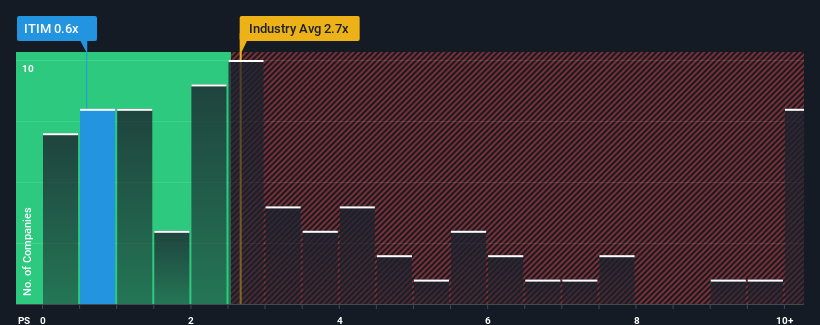

Itim Group Plc's (LON:ITIM) price-to-sales (or "P/S") ratio of 0.6x might make it look like a strong buy right now compared to the Software industry in the United Kingdom, where around half of the companies have P/S ratios above 2.7x and even P/S above 6x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Itim Group

What Does Itim Group's Recent Performance Look Like?

Itim Group could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Itim Group.Is There Any Revenue Growth Forecasted For Itim Group?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Itim Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.2% last year. The latest three year period has also seen a 20% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 14% per annum during the coming three years according to the sole analyst following the company. That's shaping up to be materially higher than the 9.5% per year growth forecast for the broader industry.

In light of this, it's peculiar that Itim Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Itim Group's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Itim Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 3 warning signs for Itim Group (1 is a bit unpleasant!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ITIM

Itim Group

Provides technology solutions in the United Kingdom, Portugal, Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives