- Hong Kong

- /

- Personal Products

- /

- SEHK:2145

3 Top Undervalued Small Caps With Recent Insider Activity

Reviewed by Simply Wall St

Global markets have been buoyed by the Federal Reserve's recent rate cut, with small-cap indexes like the Russell 2000 outperforming despite remaining below their historical peaks. This positive sentiment, coupled with encouraging economic indicators such as rising retail sales and lower jobless claims, has created a fertile environment for investors seeking undervalued opportunities in the small-cap sector. In this context, identifying promising small-cap stocks often involves looking at factors such as recent insider activity and strong fundamentals that may not yet be fully appreciated by the market.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.4x | 0.9x | 43.91% | ★★★★★★ |

| Genus | 154.7x | 1.8x | 5.09% | ★★★★★☆ |

| PSC | 8.1x | 0.4x | 39.49% | ★★★★☆☆ |

| Citizens & Northern | 13.2x | 2.9x | 42.39% | ★★★★☆☆ |

| Franklin Financial Services | 9.9x | 2.0x | 37.58% | ★★★★☆☆ |

| Sagicor Financial | 1.2x | 0.3x | -32.58% | ★★★★☆☆ |

| CVS Group | 23.7x | 1.3x | 38.05% | ★★★★☆☆ |

| Hemisphere Energy | 6.1x | 2.3x | -215.70% | ★★★☆☆☆ |

| Vital Energy | 4.3x | 0.6x | -48.01% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

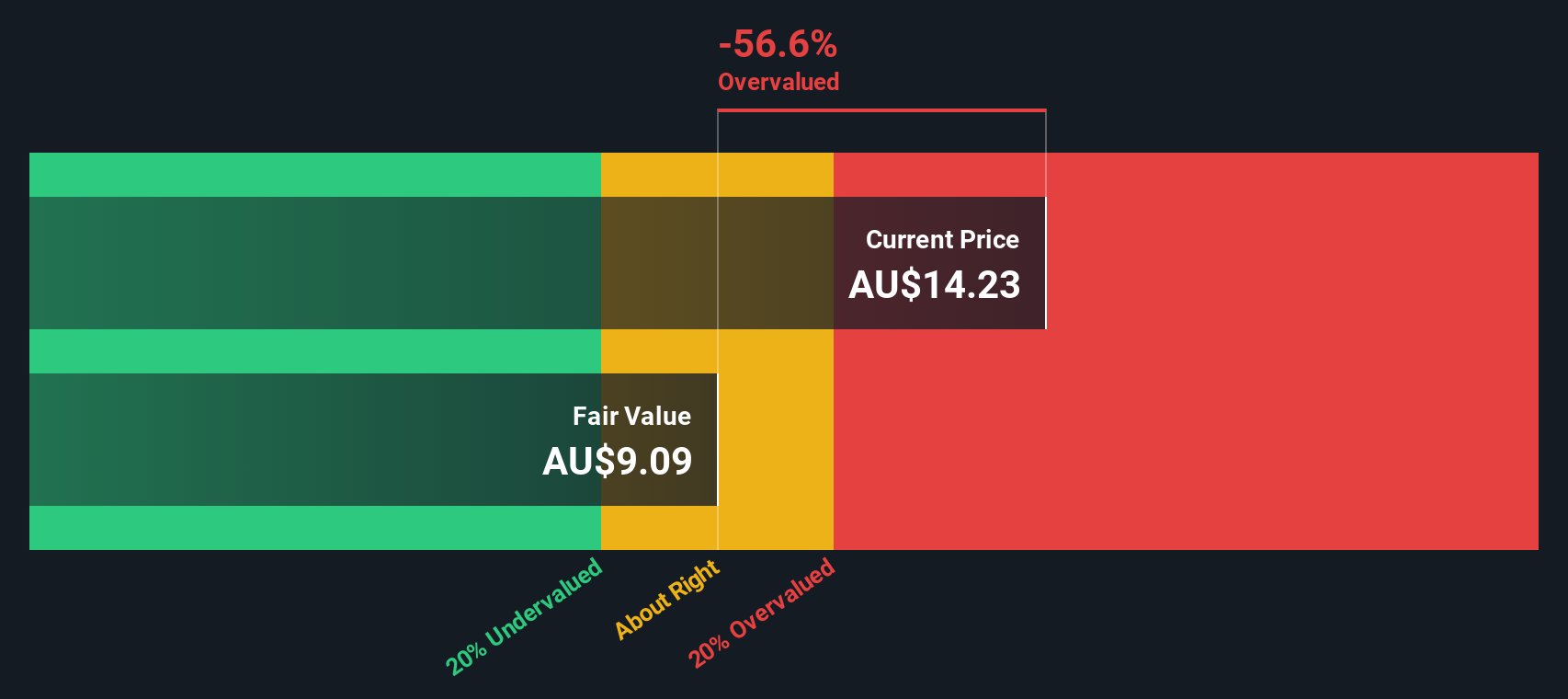

Sims (ASX:SGM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sims operates in the recycling and waste management industry, focusing on metal recycling and electronic lifecycle services, with a market cap of A$4.50 billion.

Operations: The company's primary revenue streams are from North America Metals (A$4.49 billion), Australia/New Zealand Metals (A$1.60 billion), Global Trading (A$771.20 million), and Sims Lifecycle Services (A$350 million). The cost of goods sold for the most recent period was A$6.48 billion, resulting in a gross profit margin of 10.30%. Operating expenses were A$833.6 million, with non-operating expenses at -A$91 million, leading to a net income margin of 0.02%.

PE: 1290.7x

Sims, a smaller stock, has shown insider confidence with recent share purchases by executives. Despite reporting a net loss of A$57.8 million for the year ending June 30, 2024, compared to a net income of A$181.1 million the previous year, their sales increased to A$7.2 billion from A$6.7 billion. Earnings are forecasted to grow at 41% annually, suggesting potential future value despite current low profit margins and high-risk funding sources primarily through external borrowing.

- Navigate through the intricacies of Sims with our comprehensive valuation report here.

Review our historical performance report to gain insights into Sims''s past performance.

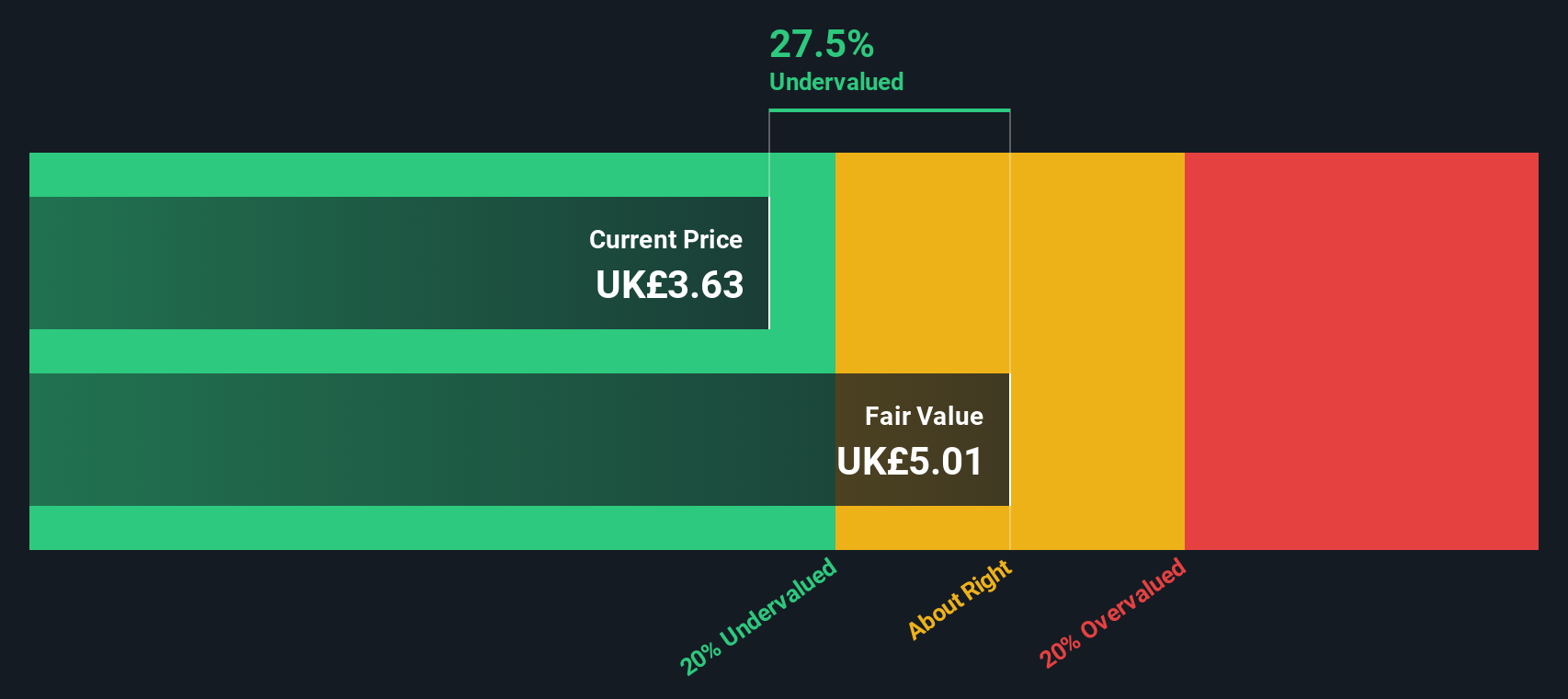

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bytes Technology Group is an IT solutions provider with a market cap of £1.10 billion.

Operations: Bytes Technology Group generates revenue primarily from its IT Solutions Provider segment, with recent figures showing £207.02 million. The company's cost of goods sold (COGS) is £61.24 million, leading to a gross profit of £145.78 million and a gross profit margin of 70.42%. Operating expenses are recorded at £89.07 million, contributing to a net income of £46.85 million and a net income margin of 22.63%.

PE: 26.6x

Bytes Technology Group, a small cap stock, has shown insider confidence with recent share purchases by executives over the past six months. The company forecasts annual earnings growth of 9.23%, but relies entirely on external borrowing for funding, which carries higher risk. At its AGM in July 2024, Bytes approved a final dividend of 6 pence per share and a special dividend of 8.7 pence per share, both paid on August 2nd to shareholders on record as of July 19th.

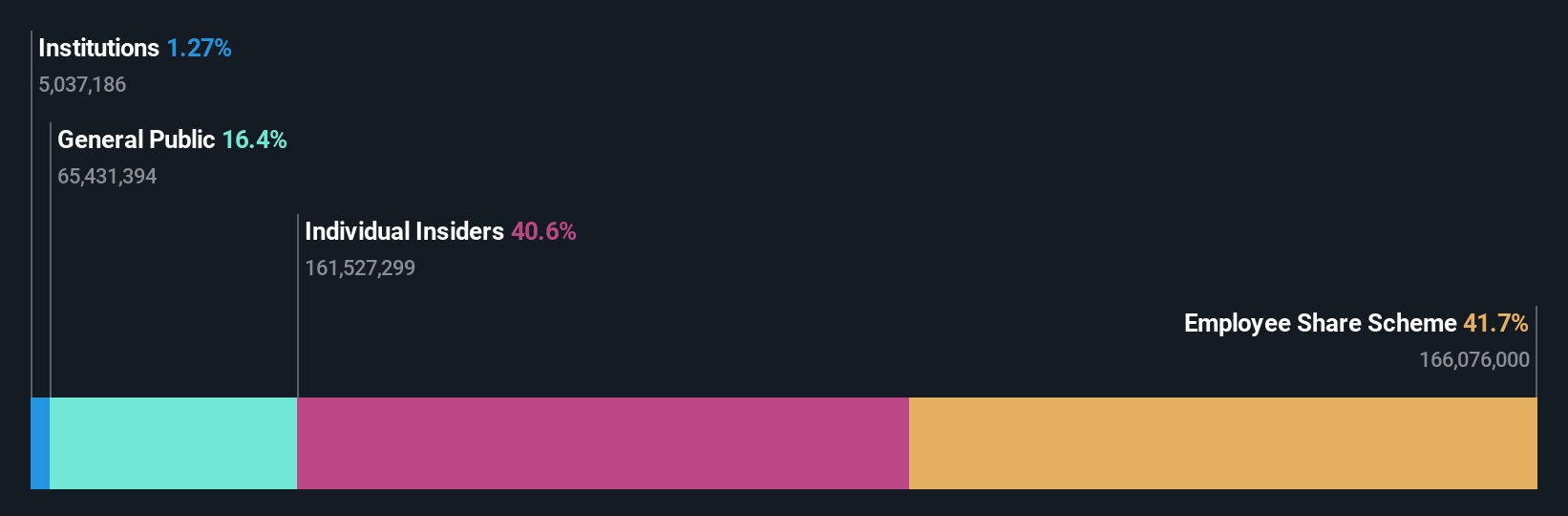

Shanghai Chicmax Cosmetic (SEHK:2145)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Chicmax Cosmetic is engaged in the manufacture and sale of cosmetic products with a market cap of CN¥4.50 billion.

Operations: Shanghai Chicmax Cosmetic generates revenue primarily from the manufacture and sale of cosmetic products. The company has seen fluctuations in its net income margin, with a recent figure of 12.47% as of June 2024. Operating expenses are significantly influenced by sales and marketing costs, which reached CN¥3.41 billion in the same period.

PE: 16.3x

Shanghai Chicmax Cosmetic reported impressive earnings for the first half of 2024, with sales jumping to CNY 3.5 billion from CNY 1.6 billion a year earlier and net income rising to CNY 401 million from CNY 101 million. Basic earnings per share increased to CNY 1.01, up from CNY 0.25 last year. The company proposed an interim dividend of RMB 0.75 per share, with insider confidence evident through recent stock purchases by executives in Q3-2024.

Summing It All Up

- Click this link to deep-dive into the 173 companies within our Undervalued Small Caps With Insider Buying screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2145

Shanghai Chicmax Cosmetic

A multi-brand cosmetics company, engages in the research, development, manufacture, and sale of skincare, maternity, and childcare products in China.

Exceptional growth potential with outstanding track record.