- United Kingdom

- /

- Software

- /

- AIM:ELCO

Eleco plc (LON:ELCO) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

Eleco plc (LON:ELCO) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

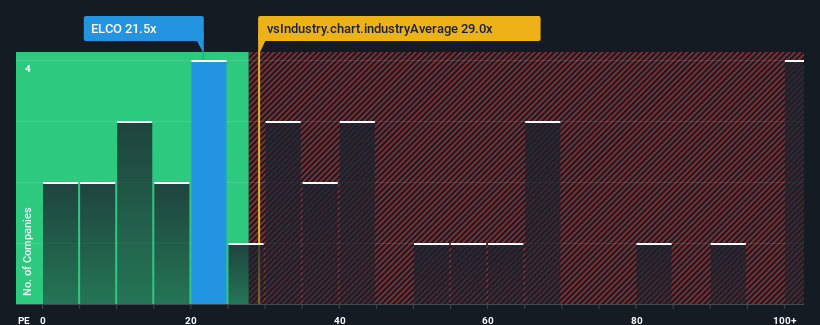

Following the firm bounce in price, Eleco may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 35.5x, since almost half of all companies in the United Kingdom have P/E ratios under 15x and even P/E's lower than 9x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Eleco certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Eleco

How Is Eleco's Growth Trending?

Eleco's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 26%. EPS has also lifted 21% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 14% over the next year. Meanwhile, the broader market is forecast to expand by 18%, which paints a poor picture.

In light of this, it's alarming that Eleco's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

What We Can Learn From Eleco's P/E?

The strong share price surge has got Eleco's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Eleco's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Eleco with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Eleco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ELCO

Eleco

Provides software and related services in the United Kingdom, Scandinavia, Germany, the rest of Europe, the United States, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives