- United Kingdom

- /

- Software

- /

- AIM:IQG

IQGeo Group (LON:IQG) Shareholders Booked A 80% Gain In The Last Three Years

By buying an index fund, investors can approximate the average market return. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the IQGeo Group plc (LON:IQG) share price is up 80% in the last three years, clearly besting the market decline of around 11% (not including dividends).

View our latest analysis for IQGeo Group

Because IQGeo Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years IQGeo Group saw its revenue shrink by 44% per year. Despite the lack of revenue growth, the stock has returned 22%, compound, over three years. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

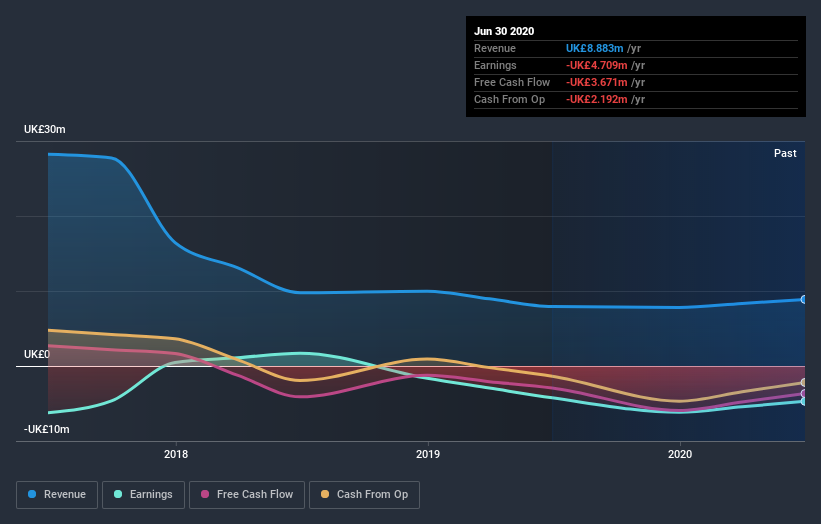

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling IQGeo Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that IQGeo Group shareholders have received a total shareholder return of 72% over one year. That's better than the annualised return of 12% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand IQGeo Group better, we need to consider many other factors. For instance, we've identified 1 warning sign for IQGeo Group that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you’re looking to trade IQGeo Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:IQG

IQGeo Group

IQGeo Group plc, together with its subsidiaries, delivers geospatial software solutions for the telecoms and utility network operators in the United Kingdom, the United States, Canada, Belgium, Germany, Japan, Malaysia, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives