- United Kingdom

- /

- Software

- /

- AIM:IGP

Intercede Group plc (LON:IGP) May Have Run Too Fast Too Soon With Recent 29% Price Plummet

Intercede Group plc (LON:IGP) shares have retraced a considerable 29% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 189%.

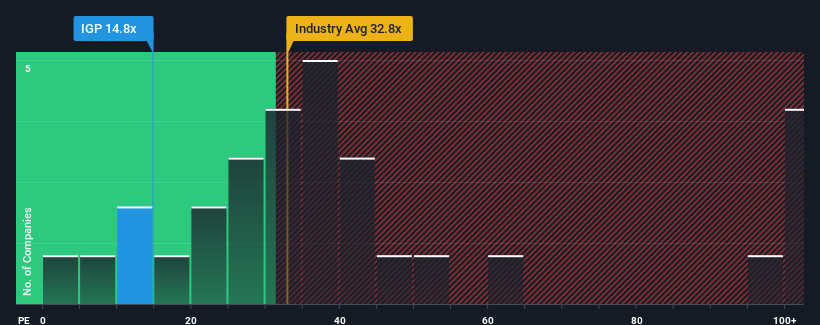

Even after such a large drop in price, it's still not a stretch to say that Intercede Group's price-to-earnings (or "P/E") ratio of 14.8x right now seems quite "middle-of-the-road" compared to the market in the United Kingdom, where the median P/E ratio is around 16x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Intercede Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Intercede Group

How Is Intercede Group's Growth Trending?

The only time you'd be comfortable seeing a P/E like Intercede Group's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 357%. The strong recent performance means it was also able to grow EPS by 245% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 62% as estimated by the only analyst watching the company. That's not great when the rest of the market is expected to grow by 18%.

In light of this, it's somewhat alarming that Intercede Group's P/E sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Key Takeaway

Following Intercede Group's share price tumble, its P/E is now hanging on to the median market P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Intercede Group currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Intercede Group you should be aware of, and 1 of them is significant.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IGP

Intercede Group

A cybersecurity company, develops and supplies identity and credential management software for digital trust primarily in the United Kingdom, rest of Europe, the United States, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives