- United Kingdom

- /

- IT

- /

- LSE:CCC

Computacenter (LON:CCC) Might Become A Compounding Machine

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, the ROCE of Computacenter (LON:CCC) looks attractive right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Computacenter is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

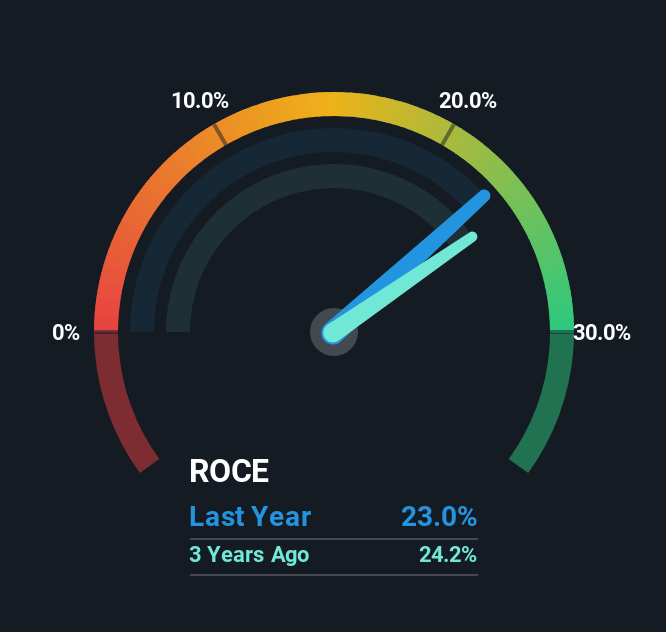

0.23 = UK£237m ÷ (UK£3.1b - UK£2.0b) (Based on the trailing twelve months to June 2025).

Therefore, Computacenter has an ROCE of 23%. In absolute terms that's a great return and it's even better than the IT industry average of 17%.

View our latest analysis for Computacenter

In the above chart we have measured Computacenter's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Computacenter .

How Are Returns Trending?

It's hard not to be impressed by Computacenter's returns on capital. The company has employed 40% more capital in the last five years, and the returns on that capital have remained stable at 23%. With returns that high, it's great that the business can continually reinvest its money at such appealing rates of return. You'll see this when looking at well operated businesses or favorable business models.

On a separate but related note, it's important to know that Computacenter has a current liabilities to total assets ratio of 66%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line On Computacenter's ROCE

In summary, we're delighted to see that Computacenter has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. However, over the last five years, the stock has only delivered a 36% return to shareholders who held over that period. So because of the trends we're seeing, we'd recommend looking further into this stock to see if it has the makings of a multi-bagger.

If you'd like to know about the risks facing Computacenter, we've discovered 1 warning sign that you should be aware of.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CCC

Computacenter

Provides technology and services to corporate and public sector organizations in the United Kingdom, Germany, Western Europe, North America, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.