- United Kingdom

- /

- IT

- /

- AIM:RCN

High Growth Tech Stocks In The UK Featuring Three Prominent Players

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 index closing lower amid weak trade data from China, highlighting concerns about global economic recovery and its impact on UK-listed companies. In this environment, identifying high growth tech stocks requires a focus on innovation and resilience to external economic pressures, making them potential candidates for navigating current market conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Audioboom Group | 8.84% | 59.33% | ★★★★★☆ |

| ENGAGE XR Holdings | 22.08% | 84.46% | ★★★★★★ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| YouGov | 3.98% | 64.42% | ★★★★★☆ |

| Oxford Biomedica | 16.89% | 80.47% | ★★★★★☆ |

| Windar Photonics | 37.17% | 46.73% | ★★★★★☆ |

| Huddled Group | 21.70% | 114.65% | ★★★★★☆ |

| Trustpilot Group | 15.18% | 40.20% | ★★★★★☆ |

| Quantum Base Holdings | 132.55% | 92.87% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 55.41% | 54.99% | ★★★★★☆ |

Click here to see the full list of 41 stocks from our UK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Redcentric (AIM:RCN)

Simply Wall St Growth Rating: ★★★★★☆

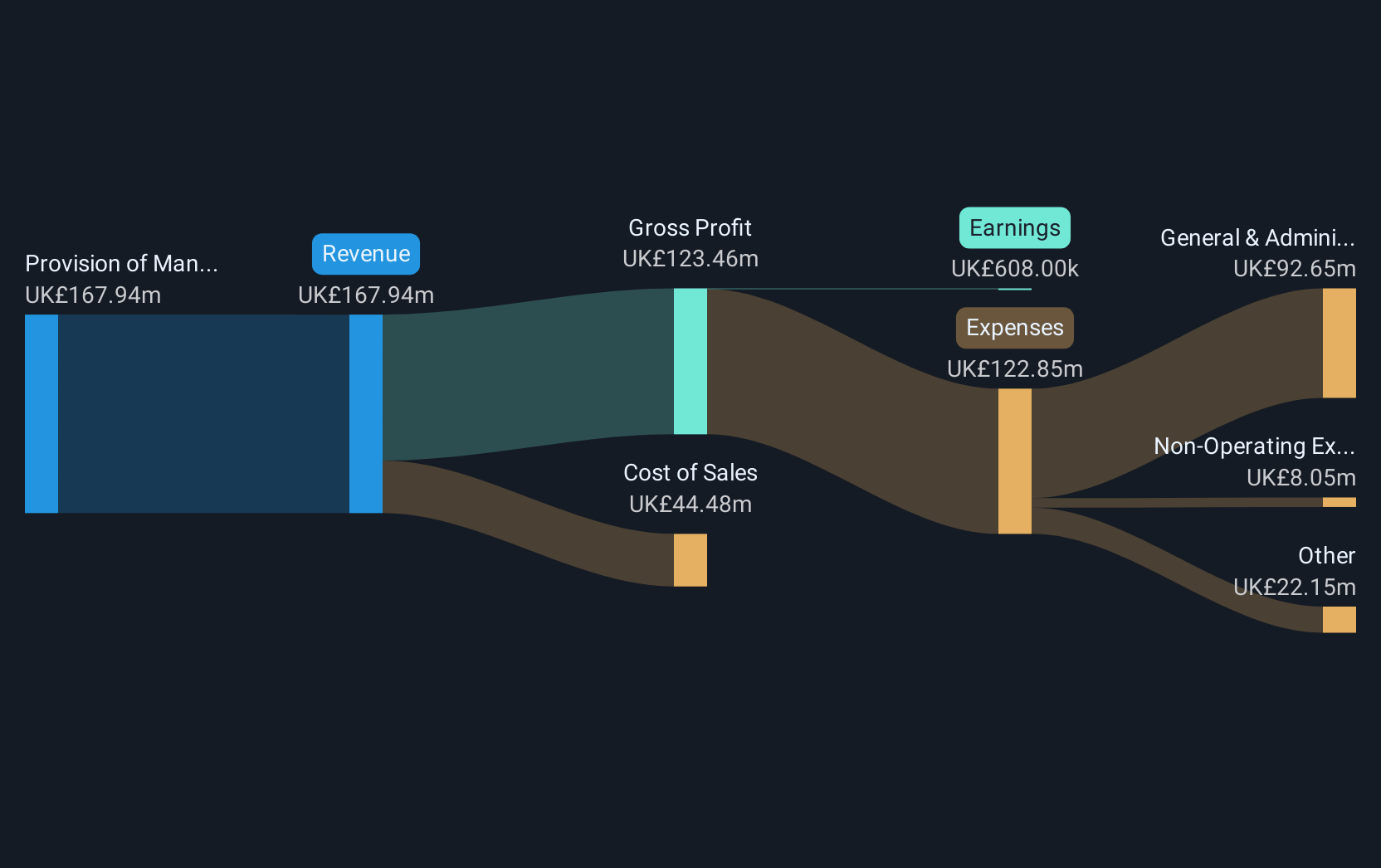

Overview: Redcentric plc is a UK-based company that delivers IT managed services to both public and private sectors, with a market cap of £203.13 million.

Operations: The company generates revenue primarily through the provision of managed services to customers, amounting to £167.94 million.

Redcentric plc, under new CEO Michelle Senecal De Fonseca, is navigating a transformative phase with robust anticipated earnings growth of 67.9% annually. Despite a one-off loss of £3.4M last year, the company's strategic shifts are yielding fruit, evidenced by its recent profitability and a revenue growth forecast at 5.3% per year—outpacing the UK market average of 3.8%. This performance is underpinned by Redcentric's solid footing in IT managed services and data center operations across the UK, sectors poised for expansion as digital transformations accelerate industry-wide. The leadership transition and sustained dividend policy signal stability and confidence in ongoing growth trajectories, aligning with broader industry trends towards enhanced cloud and hosting solutions.

- Navigate through the intricacies of Redcentric with our comprehensive health report here.

Gain insights into Redcentric's historical performance by reviewing our past performance report.

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★★☆

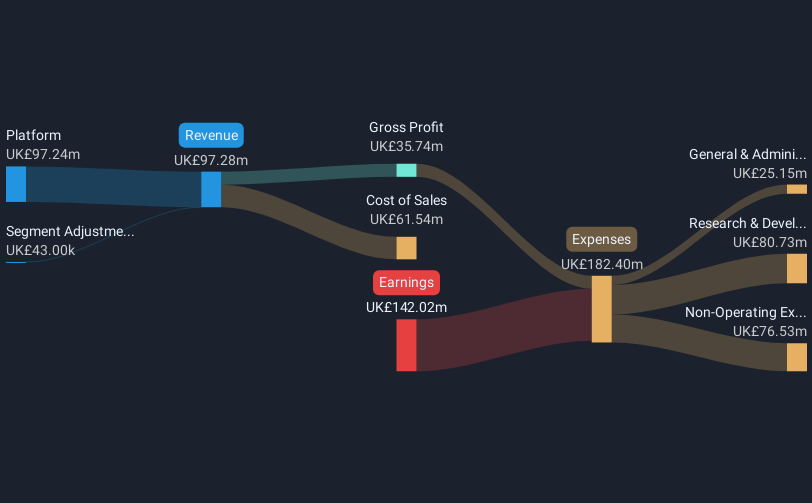

Overview: Oxford Biomedica plc is a contract development and manufacturing organization that specializes in delivering therapies globally, with a market capitalization of £358.07 million.

Operations: Oxford Biomedica plc generates revenue primarily from Manufacturing Services (£68.35 million) and Development (£47.27 million), with additional income from Licence Fees & Incentives (£7.33 million) and Procurement and Storage Services (£5.85 million). The company focuses on delivering therapies worldwide as part of its contract development and manufacturing operations.

Oxford Biomedica's strategic focus on cell and gene therapy is marked by a robust innovation drive, as evidenced by its recent establishment of the Innovation and Technology Excellence Board. This initiative aims to harness expert insights to propel technological advancements, enhancing OXB's position in the competitive CDMO landscape. Despite current unprofitability, OXB anticipates a pivot to profitability by 2025 with revenue expected to grow at 16.9% annually, outstripping the UK market average of 3.8%. The company's forward-looking approach is underscored by significant R&D investments aimed at pioneering treatments in gene therapy, setting a solid foundation for future growth amidst industry challenges like high R&D costs and complex regulatory environments.

- Get an in-depth perspective on Oxford Biomedica's performance by reading our health report here.

Evaluate Oxford Biomedica's historical performance by accessing our past performance report.

Raspberry Pi Holdings (LSE:RPI)

Simply Wall St Growth Rating: ★★★★☆☆

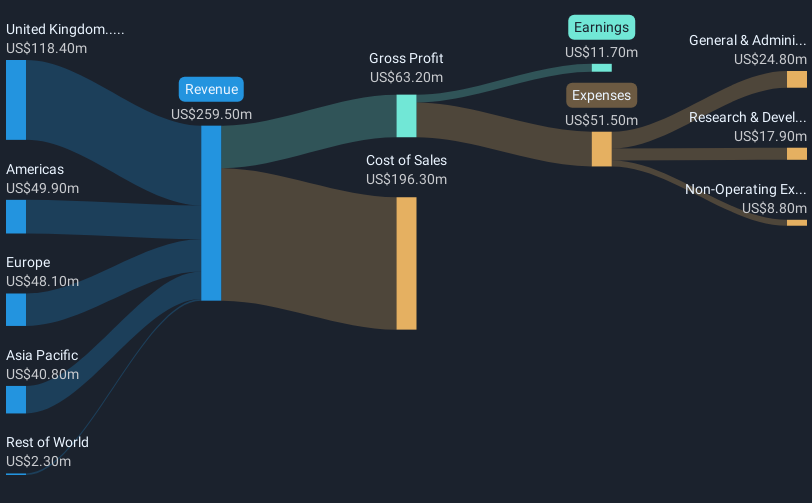

Overview: Raspberry Pi Holdings plc focuses on designing and developing single board computers and compute modules globally, with a market capitalization of £921.05 million.

Operations: The company generates revenue primarily from its computer hardware segment, amounting to $259.50 million. The business is centered around the global design and development of single board computers and compute modules.

Despite a challenging year with a 2.4% dip in sales to $259.5 million, Raspberry Pi Holdings is poised for recovery, forecasting a robust 31% annual earnings growth over the next three years. This anticipated growth starkly contrasts with last year's performance where earnings fell by 62.9%. The company's commitment to innovation is evident from its R&D focus, crucial for staying competitive against an industry average growth of 26.2%. Moreover, recent engagements like presenting at Hardware Pioneers MAX and hosting its Annual General Meeting underscore its active role in shaping tech discussions and potential strategic directions moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Raspberry Pi Holdings.

Understand Raspberry Pi Holdings' track record by examining our Past report.

Make It Happen

- Delve into our full catalog of 41 UK High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:RCN

Redcentric

Provides IT managed services for public and private sector in the United Kingdom.

High growth potential slight.

Market Insights

Community Narratives