- United Kingdom

- /

- IT

- /

- AIM:KWS

Exploring Three High Growth Tech Stocks in the United Kingdom

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines due to weak trade data from China, highlighting concerns over global economic recovery. In this environment, identifying high-growth tech stocks that can navigate these headwinds is crucial for investors seeking opportunities in the UK's dynamic technology sector.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Oxford Biomedica | 20.98% | 106.13% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Keywords Studios (AIM:KWS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Keywords Studios plc offers creative and technical services to the global video game industry, with a market capitalization of £1.96 billion.

Operations: The company generates revenue through three main segments: Create (€365.56 million), Engage (€180.43 million), and Globalize (€261.61 million). This diversified revenue model supports its operations in the global video game industry.

Keywords Studios has demonstrated resilience in a challenging market, with its revenue climbing to €440.43 million, up from €413.27 million year-over-year. Despite this growth, the company faced a net loss of €30.88 million compared to a prior net income of €15.66 million, reflecting significant investment in R&D and possibly strategic shifts amidst industry transformations such as the increasing adoption of SaaS models. The firm's commitment to innovation is evident from its R&D spending trends and its active participation in major industry conferences like Devcom 2024, signaling ongoing efforts to refine its service offerings in gaming and multimedia sectors. Looking ahead, Keywords Studios is poised for recovery with expected earnings growth at an impressive rate of 59.13% annually over the next few years despite current profitability challenges. Its revenue growth forecast at 10.2% annually outpaces the UK market average significantly (3.7%), highlighting potential for substantial market share gains as it moves towards profitability within three years—a promising outlook for a company navigating through temporary setbacks while investing heavily in future capabilities.

- Delve into the full analysis health report here for a deeper understanding of Keywords Studios.

Understand Keywords Studios' track record by examining our Past report.

Redcentric (AIM:RCN)

Simply Wall St Growth Rating: ★★★★★☆

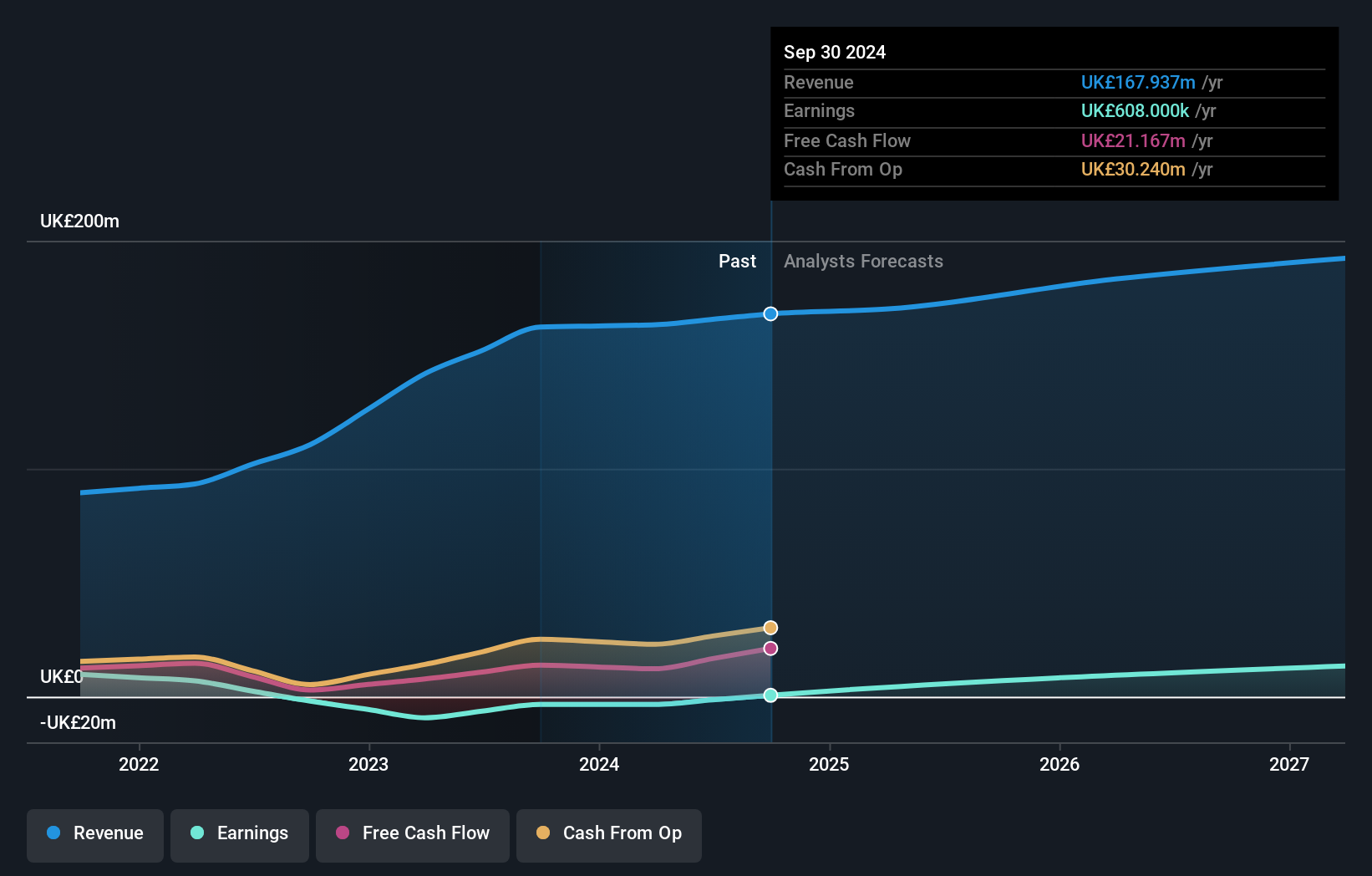

Overview: Redcentric plc is a UK-based company that offers IT managed services to both public and private sectors, with a market cap of £208.28 million.

Operations: The company generates revenue primarily through the provision of managed IT services to customers, amounting to £163.15 million.

Redcentric plc, navigating through a transformative phase, recently announced leadership changes poised to steer its strategic direction. With revenue growth modestly outpacing the UK market at 4.9% annually and an anticipated profitability within three years, the company is setting a foundation for stable growth. Particularly noteworthy is Redcentric's R&D commitment, crucial for maintaining competitive edge in tech innovation; last year's R&D expenditure formed a significant part of their strategy to pivot towards more sustainable profit models. The firm also reported a narrowed net loss from GBP 9.25 million to GBP 3.44 million year-over-year, reflecting tighter operational control and potential recovery signs. These financial and executive shifts suggest Redcentric is cultivating robust internal capabilities to harness future market opportunities effectively.

- Dive into the specifics of Redcentric here with our thorough health report.

Evaluate Redcentric's historical performance by accessing our past performance report.

Genus (LSE:GNS)

Simply Wall St Growth Rating: ★★★★☆☆

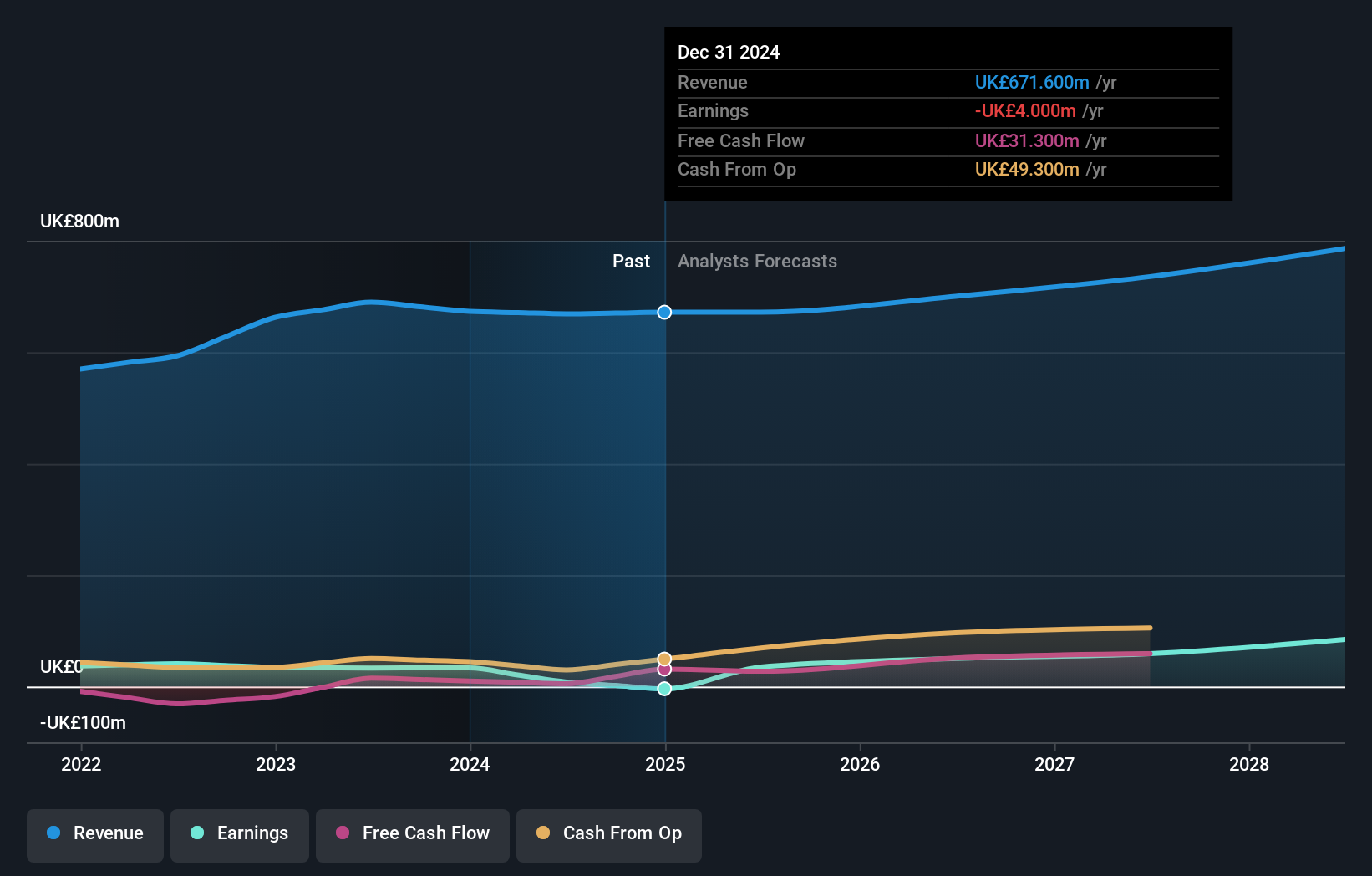

Overview: Genus plc is an animal genetics company with operations across multiple continents, including North America, Latin America, Europe, the Middle East, Russia, Africa, and Asia; it has a market cap of £1.35 billion.

Operations: Genus plc generates revenue primarily through its two main segments: Genus ABS, contributing £314.90 million, and Genus PIC, with £352.50 million in revenue. The company operates globally across various regions, leveraging its expertise in animal genetics to drive these revenue streams.

Genus plc, amidst a challenging fiscal year, evidenced by a sales dip to GBP 668.8 million from GBP 689.7 million and a stark net income drop to GBP 7.9 million from GBP 33.3 million, still projects robust future growth with earnings expected to surge by 39.4% annually. This optimism is bolstered by its R&D spending which remains pivotal in driving innovation; notably, the firm's commitment here aligns with an industry leaning heavily on technological advancements to stay competitive. Despite the recent financial turbulence and a modest revenue growth forecast of 4.1% per year—slightly outpacing the UK market average of 3.7%—Genus's strategic focus on R&D could well position it for recovery and growth in the evolving biotech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Genus.

Examine Genus' past performance report to understand how it has performed in the past.

Make It Happen

- Explore the 46 names from our UK High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keywords Studios might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:KWS

Keywords Studios

Provides creative and technical services to the video game industry worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives