- United Kingdom

- /

- Software

- /

- LSE:BYIT

Is Bytes Technology Group plc's (LON:BYIT) Stock's Recent Performance Being Led By Its Attractive Financial Prospects?

Bytes Technology Group (LON:BYIT) has had a great run on the share market with its stock up by a significant 21% over the last three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study Bytes Technology Group's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Bytes Technology Group

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Bytes Technology Group is:

74% = UK£44m ÷ UK£60m (Based on the trailing twelve months to August 2023).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every £1 worth of equity, the company was able to earn £0.74 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Bytes Technology Group's Earnings Growth And 74% ROE

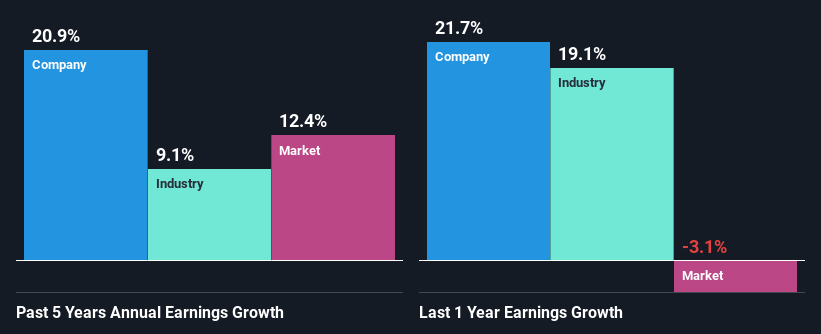

To begin with, Bytes Technology Group has a pretty high ROE which is interesting. Additionally, the company's ROE is higher compared to the industry average of 10% which is quite remarkable. Under the circumstances, Bytes Technology Group's considerable five year net income growth of 21% was to be expected.

As a next step, we compared Bytes Technology Group's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 9.1%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. What is BYIT worth today? The intrinsic value infographic in our free research report helps visualize whether BYIT is currently mispriced by the market.

Is Bytes Technology Group Making Efficient Use Of Its Profits?

Bytes Technology Group's three-year median payout ratio is a pretty moderate 44%, meaning the company retains 56% of its income. This suggests that its dividend is well covered, and given the high growth we discussed above, it looks like Bytes Technology Group is reinvesting its earnings efficiently.

While Bytes Technology Group has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 46%. Regardless, Bytes Technology Group's ROE is speculated to decline to 58% despite there being no anticipated change in its payout ratio.

Summary

In total, we are pretty happy with Bytes Technology Group's performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

Valuation is complex, but we're here to simplify it.

Discover if Bytes Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BYIT

Bytes Technology Group

Offers software, security, AI, and cloud services in the United Kingdom, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Circle Internet Group (CRCL): The Programmable Dollar Powerhouse – Post-IPO Momentum and Stablecoin Dominance.

TTM Technologies (TTMI): The Backbone of the AI Tsunami and Defense Modernization.

Bloom Energy Corp (BE): The AI "Bridge-to-Power" – Scaling to 2GW Capacity for the Next-Gen Data Center.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026