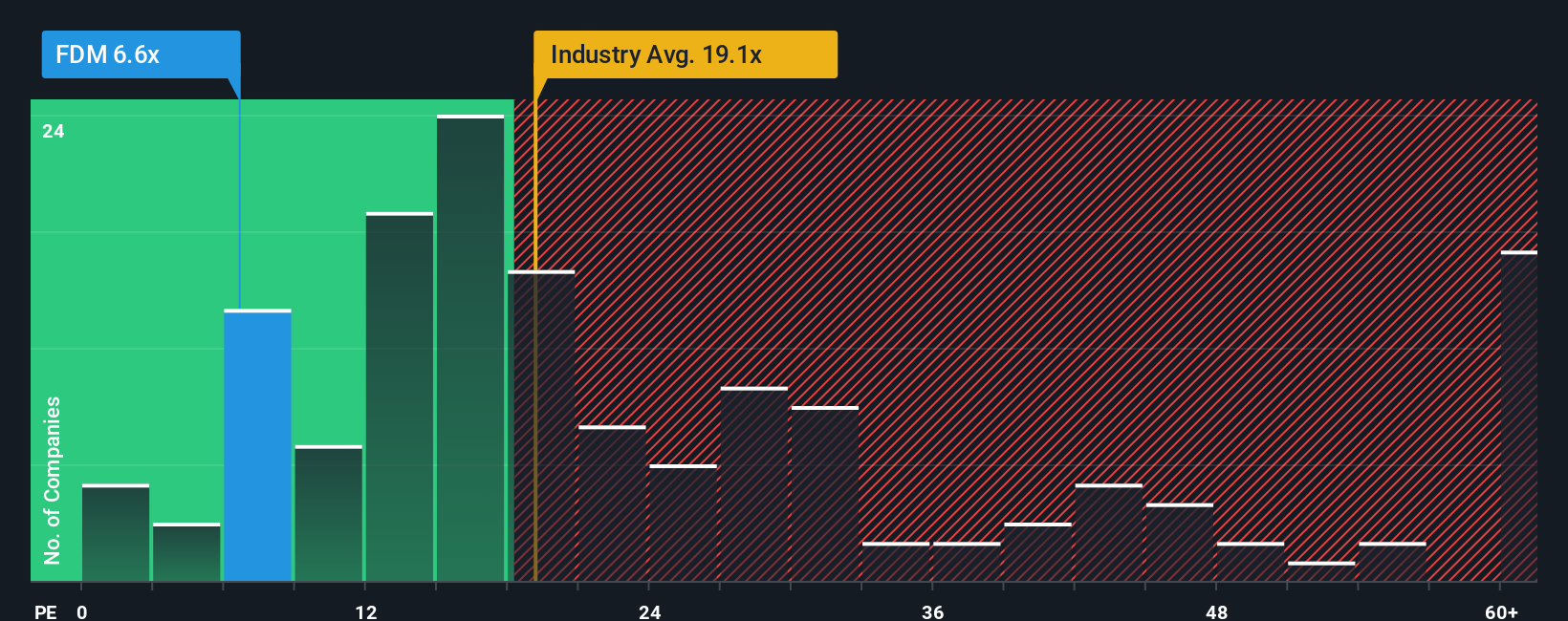

After such a large drop in price, FDM Group (Holdings) may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.6x, since almost half of all companies in the United Kingdom have P/E ratios greater than 17x and even P/E's higher than 29x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

FDM Group (Holdings) hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for FDM Group (Holdings)

Is There Any Growth For FDM Group (Holdings)?

The only time you'd be truly comfortable seeing a P/E as depressed as FDM Group (Holdings)'s is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 50%. The last three years don't look nice either as the company has shrunk EPS by 36% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth is heading into negative territory, declining 7.4% each year over the next three years. That's not great when the rest of the market is expected to grow by 15% each year.

In light of this, it's understandable that FDM Group (Holdings)'s P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

FDM Group (Holdings)'s P/E looks about as weak as its stock price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of FDM Group (Holdings)'s analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 4 warning signs we've spotted with FDM Group (Holdings) (including 1 which doesn't sit too well with us).

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:FDM

FDM Group (Holdings)

Provides information technology (IT) services in the United Kingdom, North America, Europe, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives