- United Kingdom

- /

- Software

- /

- AIM:FADL

Fadel Partners, Inc. (LON:FADL) Might Not Be As Mispriced As It Looks

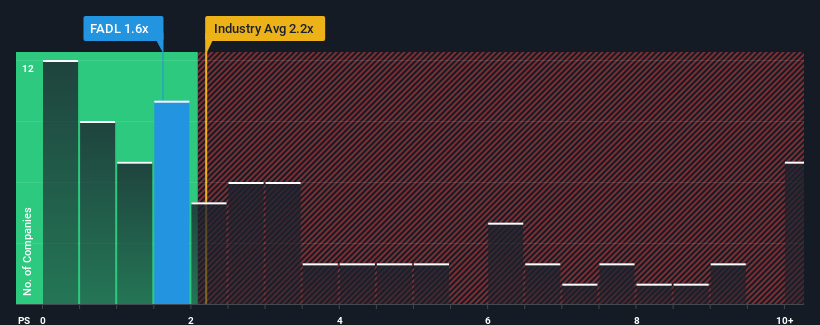

Fadel Partners, Inc.'s (LON:FADL) price-to-sales (or "P/S") ratio of 1.6x might make it look like a buy right now compared to the Software industry in the United Kingdom, where around half of the companies have P/S ratios above 2.2x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Our free stock report includes 3 warning signs investors should be aware of before investing in Fadel Partners. Read for free now.See our latest analysis for Fadel Partners

How Fadel Partners Has Been Performing

Fadel Partners could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Fadel Partners' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Fadel Partners?

Fadel Partners' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 10%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.8% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 9.8% during the coming year according to the one analyst following the company. With the industry predicted to deliver 8.6% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Fadel Partners' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Fadel Partners' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Fadel Partners currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Fadel Partners (of which 1 shouldn't be ignored!) you should know about.

If you're unsure about the strength of Fadel Partners' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:FADL

Fadel Partners

Engages in the provision and service of its intellectual property rights and royalty management suite of software in the United States.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives