- United Kingdom

- /

- IT

- /

- AIM:GRC

Take Care Before Jumping Onto GRC International Group plc (LON:GRC) Even Though It's 48% Cheaper

The GRC International Group plc (LON:GRC) share price has fared very poorly over the last month, falling by a substantial 48%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 74% loss during that time.

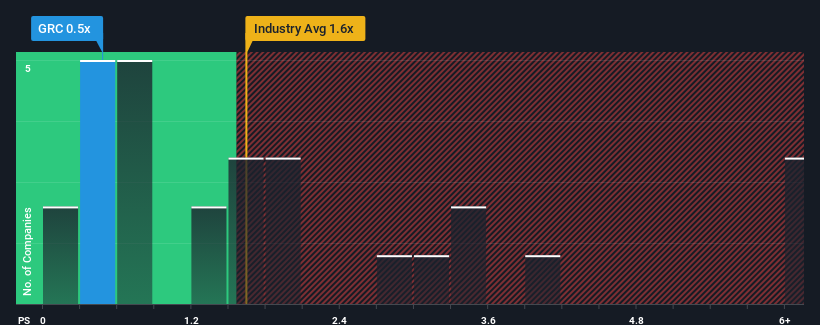

After such a large drop in price, when close to half the companies operating in the United Kingdom's IT industry have price-to-sales ratios (or "P/S") above 1.6x, you may consider GRC International Group as an enticing stock to check out with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for GRC International Group

How GRC International Group Has Been Performing

GRC International Group could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GRC International Group.How Is GRC International Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as GRC International Group's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 5.5% gain to the company's revenues. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 11% growth forecast for the broader industry.

In light of this, it's peculiar that GRC International Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

GRC International Group's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at GRC International Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with GRC International Group (including 2 which are concerning).

If these risks are making you reconsider your opinion on GRC International Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:GRC

GRC International Group

Offers various products and services to address the information technology (IT) governance, risk management, and compliance requirements of organizations in the United Kingdom, rest of Europe, the United States, Ireland, Italy, Australia, and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives