- United Kingdom

- /

- Software

- /

- AIM:CRTA

It Looks Like WANdisco plc's (LON:WAND) CEO May Expect Their Salary To Be Put Under The Microscope

Shareholders will probably not be too impressed with the underwhelming results at WANdisco plc (LON:WAND) recently. At the upcoming AGM on 16 June 2021, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for WANdisco

How Does Total Compensation For David Richards Compare With Other Companies In The Industry?

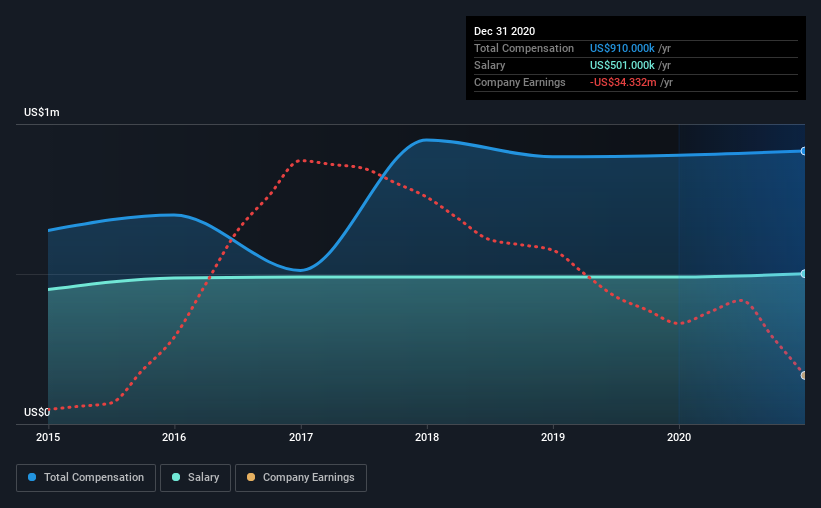

According to our data, WANdisco plc has a market capitalization of UK£250m, and paid its CEO total annual compensation worth US$910k over the year to December 2020. That is, the compensation was roughly the same as last year. In particular, the salary of US$501.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the industry with market capitalizations between UK£142m and UK£567m, we discovered that the median CEO total compensation of that group was US$589k. Hence, we can conclude that David Richards is remunerated higher than the industry median. Furthermore, David Richards directly owns UK£9.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$501k | US$490k | 55% |

| Other | US$409k | US$406k | 45% |

| Total Compensation | US$910k | US$896k | 100% |

Speaking on an industry level, nearly 70% of total compensation represents salary, while the remainder of 30% is other remuneration. WANdisco sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

WANdisco plc's Growth

Over the last three years, WANdisco plc has shrunk its earnings per share by 16% per year. It saw its revenue drop 35% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has WANdisco plc Been A Good Investment?

With a total shareholder return of -63% over three years, WANdisco plc shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 3 warning signs for WANdisco that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading WANdisco or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:CRTA

Cirata

Engages in the development and provision of collaboration software in North America, Germany, rest of Europe, China, and internationally.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives