- United Kingdom

- /

- Software

- /

- LSE:BYIT

Bytes Technology Group (LON:BYIT) Will Pay A Larger Dividend Than Last Year At £0.024

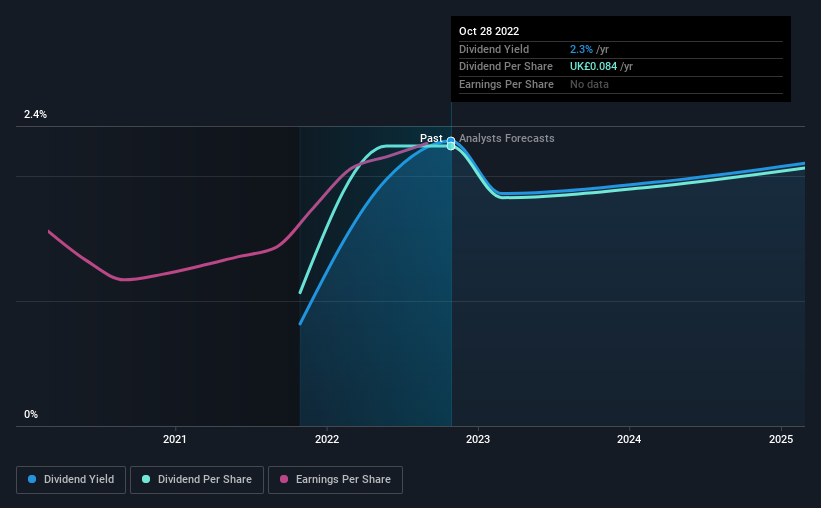

The board of Bytes Technology Group plc (LON:BYIT) has announced that it will be paying its dividend of £0.024 on the 2nd of December, an increased payment from last year's comparable dividend. This makes the dividend yield 2.3%, which is above the industry average.

See our latest analysis for Bytes Technology Group

Bytes Technology Group's Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. The last dividend was quite comfortably covered by Bytes Technology Group's earnings, but it was a bit tighter on the cash flow front. By paying out so much of its cash flows, this could indicate that the company has limited opportunities for investment and growth.

The next year is set to see EPS grow by 90.5%. If the dividend continues on this path, the payout ratio could be 44% by next year, which we think can be pretty sustainable going forward.

Bytes Technology Group Is Still Building Its Track Record

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. Bytes Technology Group has seen EPS rising for the last three years, at 13% per annum. Since earnings per share is growing at an acceptable rate, and the payout policy is balanced, we think the company is positioning itself well to grow earnings and dividends in the future.

Our Thoughts On Bytes Technology Group's Dividend

In summary, while it's always good to see the dividend being raised, we don't think Bytes Technology Group's payments are rock solid. The company hasn't been paying a very consistent dividend over time, despite only paying out a small portion of earnings. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Bytes Technology Group that investors need to be conscious of moving forward. Is Bytes Technology Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Bytes Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:BYIT

Bytes Technology Group

Offers software, security, AI, and cloud services in the United Kingdom, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Energy One (ASX:EOL): Sticky software with improving margins

Circle Internet Group: From Crypto Proxy to Rate-Sensitive Financial Infrastructure

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks