- United Kingdom

- /

- Software

- /

- AIM:TRAC

Here's Why Starcom plc's (LON:STAR) CEO Compensation Is The Least Of Shareholders Concerns

The performance at Starcom plc (LON:STAR) has been rather lacklustre of late and shareholders may be wondering what CEO Avi Hartmann is planning to do about this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 15 July 2021. Voting on executive pay could be a powerful way to influence management, as studies have shown that the right compensation incentives impact company performance. We think CEO compensation looks appropriate given the data we have put together.

See our latest analysis for Starcom

How Does Total Compensation For Avi Hartmann Compare With Other Companies In The Industry?

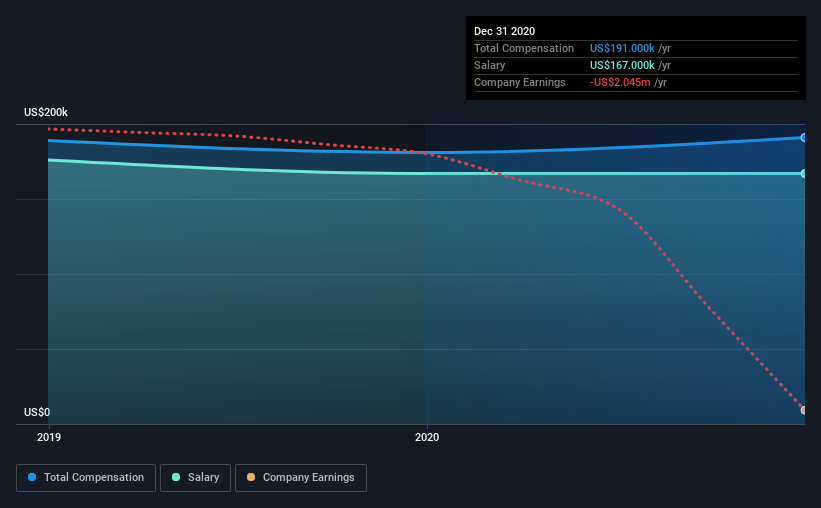

At the time of writing, our data shows that Starcom plc has a market capitalization of UK£3.5m, and reported total annual CEO compensation of US$191k for the year to December 2020. That's a modest increase of 5.5% on the prior year. Notably, the salary which is US$167.0k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below UK£145m, reported a median total CEO compensation of US$366k. That is to say, Avi Hartmann is paid under the industry median. What's more, Avi Hartmann holds UK£316k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$167k | US$167k | 87% |

| Other | US$24k | US$14k | 13% |

| Total Compensation | US$191k | US$181k | 100% |

Speaking on an industry level, nearly 68% of total compensation represents salary, while the remainder of 32% is other remuneration. According to our research, Starcom has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Starcom plc's Growth Numbers

Over the past three years, Starcom plc has seen its earnings per share (EPS) grow by 6.7% per year. Its revenue is down 26% over the previous year.

We generally like to see a little revenue growth, but the modest improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Starcom plc Been A Good Investment?

The return of -63% over three years would not have pleased Starcom plc shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The loss to shareholders over the past three years is certainly concerning. Perhaps the poor price performance may have something to do with the the fact that earnings per share growth has not been performing as strongly either. In the upcoming AGM, shareholders should take this opportunity to raise these concerns with the board and revisit their investment thesis with regards to the company.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 3 warning signs for Starcom (2 don't sit too well with us!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Starcom, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:TRAC

t42 IoT Tracking Solutions

A technology company, engages in sales of hardware and software products in the United Kingdom.

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026