- United Kingdom

- /

- Software

- /

- AIM:IDOX

High Growth Tech Stocks To Watch In June 2025

Reviewed by Simply Wall St

Amidst a backdrop of faltering trade data from China and its impact on the UK's FTSE 100, which recently closed lower due to these global cues, investors are keenly observing how such macroeconomic factors influence high-growth tech stocks within the UK market. In this environment, identifying promising tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability in response to shifting economic conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Audioboom Group | 8.84% | 59.33% | ★★★★★☆ |

| ENGAGE XR Holdings | 22.08% | 84.46% | ★★★★★★ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| YouGov | 3.98% | 64.42% | ★★★★★☆ |

| Pinewood Technologies Group | 24.99% | 40.16% | ★★★★★☆ |

| Oxford Biomedica | 16.89% | 80.47% | ★★★★★☆ |

| Windar Photonics | 37.85% | 47.21% | ★★★★★☆ |

| Trustpilot Group | 15.20% | 40.20% | ★★★★★☆ |

| Quantum Base Holdings | 132.55% | 92.87% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 55.41% | 54.99% | ★★★★★☆ |

Click here to see the full list of 42 stocks from our UK High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Craneware (AIM:CRW)

Simply Wall St Growth Rating: ★★★★☆☆

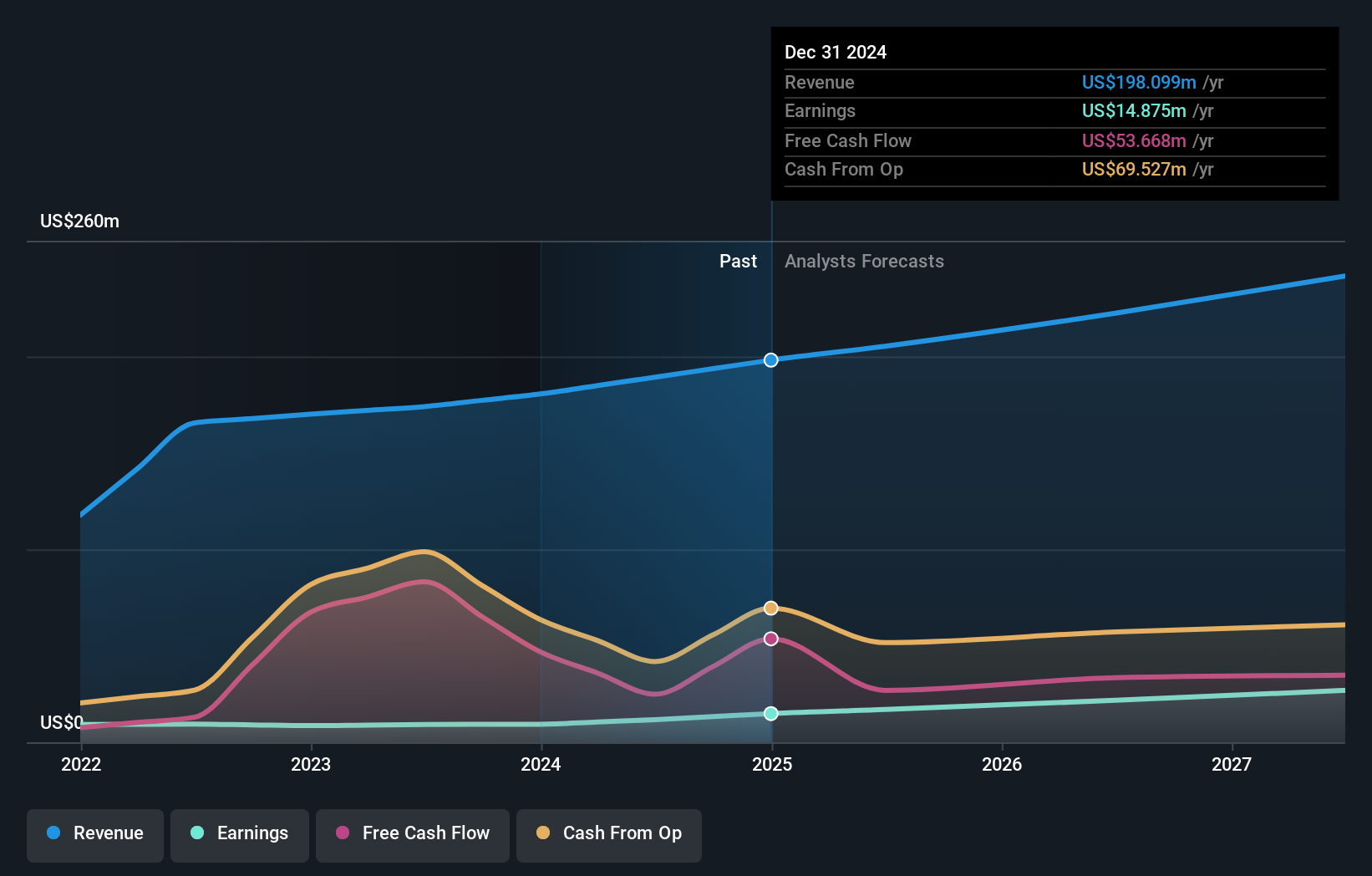

Overview: Craneware plc, along with its subsidiaries, focuses on developing, licensing, and supporting healthcare software solutions in the United States, with a market capitalization of £717.89 million.

Operations: Craneware generates revenue primarily from its healthcare software segment, which accounted for $198.10 million. The company's business model centers on developing and licensing software solutions for the U.S. healthcare industry.

Craneware, a UK-based healthcare software provider, has demonstrated robust financial performance with a 58.9% earnings growth over the past year, significantly outpacing the industry's -5.6%. Despite recent M&A turbulence, where Bain Capital withdrew a £940 million acquisition proposal citing valuation discrepancies, Craneware's strategic focus remains strong. The company's commitment to R&D is evident from its consistent investment in innovation, crucial for maintaining its competitive edge in the evolving healthcare technology sector. This approach not only enhances product offerings but also solidifies client relationships by aligning with market demands for efficient healthcare solutions.

IDOX (AIM:IDOX)

Simply Wall St Growth Rating: ★★★★☆☆

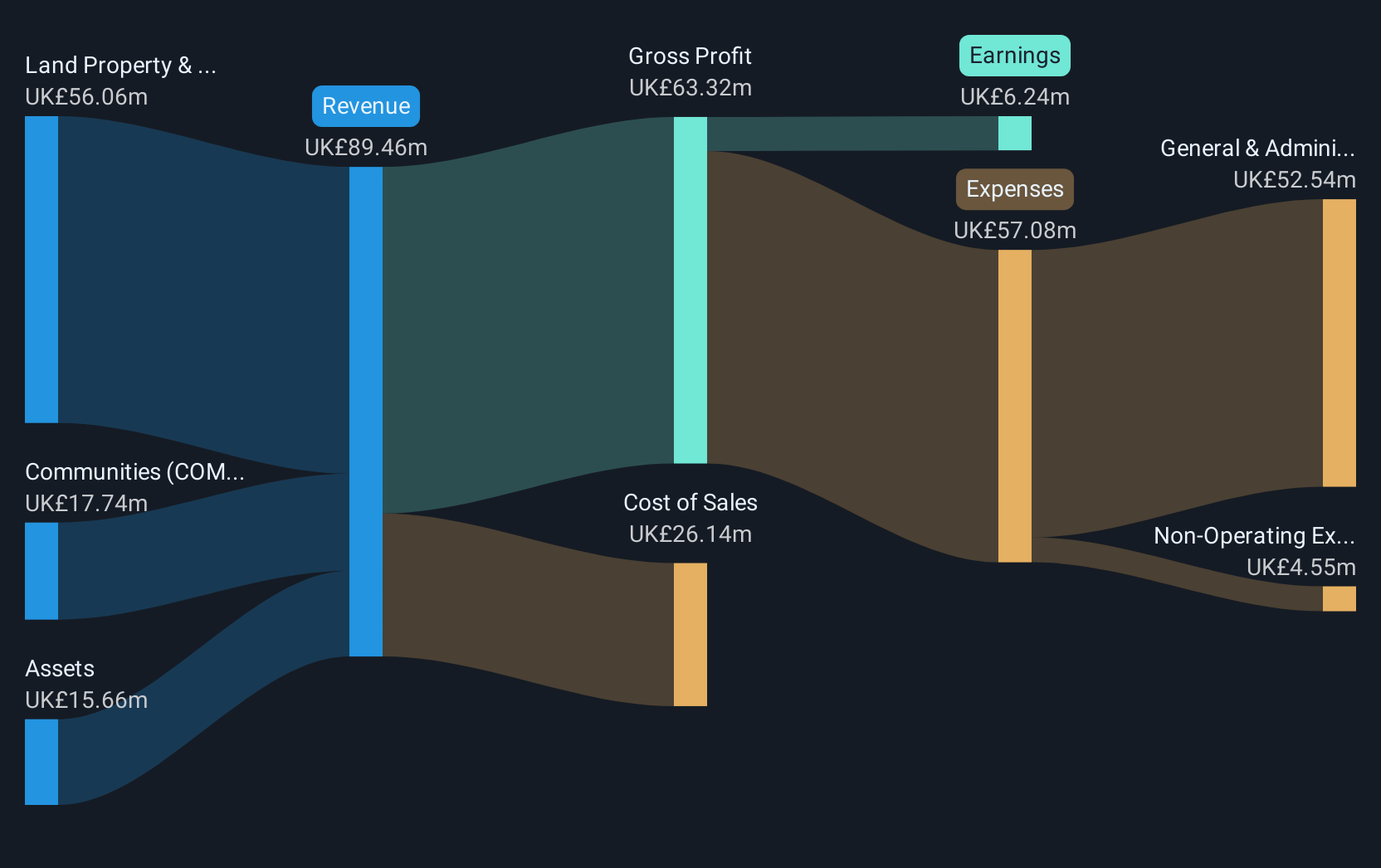

Overview: IDOX plc, with a market cap of £287.17 million, offers software and services to manage local government and other organizations across the UK, US, Europe, and internationally through its subsidiaries.

Operations: IDOX generates revenue by providing specialized software solutions and services to local governments and various organizations globally. The company focuses on enhancing operational efficiency for its clients through its technology offerings.

IDOX, a player in the UK tech scene, has recently shown promising financial growth with half-year sales rising to GBP 45.01 million from GBP 43.15 million and net income increasing to GBP 4.23 million from GBP 3.25 million year-over-year. This growth trajectory is underscored by an expected annual earnings increase of 23.1% and revenue growth predictions at 6.2%, outpacing the UK market's forecast of 3.6%. Despite not leading the software industry's performance, which grew at a rate of 17.6%, IDOX's commitment to innovation through sustained R&D investments positions it well for future scalability in an increasingly competitive market landscape.

- Click here and access our complete health analysis report to understand the dynamics of IDOX.

Assess IDOX's past performance with our detailed historical performance reports.

Informa (LSE:INF)

Simply Wall St Growth Rating: ★★★★☆☆

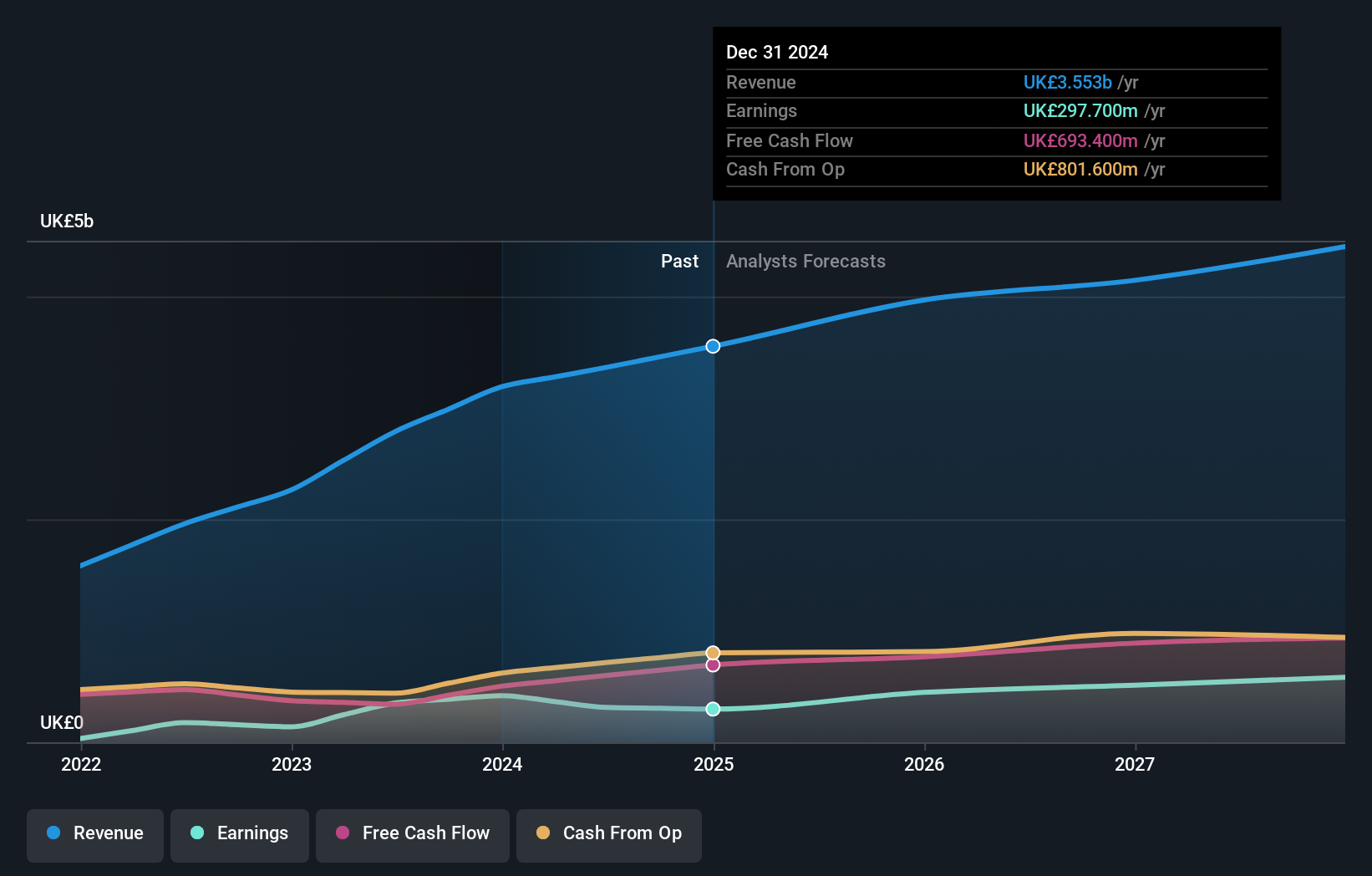

Overview: Informa plc is an international company based in the United Kingdom that specializes in events, digital services, and academic research across various regions including Continental Europe, North America, and China, with a market capitalization of £10.41 billion.

Operations: Informa generates revenue primarily through its segments: Informa Markets (£1.72 billion), Informa Connect (£631 million), Informa Tech (£423.90 million), and Taylor & Francis (£698.20 million).

Amidst a bustling schedule of industry conferences and a solid affirmation of its annual financial targets, Informa has demonstrated resilience and adaptability in the competitive tech landscape. With an anticipated revenue growth rate of 7.1% per year, surpassing the UK market average of 3.6%, and an impressive forecast for earnings growth at 20.3% annually, Informa is positioning itself as a formidable entity in high-growth sectors. Despite facing challenges such as a significant one-off loss impacting financials last year and profit margins dipping to 8.4% from 13.1%, the company's strategic engagements like London Tech Week signal robust sectoral integration and potential for sustained growth.

- Dive into the specifics of Informa here with our thorough health report.

Examine Informa's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Explore the 42 names from our UK High Growth Tech and AI Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:IDOX

IDOX

Through its subsidiaries, provides software and services for the management of local government and other organizations in the United Kingdom, the United States, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives