Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies SysGroup plc (LON:SYS) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for SysGroup

What Is SysGroup's Debt?

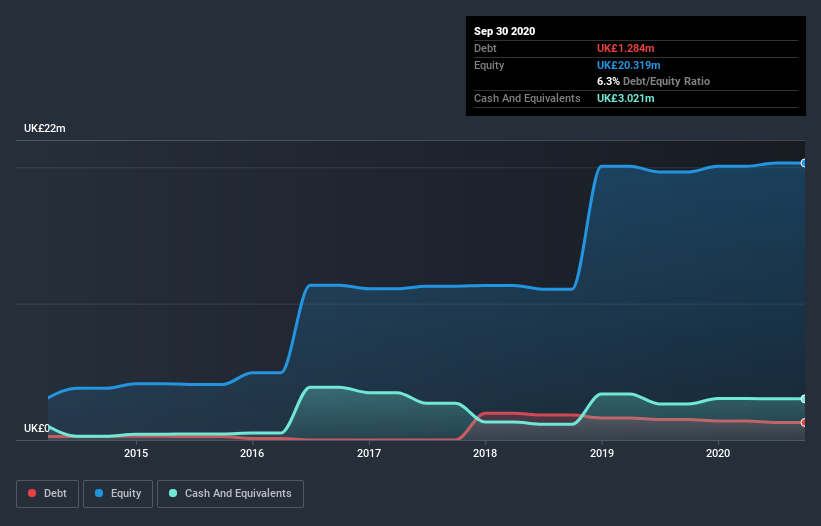

As you can see below, SysGroup had UK£1.28m of debt at September 2020, down from UK£1.51m a year prior. However, its balance sheet shows it holds UK£3.02m in cash, so it actually has UK£1.74m net cash.

How Strong Is SysGroup's Balance Sheet?

The latest balance sheet data shows that SysGroup had liabilities of UK£5.73m due within a year, and liabilities of UK£2.33m falling due after that. Offsetting these obligations, it had cash of UK£3.02m as well as receivables valued at UK£1.47m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£3.57m.

Given SysGroup has a market capitalization of UK£21.3m, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, SysGroup boasts net cash, so it's fair to say it does not have a heavy debt load!

Pleasingly, SysGroup is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 314% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if SysGroup can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. SysGroup may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, SysGroup actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

Although SysGroup's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of UK£1.74m. The cherry on top was that in converted 281% of that EBIT to free cash flow, bringing in UK£1.9m. So we don't think SysGroup's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example - SysGroup has 2 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade SysGroup, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:SYS

SysGroup

Provides managed information technology services specializing in the delivery of cloud, data, and security services to power AI and ML transformation in the United Kingdom and internationally.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Unique One, Retail Sector, but Short Time Investmentnya Almost 2,5 kali Persediaan

OPAP S.A.: Merger Momentum and Greek Gaming Resilience

A Global Powerhouse in the Making

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion