- United Kingdom

- /

- Software

- /

- AIM:ZOO

Here's What ZOO Digital Group plc's (LON:ZOO) Shareholder Ownership Structure Looks Like

The big shareholder groups in ZOO Digital Group plc (LON:ZOO) have power over the company. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

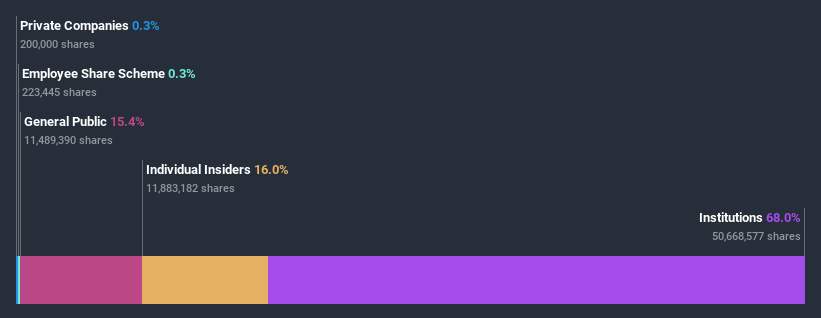

ZOO Digital Group is not a large company by global standards. It has a market capitalization of UK£85m, which means it wouldn't have the attention of many institutional investors. In the chart below, we can see that institutions own shares in the company. We can zoom in on the different ownership groups, to learn more about ZOO Digital Group.

Check out our latest analysis for ZOO Digital Group

What Does The Institutional Ownership Tell Us About ZOO Digital Group?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

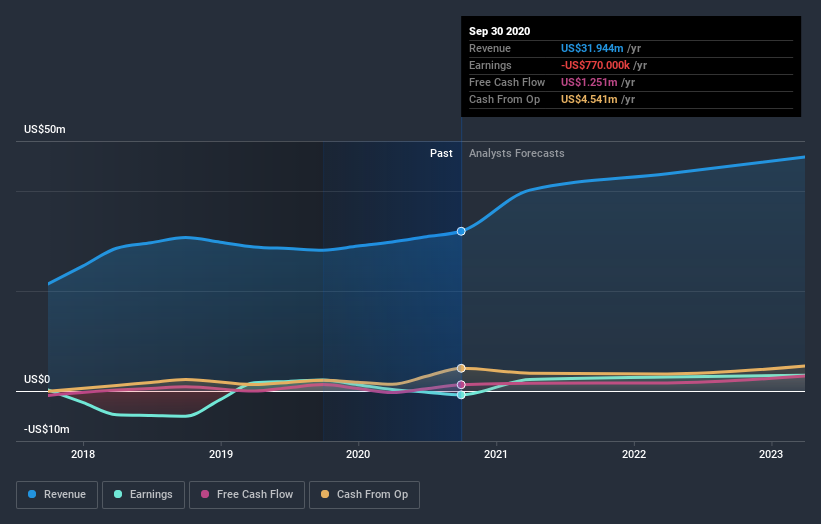

ZOO Digital Group already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at ZOO Digital Group's earnings history below. Of course, the future is what really matters.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. We note that hedge funds don't have a meaningful investment in ZOO Digital Group. The company's CEO Stuart Green is the largest shareholder with 16% of shares outstanding. Herald Investment Management Limited is the second largest shareholder owning 11% of common stock, and Invesco Ltd. holds about 9.4% of the company stock.

We also observed that the top 7 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of ZOO Digital Group

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in ZOO Digital Group plc. Insiders own UK£14m worth of shares in the UK£85m company. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

With a 15% ownership, the general public have some degree of sway over ZOO Digital Group. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for ZOO Digital Group that you should be aware of before investing here.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade ZOO Digital Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ZOO Digital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:ZOO

ZOO Digital Group

Together with subsidiaries, provides productivity tools and media services in the United Kingdom, the United State, India, Italy, Germany, South Korea, and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion