- United Kingdom

- /

- Software

- /

- LSE:AVV

Trade Alert: The Non-Executive Vice Chairman Of AVEVA Group plc (LON:AVV), Peter Herweck, Has Sold Some Shares Recently

Anyone interested in AVEVA Group plc (LON:AVV) should probably be aware that the Non-Executive Vice Chairman, Peter Herweck, recently divested UK£271k worth of shares in the company, at an average price of UK£38.13 each. In particular, we note that the sale equated to a 100% reduction in their position size, which doesn't exactly instill confidence.

View our latest analysis for AVEVA Group

The Last 12 Months Of Insider Transactions At AVEVA Group

Notably, that recent sale by Peter Herweck is the biggest insider sale of AVEVA Group shares that we've seen in the last year. That means that even when the share price was below the current price of UK£38.93, an insider wanted to cash in some shares. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. This single sale was 100% of Peter Herweck's stake.

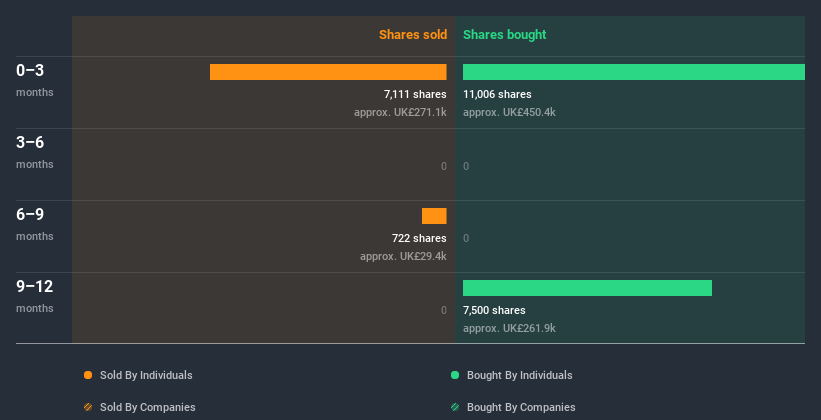

Happily, we note that in the last year insiders paid UK£714k for 18.51k shares. But insiders sold 7.83k shares worth UK£300k. In the last twelve months there was more buying than selling by AVEVA Group insiders. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Does AVEVA Group Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Insiders own 0.06% of AVEVA Group shares, worth about UK£7.2m, according to our data. Whilst better than nothing, we're not overly impressed by these holdings.

So What Does This Data Suggest About AVEVA Group Insiders?

It's certainly positive to see the recent insider purchases. And an analysis of the transactions over the last year also gives us confidence. On this analysis the only slight negative we see is the fairly low (overall) insider ownership; their transactions suggest that they are quite positive on AVEVA Group stock. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To help with this, we've discovered 3 warning signs (1 is potentially serious!) that you ought to be aware of before buying any shares in AVEVA Group.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading AVEVA Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:AVV

AVEVA Group

AVEVA Group plc, through its subsidiaries, provides engineering and industrial software solutions in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives