Stock Analysis

- United Kingdom

- /

- Software

- /

- AIM:FDP

Exploring Three UK Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the United Kingdom grapples with fluctuating inflation and public finance figures, investors remain keenly observant of market dynamics and regulatory developments. In such a climate, growth companies with high insider ownership can offer a unique appeal, potentially aligning management's interests closely with shareholder value amidst broader economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Getech Group (AIM:GTC) | 17.2% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 50.8% |

| Petrofac (LSE:PFC) | 16.6% | 115.4% |

| Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

| Energean (LSE:ENOG) | 10.7% | 22.4% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

| Plant Health Care (AIM:PHC) | 26.4% | 94.4% |

| Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Afentra (AIM:AET) | 38.3% | 198.2% |

Underneath we present a selection of stocks filtered out by our screen.

FD Technologies (AIM:FDP)

Simply Wall St Growth Rating: ★★★★☆☆

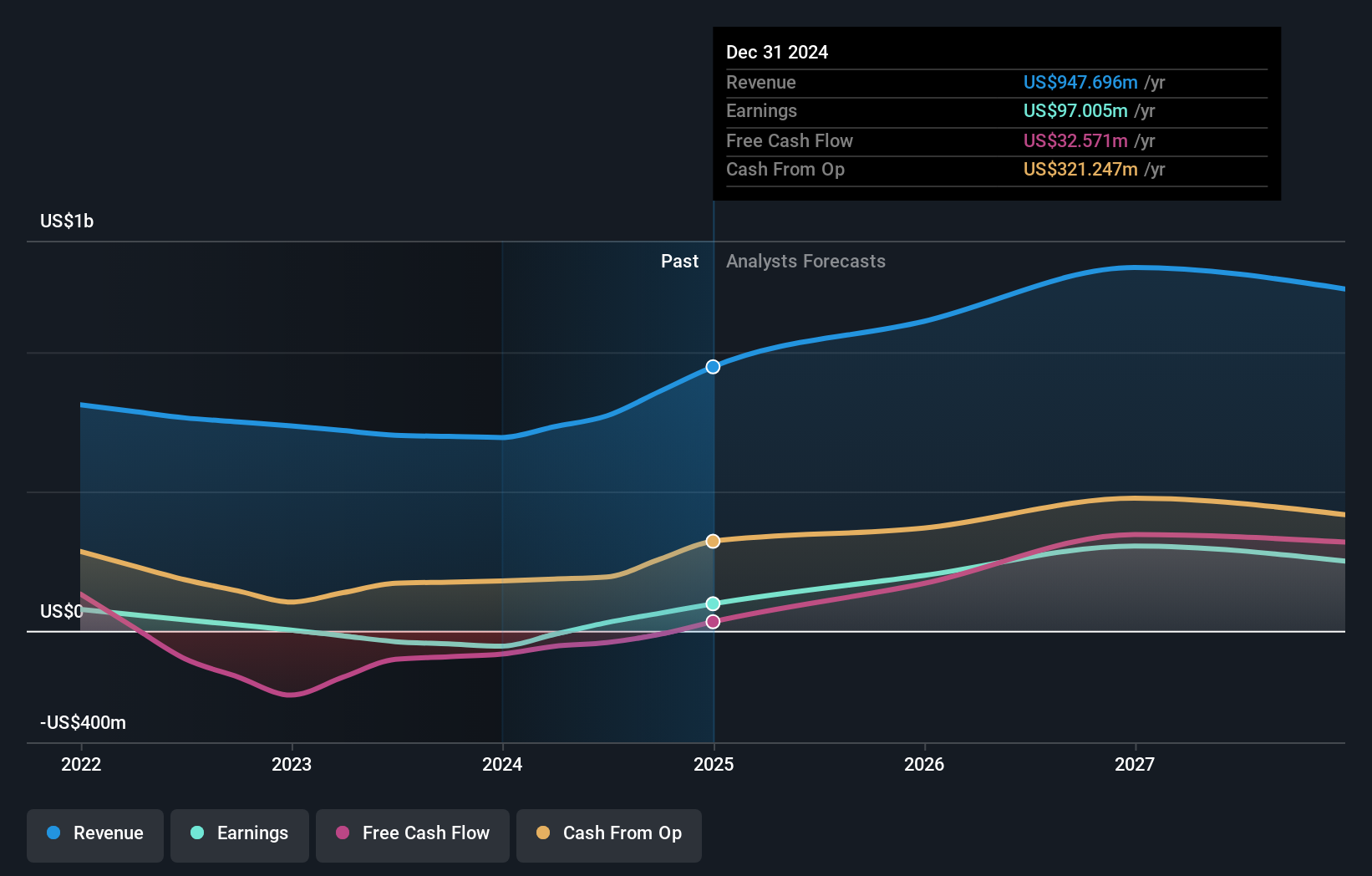

Overview: FD Technologies plc is a provider of software and consulting services based in the United Kingdom, operating globally with a market capitalization of approximately £353.31 million.

Operations: The firm generates revenue through its software and consulting services both in the UK and internationally.

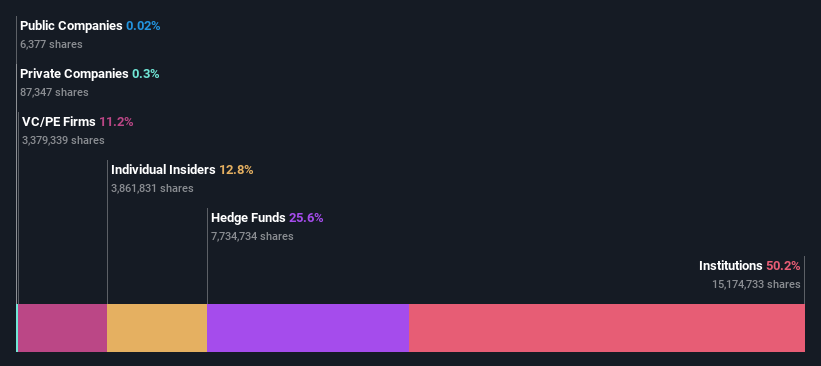

Insider Ownership: 12.8%

Earnings Growth Forecast: 41.1% p.a.

FD Technologies, a UK-based firm, has shown moderate revenue growth at 4.4% annually, slightly outpacing the UK market average of 3.7%. Despite this, profitability remains a challenge with forecasts indicating potential profitability within three years amidst an anticipated profit growth of 41.08% per year. Recent strategic moves include a planned separation of its businesses and an all-share merger aimed at enhancing shareholder value, reflecting proactive management despite current non-profitability issues.

- Click here and access our complete growth analysis report to understand the dynamics of FD Technologies.

- The analysis detailed in our FD Technologies valuation report hints at an deflated share price compared to its estimated value.

Hochschild Mining (LSE:HOC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company operating in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of approximately £0.89 billion.

Operations: Hochschild Mining's revenue is primarily generated from its operations at Inmaculada, contributing $396.64 million, followed by San Jose with $242.46 million and Pallancata adding $54.05 million.

Insider Ownership: 38.4%

Earnings Growth Forecast: 57.2% p.a.

Hochschild Mining, with significant insider buying in recent months, is poised for growth. The company's revenue is expected to increase by 8.3% annually, outstripping the UK market's 3.7%. Although profitability has been a challenge with a net loss reported last year, forecasts suggest a turnaround with earnings potentially growing by 57.16% annually over the next three years. Recent strategic acquisitions indicate an aggressive growth strategy, focusing on disciplined capital allocation and high internal return targets for M&A activities.

- Click here to discover the nuances of Hochschild Mining with our detailed analytical future growth report.

- The analysis detailed in our Hochschild Mining valuation report hints at an inflated share price compared to its estimated value.

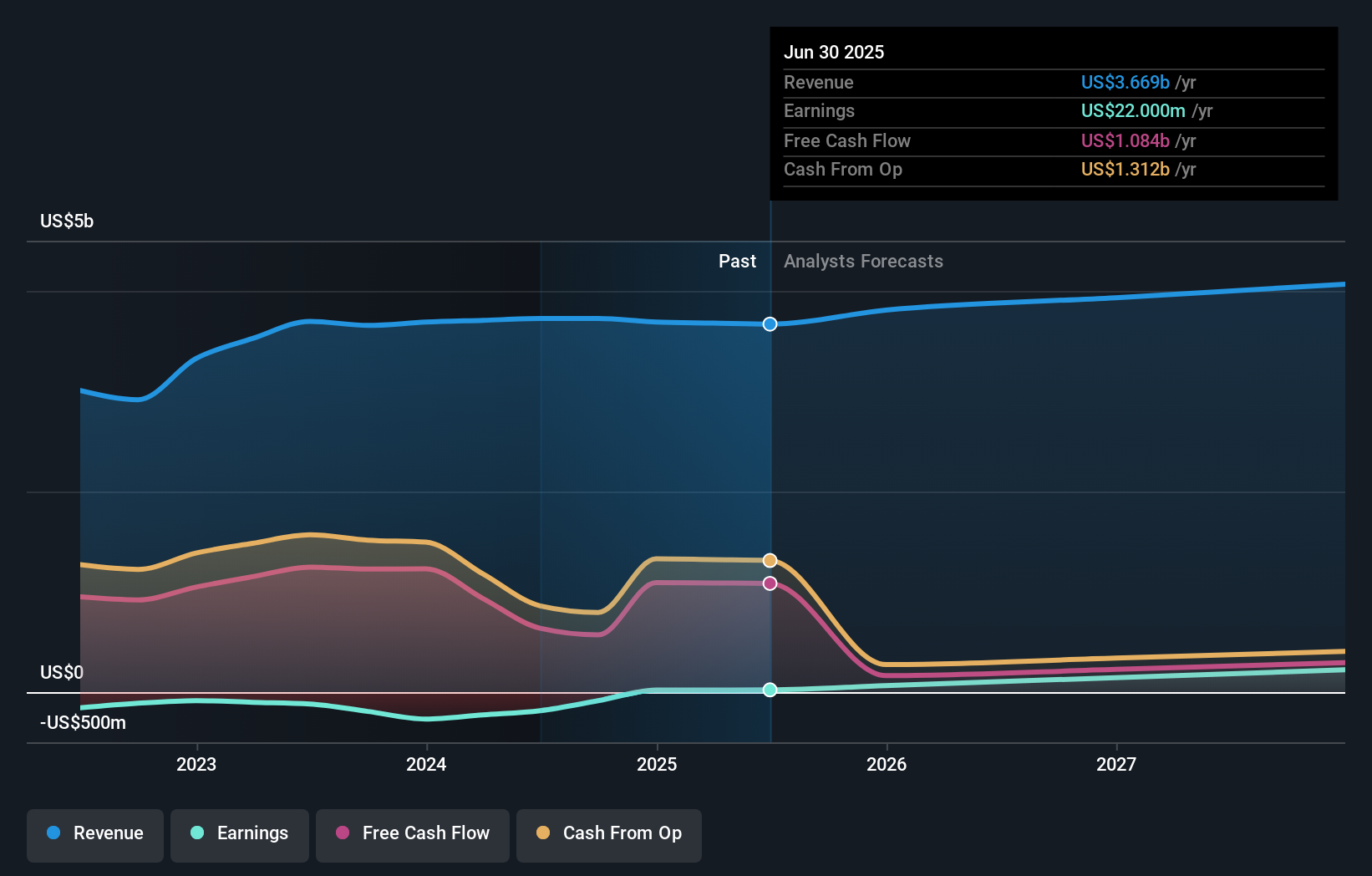

IWG (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IWG plc operates globally, offering workspace solutions across the Americas, Europe, the Middle East, Africa, and Asia Pacific with a market capitalization of approximately £2.06 billion.

Operations: The company generates revenue through workspace solutions, primarily in the Americas (£1.05 billion), Europe, the Middle East, and Africa (£1.32 billion), and the Asia Pacific (£0.27 billion).

Insider Ownership: 28.9%

Earnings Growth Forecast: 101.7% p.a.

IWG, a UK-based growth company with significant insider ownership, is trading at a value deemed favorable relative to its industry peers. Despite recent financial challenges, including a net loss reported for the full year ended December 31, 2023, IWG's revenue growth is forecasted at 7.8% annually over the next few years—outpacing the broader UK market projection of 3.7%. The company's transition to profitability within three years aligns with an above-average market growth expectation. Recent activities include modest share buybacks and consistent revenue reports in quarterly statements.

- Click to explore a detailed breakdown of our findings in IWG's earnings growth report.

- Our comprehensive valuation report raises the possibility that IWG is priced lower than what may be justified by its financials.

Key Takeaways

- Embark on your investment journey to our 65 Fast Growing UK Companies With High Insider Ownership selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether FD Technologies is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FDP

FD Technologies

Provides software and consulting services in the United Kingdom and internationally.

Excellent balance sheet with reasonable growth potential.